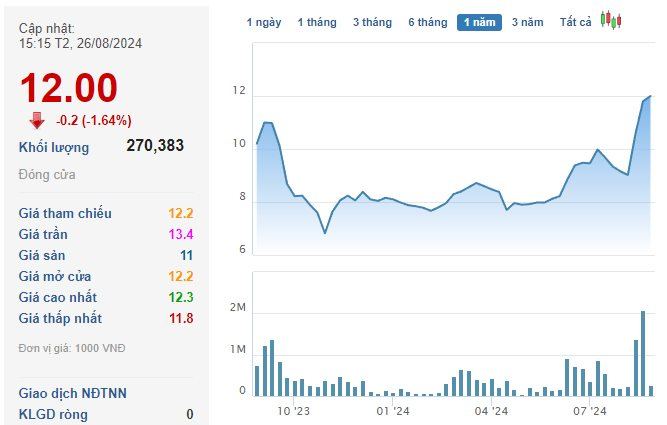

In the latest announcement, Mr. Nguyen Phan Trung Kien, CEO of Hoa Binh Securities (code: HBS) , registered to buy 8 million HBS shares through matching and order matching methods to increase ownership. Prior to this, Mr. Kien did not own any shares in the company.

The expected transaction time is from August 28 to September 25, 2024. Tentatively calculated at the market price, the CEO needs to spend about VND 100 billion to complete the above transaction. The number of shares registered to buy by Mr. Kien is equivalent to more than 24% of the total number of circulating shares of HBS.

It is known that Mr. Kien has just been appointed as the General Director of HBS since the beginning of May 2024, replacing Mr. Dinh The Loi. According to the information found, Mr. Kien was born in 1982 in Ha Tinh province. Before joining HBS, Mr. Kien held important positions at National Securities Joint Stock Company, Fastgo Joint Stock Company, and OceanBank.

On August 29, HBS will finalize the list of shareholders who are eligible for a 2023 cash dividend payment with a ratio of 20%, equivalent to VND 2,000/share. The ex-dividend date is August 28, and the expected payment date is September 12, 2024. With nearly 33 million circulating shares, the total dividend payment is estimated to be nearly VND 66 billion.

In terms of business results, for the first 6 months of 2024, HBS recorded operating revenue of nearly VND 18 billion, up 174% over the same period last year. Higher expenses caused pre-tax profit to decrease by 7% over the same period to nearly VND 11 billion.

Building Giants: Profitability Continues in Q4/2023 – Is the Light at the End of the Tunnel Finally Visible?

In the final quarter of 2023, Hòa Bình Construction reported a post-tax profit of over 100 billion VND, breaking the streak of four consecutive quarters of losses. Similarly, Vinaconex, Coteccons, and Hưng Thịnh Incons also reported post-tax profits of 132 billion VND, 69 billion VND, and 33 billion VND respectively.