SVC Holdings officially changes its name to Tasco Auto – Source: HUT

|

What does Tasco have before acquiring SVC Holdings?

Prior to the acquisition, Tasco Corporation (HNX: HUT) is known as one of the major players in BOT (Build-Operate-Transfer) and BT (Build-Transfer) investment projects. Notable BOT projects include National Road 1A passing through Quang Ninh and Quang Binh provinces; BOT 39 in Thai Binh; Le Duc Tho BOT in Hanoi; Hai Phong BOT; Dong Hung BOT renovation in Thai Binh…

In addition, VETC JSC – a subsidiary of HUT – is the leading provider of automated road toll collection services (VETC) in Vietnam with over 75% market share, 117 toll stations nationwide; serving about 3 million customers. Among them, VETC installs and operates 47 toll stations, while the remaining stations are installed by BOT investors and operated by VETC.

Toll station implemented by VETC – Source: HUT

|

The major toll collection player expects to increase its user base to 5 million by 2025, maintain a 75 – 80% market share, expand into additional services such as fuel payment, parking lot, and airport toll collection… HUT‘s leaders also stated that this will continue to be a key business area in the near future.

To pave the way for the automotive and smart infrastructure services, HUT divests from non-core areas; for example, divesting all capital in Thang Long Corporation – JSC (HNX: TTL) operating in the construction of transportation works. Similarly, HUT used to participate in the healthcare sector with investment projects in Hanoi Eye Hospital 2 and a 500-bed comprehensive hospital complex, but has since withdrawn through a 100% divestment from T’Hospital LLC.

Completing the largest piece of the ecosystem

Currently, Vietnam is still a country with low car ownership rates in the region, but it has a rapidly growing middle class. The acquisition of a leading car distributor is seen as an important step for HUT to build an ecosystem that serves the entire life cycle of car services.

Tasco Auto is expected to make significant contributions to HUT‘s ecosystem

|

As a result, HUT officially owns 100% of SVC Holdings and changes its name to Tasco Auto after completing the private offering share exchange in August 2023.

