The Ministry of Finance and the State Securities Commission (SSC) have officially announced the Draft Circular amending four circulars related to foreign institutional investors being able to purchase securities without pre-funding (Non Pre-funding solution – NPS) and the roadmap for information disclosure in English.

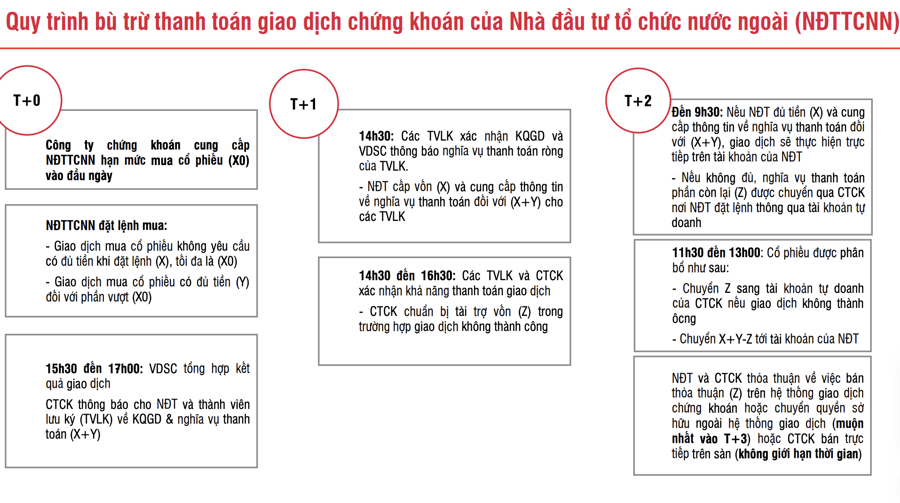

The issue of pre-funding is addressed through a solution that allows securities companies to provide payment support for foreign institutional investors. This involves foreign institutional investors buying stocks at T+0 and receiving capital at T+1 to T+2. This will address the requirements for an upgrade from FTSE Russell, including delivery versus payment (transfer of shares at the time of payment) and handling of failed transactions.

Regarding the roadmap for information disclosure in English, the goal is that from January 1, 2028, all public and listed companies will disclose periodic and extraordinary information in English. This will improve information accessibility for foreign investors and enhance market transparency, as well as address concerns from MSCI regarding market regulations and information flow.

SSI Research expects the Circular to be implemented in the 4th quarter of this year and to serve as a basis for FTSE Russell’s positive assessment in the September 2024 ranking and its decision to upgrade Vietnam in the September 2025 evaluation.

With the upgrade to an emerging market, preliminary estimates from SSI Research suggest that up to $1.6 billion in capital could flow from ETFs alone, excluding capital from active funds (FTSE Russell estimates that the total assets of active funds are five times that of ETFs).

The upgrade from a frontier to an emerging market is not just a change in name but also in nature, and the majority of the capital will come from professional foreign institutional investors. In other words, this is a successful step towards developing a broader investor base.

The upgrade by FTSE Russell will provide a good opportunity for the Vietnamese stock market to gain the attention of MSCI, especially as the list of stock markets with potential for an upgrade to emerging market status is quite limited. Currently, Vietnam has the highest weight in the MSCI Frontier Markets Index.

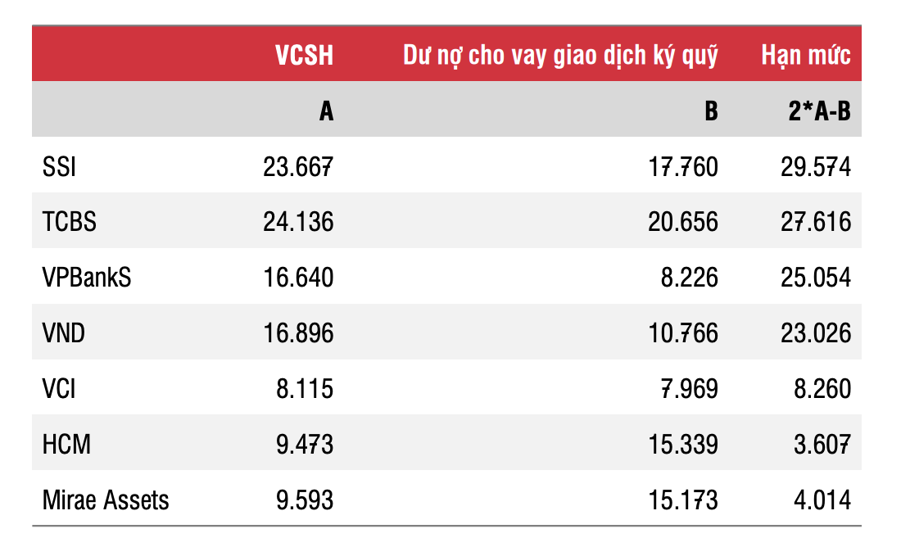

The Draft Circular sets a limit on the order value for buying stocks, which securities companies must determine at the beginning of the trading day. This value is the total of the amounts that can be converted into cash by the securities company, but it must not exceed the difference between twice the value of the company’s equity and the debt from securities margin trading.

The amounts that can be converted into cash by the securities company include cash in the fund; bank deposits, government bonds, and certificates of deposit (not yet used to secure financial obligations); proceeds from the sale of proprietary stocks awaiting settlement; receivables from advance payments for the sale of listed or registered stocks, and advance payments from foreign institutional investors to ensure payment capability. Securities companies can also use available credit limits and payment guarantees from domestic and foreign credit institutions.

SSI is the company with the largest owner’s equity of VND 23,667 billion, with a margin lending balance of VND 17,760 billion and a limit of VND 29,574 billion. This is followed by TCBS with owner’s equity of VND 24,136 billion, a margin lending balance of VND 20,656 billion, and a limit of VND 27,616 billion. In third place is VPBankS with owner’s equity of VND 16,640 billion, a margin lending balance of VND 8,226 billion, and a limit of VND 25,054 billion. VnDirect has owner’s equity of VND 16,896 billion, a margin lending balance of VND 10,766 billion, and a limit of VND 23,026 billion.

According to a recent World Bank estimate, if Vietnam is upgraded to emerging market status by MSCI and FTSE Russell, it could attract net capital inflows of $5 billion into its stock market as global emerging market portfolios are reallocated to Vietnam. Capital inflows could reach $25 billion by 2030 if strong reforms continue and the global investment environment remains healthy.