On August 27, the Bank for Prosperity and Development (PGBank) held an extraordinary general meeting for 2024 to elect two new independent members to its board of directors: Ms. Cao Thi Thuy Nga and Mr. Dao Quoc Tinh.

Mr. Dao Quoc Tinh, a Ph.D. in Economics from the Banking Academy, has 38 years of experience in the field of finance and banking. He has held several important positions at the State Bank of Vietnam.

Ms. Cao Thi Thuy Nga, a master’s degree in Finance and Monetary Economics from the Academy of Finance, has 42 years of experience in the financial and banking industries. Prior to joining PGBank’s board as an independent director, she served as Deputy General Director of MB Bank.

Regarding the vacant position of general director at PGBank since April 2024, Mr. Pham Manh Thang, Chairman of the Board of PGBank, stated that the bank has approached several candidates and submitted them to the State Bank of Vietnam for consideration and approval to meet the bank’s development requirements.

PGBank welcomes two new independent board members

The Bank of Agriculture and Rural Development of Vietnam (Agribank) also held a conference to announce the decision of the Governor of the State Bank of Vietnam to appoint Mr. Vuong Hong Linh, Director of Dak Lak Province Branch, as Deputy General Director of Agribank.

Mr. Dao Minh Tu – Permanent Vice Governor of the State Bank of Vietnam, presents the appointment decision and congratulatory flowers to Mr. Vuong Hong Linh

Meanwhile, the Orient Commercial Joint Stock Bank (OCB) has received a resignation request from Mr. Nguyen Van Huong, Deputy General Director in charge of the Retail Block, due to personal reasons.

Mr. Huong was appointed Deputy General Director in charge of the Retail Block at the end of 2022 and has over 21 years of experience in the financial and banking industries. After his resignation, the OCB management team now consists of nine members, including Mr. Pham Hong Hai, the General Director.

Earlier, in August, Mr. Nguyen Dinh Tung also resigned from his position as a member of the Board of Directors due to personal reasons. In April 2024, Mr. Tung had also resigned from his position as General Director of the bank. Mr. Tung left OCB after more than a decade of dedication.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

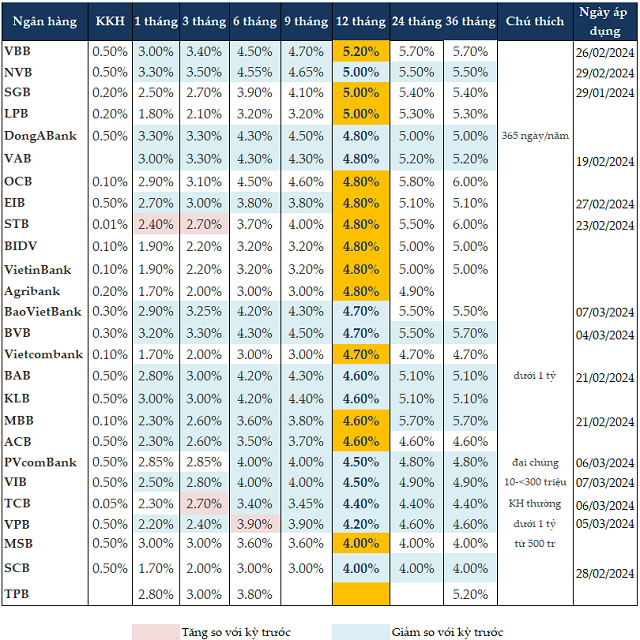

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Deputy Head of Internal Audit Department of SBV appointed Deputy CEO of Agribank

After the new appointments, Agribank’s Executive Board now consists of 9 members, with Mr. Pham Toan Vuong as the CEO.