On August 23, Becamex TDC, a leading business and development company in Binh Duong, Vietnam, announced their plans to raise capital through a private placement of shares. The company intends to offer 35 million shares at a price to be determined by the Board of Directors, not less than VND 10,000 per share. The offering is expected to take place in 2024, pending approval from the State Securities Commission. The proceeds from the share issuance, estimated at a minimum of VND 350 billion, will be used to repurchase a portion of the TDC.BOND.700.2020 bonds before their maturity date.

The TDC.BOND.700.2020 bonds, with a face value of VND 700 billion and collateral, were issued on November 9, 2020, and are set to mature on November 15, 2025. The original purpose of these bonds was to raise capital to pay dividends and arrears to the parent company, Becamex IDC, and to repay bank loans and interest.

In addition to seeking shareholder approval for the private placement, Becamex TDC is also proposing adjustments to its business lines and a reduction in the foreign ownership limit from 50% to 49%. The company will be gathering shareholder opinions from August 30 to September 10, with the record date for shareholders set as August 26.

Following this news, TDC shares on the stock exchange experienced a sharp sell-off on August 26, plunging to the floor price of VND 11,050 per share with no buyers. However, the current market price is still about 12% higher than at the beginning of 2024, valuing the company at over VND 1,100 billion.

For the second quarter of 2024, Becamex TDC reported a 14.2% decrease in revenue compared to the same period last year, totaling VND 115 billion. However, the company recorded a significant improvement in profitability, with a post-tax profit of over VND 74 billion, compared to a loss of over VND 281 billion in the previous year.

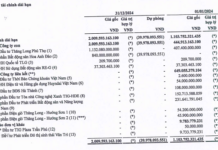

For the first half of 2024, the company’s revenue reached over VND 234 billion, a slight decrease of 1.6% year-on-year. The post-tax profit was over VND 50 billion, a positive turnaround from the loss of nearly VND 322 billion in the same period last year. Despite this improvement, the company still carries a cumulative loss of nearly VND 318 billion as of the end of the second quarter.

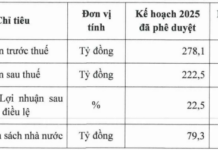

Becamex TDC’s business plan for 2024 targets a total revenue of VND 2,441 billion and a post-tax profit of nearly VND 408 billion. With the results achieved in the first half, the real estate company has only fulfilled over 12% of its annual profit plan.

Vietnam Airlines sees promising results in its quest for financial balance

By the end of 2023, this business has incurred a total loss of over 5.8 trillion VND despite a 30% increase in revenue.

Binh Duong: Land prices to increase up to 247% from current prices.

If passed, the proposed Resolution will result in an increase in land prices in Binh Duong province, ranging from a minimum of 11% to a maximum of 247% compared to the current prices. This adjustment is aimed at aligning the land prices with the current reality, as some communes are upgraded to wards and towns.