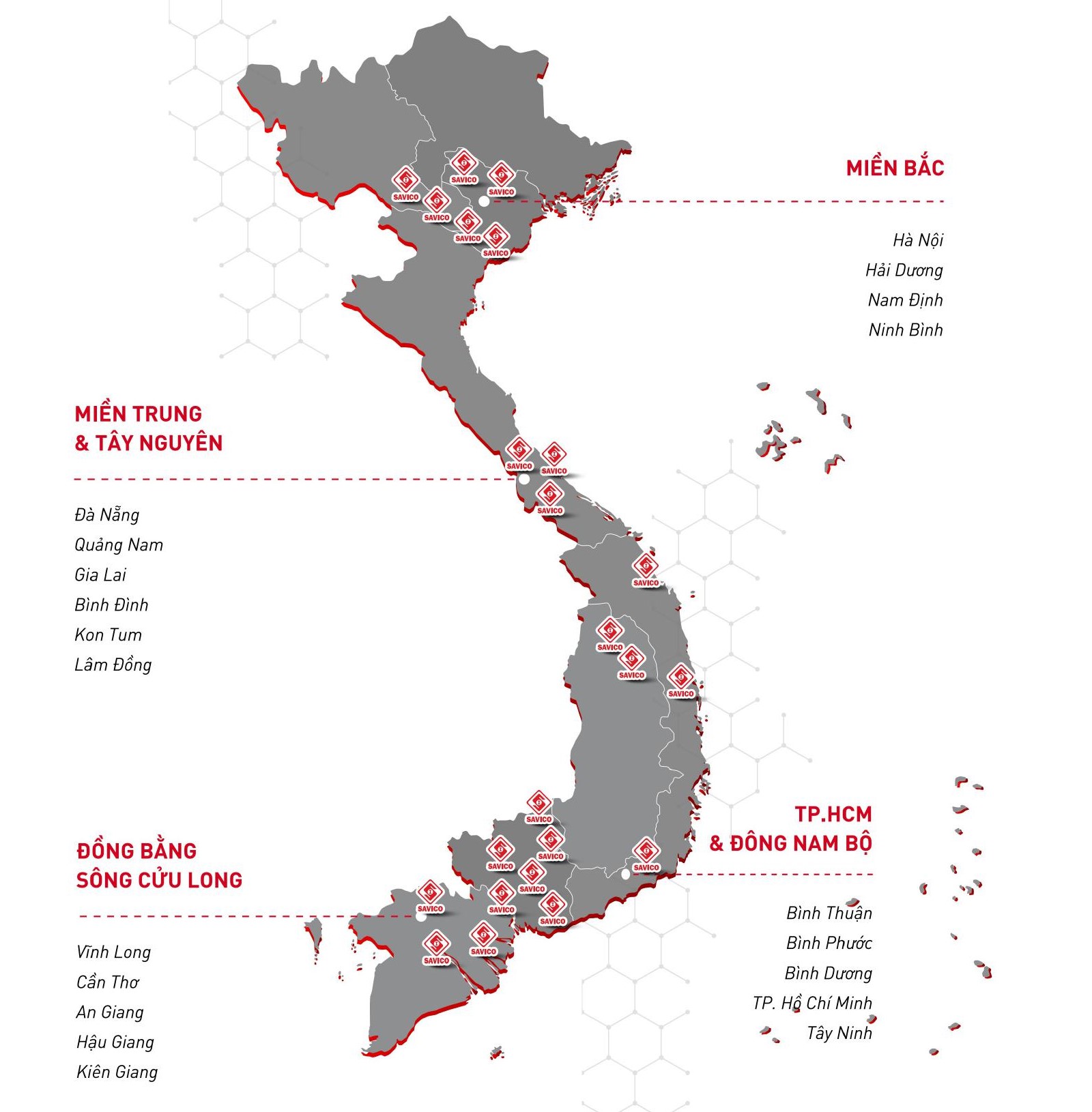

The most notable factor in Tasco Auto is its ownership of 54.1% of Saigon General Service Corporation (Savico, HOSE: SVC). The acquisition makes HUT naturally become one of the largest domestic automobile distributors and service providers, as well as owning 86 agencies nationwide.

By the end of 2021, SVC was the largest distributor of Toyota (with over 22% market share), Ford (33% market share), and Volvo (with 8% market share of luxury cars). Currently, SVC is partnering with 14 car brands, accounting for 13.5% market share.

Distribution system of SVC nationwide – Source: HUT

|

As part of HUT, Tasco Auto becomes more ambitious with the goal of developing 120 agencies by 2026, seeking opportunities to distribute additional high-end brands, electric vehicles… and not ruling out the possibility of participating in the higher value chain of the automotive industry.

In its latest move, Tasco Auto, through its subsidiary Greenlynk Automotives, has completed the registration process, built showrooms to bring Lynk & Co – a Northern European brand owned by Geely Group China since 2010 – to Vietnam by the end of 2023.

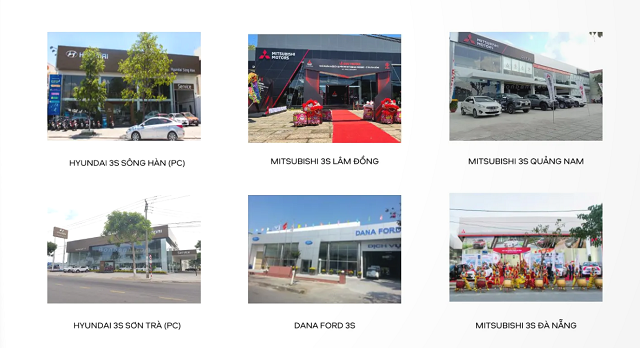

Some showrooms of SVC nationwide – Source: HUT

|

Appointment of former Ford Vietnam CEO to Tasco Auto

After the acquisition, HUT appointed Mr. Pham Van Dung, former CEO of Ford Vietnam from 2015 to 2022, as Chairman of Tasco Auto and Mr. Nguyen Thien Minh as Chairman of the Management Board of VETC Automatic Fee Collection JSC and Chairman of the Technology Council of Tasco, starting from November 2023.

Mr. Dung has over 20 years of experience working for global corporations such as GM-Daewoo, Ford, Inchcape… Personally, he has also held various positions as the Vice Chairman of Vietnam Automobile Manufacturers’ Association (VAMA) and a member of American Chamber of Commerce in Vietnam (AMCHAM).

Similarly, Mr. Minh has more than 20 years of experience in building technology platforms in startups, multinational corporations in the US, Europe, Singapore such as PayPal, Wells Fargo, BestBuy, OpenTV, DTT, Callaway Golf Interactive, American Airlines… and in Vietnam such as ILA, Geniebook. In addition, Mr. Minh is also a co-founder and CTO of ride-hailing app Be and digital bank Cake.

