Vietnam’s Automotive Industry Projected to Maintain Double-Digit Growth in the Long Run

After an impressive growth spurt in 2022, Vietnam’s automotive market experienced a sharp decline in 2023, with total market production (VAMA + Hyundai Thanh Cong) falling by approximately 24% to nearly 370,000 units due to weak demand stemming from domestic and global economic challenges.

Despite this setback, automotive businesses remained optimistic about the long-term growth prospects of the market. In 2023, nearly 40 new car models were launched, and new brands, such as Lynk&Co, entered the Vietnamese market, offering customers more choices and increasing competition in the automotive industry.

Also, in 2023, with the goal of completing the full life cycle of services in the automotive industry (including importing, distributing new cars, trading used cars, car insurance, and electronic toll collection), Tasco Joint Stock Company acquired SVC Holdings (now Tasco Auto) – the largest car distribution system in Vietnam, with a market share of over 13% in VAMA and holding more than 20% market share of various brands such as Volvo (100% market share), Lynk & Co, Toyota, Ford, Mitsubishi, etc., with a system of more than 90 showrooms nationwide.

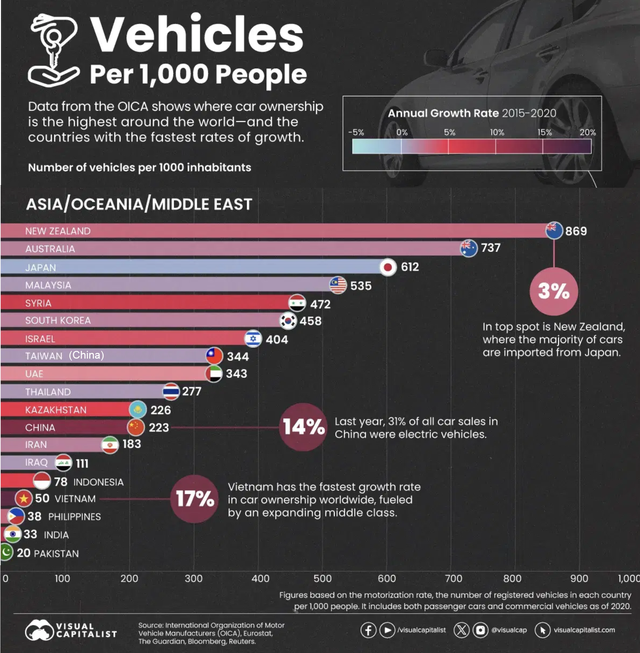

Vietnam is among the fastest-growing automotive markets globally during 2015-2020.

Tasco’s 2023 Annual Report predicts that, in the long run, the growth drivers of Vietnam’s automotive industry will come from the increasing middle class. The IMF forecasts that by 2025, Vietnam’s per capita GDP will reach approximately $4,688 (with a CAGR of 5.8% from 2020-2025), leading to a significant increase in the country’s middle-class population. This will, in turn, boost the demand for all types of luxury goods, including automobiles.

Additionally, policies promoting the development of highways and upgrades to transportation infrastructure, as well as urban planning that expands into peripheral areas and satellite cities, are all expected to fuel the growth of the automotive industry.

According to the Ministry of Industry and Trade’s draft Automotive Industry Development Strategy for the period up to 2030, with a vision towards 2045, the Vietnamese automotive market still has significant room for growth. The total automobile production is projected to reach approximately 1.5 million units by 2035, equivalent to a CAGR of around 13%-14% during the period from 2024 to 2035.

A Partnership Between Two Industry Giants as the Market Starts to Warm Up

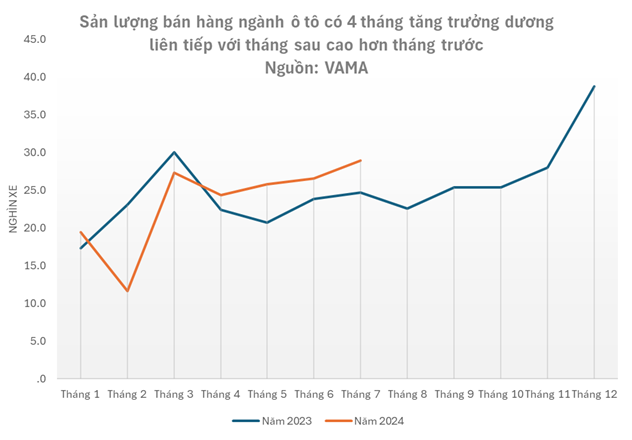

In the first half of 2024, the market has not yet fully recovered, but positive signals have become more frequent. As of July, the market has experienced four consecutive months of year-on-year growth.