Automotive – Insurance – Financial Ecosystem

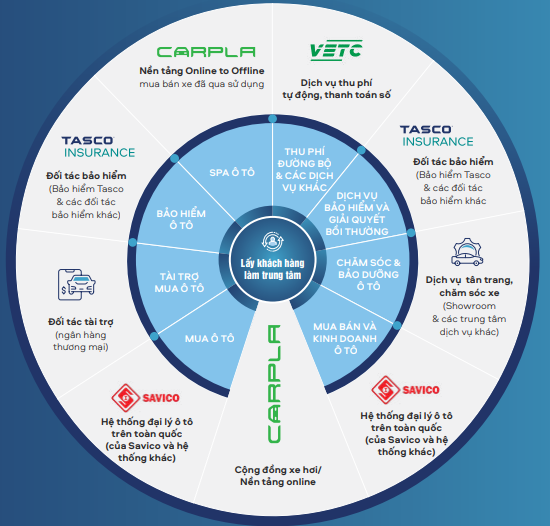

With the aim of “providing services throughout the vehicle life cycle,” at the end of 2022, Tasco Auto invested in Carpla – a platform for distributing used cars with integrated online (Carpla) and offline services (SVC showrooms).

Carpla buys used cars, then brings them for inspection, certification, cleaning, and disinfection before displaying them in stores. Currently, this platform has 6 automalls nationwide.

A Carpla store in Hanoi – Source: Carpla

|

Tasco will not only sell new and used cars, spare parts, repair and beautify cars but also offer additional services such as insurance, car financing. At the end of 2022, the Company received the transfer of 100% of the capital contribution of General Insurance Company Groupama Vietnam from Groupama Assurances Mutuelles (France).

Although established since 2001, Groupama Vietnam has a modest stature. According to the Vietnam Insurance Market Report in 2021, this non-life insurance company did not record revenue in 2020 and 2021, and the compensation/payment expense was only 6 million VND and 326 million VND respectively. Total assets reached 295 billion VND by the end of 2021, with equity of 287 billion VND.

Groupama Vietnam has become part of HUT since the end of 2022

|

HUT renamed Groupama Vietnam to Tasco Insurance (TIC), targeting the motor vehicle insurance sector, with a revenue target of 300 billion VND in 2023. In a year-end resolution in 2022, Tasco stated that it will pour over 612 billion VND to increase the chartered capital of TIC from 405 billion VND to over 1,017 billion VND.

Similarly, realizing the potential to access credit for car purchases by customers, which can become a driving factor for the automotive ecosystem, the “BOT tycoon” participates in the financial solution area (Tasco Finance) for people who want to own a car, allowing them to borrow from banks…

HUT‘s management team hopes that the approximately 2.7 million people using VETC’s services when buying, selling or exchanging cars, using car-related services will all use technology to connect the car service infrastructure from VETC to Carpla and SVC.

HUT‘s products, services, and value chain – Source: HUT‘s 2022 Annual Report

|

The results fall short of expectations

For SVC, the business results of the past 10 years have benefited from the increasing demand for cars in Vietnam, with only short pauses during the global economic recession and the pandemic.

In 2023, the company continued its success in terms of sales, bringing in revenues of approximately 21 trillion VND, triple the figure of 2013. However, the difficult economic situation forced the company to spend more on promotions, resulting in a sharp drop in net profit to only 29 billion VND, equivalent to 10% of 2022, and even lower than 2013, making the already “tight” profit margin of the car distribution segment even worse.

| Net profit trend of SVC from 2013 – 2023 |

These results brought HUT‘s revenue to nearly 11 trillion VND, ten times after the consolidation, but only achieved half of the initial plan set at the beginning of the year.

The company’s management had expected the merger to bring in 600 billion VND in after-tax profit in 2023, with Tasco Auto contributing 85%. However, the reality in 2023 shows continued difficulties in the automobile industry, with HUT only earning a meager 53 billion VND, less than 10% of the target.

The balance sheet also expanded significantly after the consolidation. Total assets reached about 27 trillion VND, an increase of 131%; while liabilities doubled from the beginning of the year to about 15.6 trillion VND. By the end of 2023, bank loans accounted for 50% of HUT‘s total debt.

| Asset, revenue, and profit before tax trend of HUT from 2013 – 2023 |

An analysis of the domestic business sector by securities firm SSI suggests that the most difficult period for the automobile industry has passed. SSI also forecasts that the market will continue to face challenges in the first half of 2024 due to weak consumer demand and the anticipation of new car models, but overall, this year’s automobile market will recover in terms of both volume and value; the growth rate of new cars in 2024 is expected to be around 9% compared to the same period.