This improvement in the automotive market is also reflected in the financial performance of major automotive companies listed on the stock exchange, which have shown significant improvements.

Savico, a subsidiary of Tasco Auto, reported a 19% increase in revenue in the second quarter, reaching nearly VND 5,300 billion, while its pre-tax profit surged from VND 4 billion to VND 80 billion. Similarly, Haxaco, a dealer of the Mercedes and MG brands, reported a 40% increase in revenue, surpassing VND 1,100 billion.

Amid this positive news, the automotive market witnessed a notable development as the Japanese conglomerate Mitsui & Co. officially signed an agreement to become a strategic shareholder of Tasco Auto.

The timing of this deal suggests that the two parties had been in discussions during the most challenging period for the market in 2023 and were eager to capitalize on the recovery momentum and the long-term growth potential of Vietnam’s automotive industry.

Representatives of Mitsui and Tasco signing the contract, finalizing the agreement for Mitsui to become a strategic shareholder of Tasco Auto.

Mitsui & Co. is a leading Japanese conglomerate with a diverse range of businesses, including mobility (encompassing automotive, machinery, and parts, as well as services related to maritime, aviation, and railways) as one of its core pillars.

Mitsui’s mobility business has a presence in over 60 countries and regions, with operations spanning multiple fields. Automotive and transportation are key investment focuses for Mitsui, with investments in over 100 companies across 26 countries and regions, offering a diverse range of products and services.

In North America, Mitsui is a strategic partner of Penske, one of the world’s largest automotive distribution groups, with over 3,200 branches and 30 brands. Mitsui has also invested in PAG, a Penske subsidiary specializing in automotive retail since 2001, and established a joint venture, Penske Truck Leasing (PTL), in 2015, for truck leasing, enabling Mitsui to enter the global leasing, transportation, and logistics services chain.

Both Mitsui and Tasco are committed to building a fully integrated value chain for the automotive industry. Therefore, this partnership is seen as more than just a typical investment; it is expected to boost the development of the automotive market, increasing car ownership rates, which are currently low but growing rapidly.

The strategic collaboration between Tasco and Mitsui in Tasco Auto is considered a significant step towards realizing Tasco’s strategic goals. Tasco Auto has also shared plans to venture upstream with a CKD automobile assembly plant project in collaboration with a top 10 global OEM manufacturer. Mitsui has extensive experience in this area, with involvement in joint ventures such as Daihatsu Malaysia and Toyota Motor Philippines in Southeast Asia.

In conclusion, the strategic partnership between the Tasco and Mitsui conglomerates is driven by a shared vision to capitalize on the strong long-term growth prospects in the automotive sector. It combines Tasco’s leading advantages in automotive services in Vietnam with Mitsui’s international experience, global network, and strong financial backing. This synergy will maximize the strengths of both parties to foster business development and expansion, enhancing operational efficiency.

Vietnam and the Philippines continue to boost rice trade cooperation.

Both parties agree to promote rice trade, not only to increase trade volume but also as a crucial pillar of cooperation that demonstrates mutual trust in ensuring food security…

Vietnam: A Rising Dragon with Remarkable Development, says New Zealand Prime Minister

The Prime Minister of New Zealand praised Vietnam as an important partner, one of the countries that has made very strong development momentum. “Congratulations to the Government and people of Vietnam for achieving great accomplishments in economic activities, Vietnam has become a dragon with remarkable development and high annual growth,” he said.

The Ambitious Ecosystem of Tasco, the Master of Car Services

With the successful acquisition of SVC Holdings and the rebranding as Tasco Auto, Tasco has added a vital piece to its puzzle in striving to perfect the ecosystem centered around automotive distribution and services.