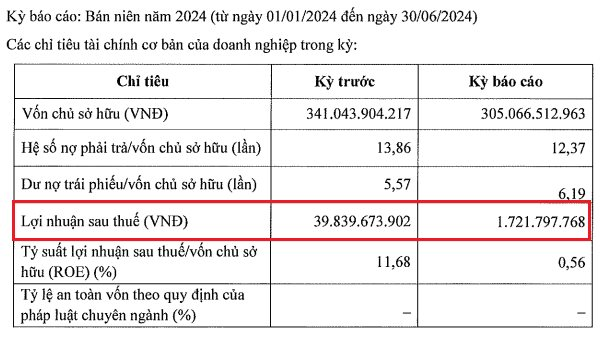

Investment Consulting Company Nguyen Binh has just announced periodic information about its financial situation for the first half of 2024.

Accordingly, this real estate company recorded after-tax profit of VND 1.7 billion, down nearly 96% over the same period in 2023, causing the after-tax profit margin/equity (ROE) to reach only 0.56%, this figure was 11.68% in the same period last year.

Previously, in the fiscal years 2021, 2022, and 2023, this real estate company reported after-tax profits of VND 525 million, VND 638 million, and VND 2.1 billion, respectively.

In terms of financial health, as of June 30, 2024, Nguyen Binh Investment’s total assets were VND 305 billion, down 10.5% over the same period. The debt-to-equity ratio was 12.37 times, equivalent to VND 3,774 billion. Of this, bond debt was nearly VND 1,900 billion.

The only bright spot in Nguyen Binh Investment’s semi-annual financial report was that the company’s payables decreased by nearly VND 1,000 billion compared to the beginning of the year (VND 4,629 billion). Meanwhile, the company’s bond debt slightly decreased compared to the beginning of the year (decreased by more than VND 10.2 billion).

Nguyen Binh Investment’s profit drops by nearly 96% compared to the same period, falling to just VND 1.7 billion.

According to data from the Hanoi Stock Exchange (HNX), Nguyen Binh Investment is currently circulating 3 lots of bonds, including: NBCCH2126001, NBCCH2124002, and NBCCH2124003, with a total value of VND 1,900 billion.

Of which, the NBCCH2126001 bond lot is worth VND 400 billion, issued on May 24, 2021, with a term of 5 years and a maturity date of May 24, 2026.

The NBCCH2124002 bond lot is worth VND 1,000 billion, issued on June 21, 2021, with a term of 3 years and a maturity date of June 21, 2024.

The NBCCH2124003 bond lot is worth VND 500 billion, issued on July 21, 2021, with a maturity date of July 22, 2026.

The registrar and depository for all three bond lots is Smartmind Securities Joint Stock Company (formerly known as KS Securities Joint Stock Company).

In June and July, Nguyen Binh Investment repurchased part of the NBCCH2124002 bond lot (valued at over VND 10.2 billion) and the NBCCH2124003 bond lot (valued at over VND 14.9 billion) before their maturity dates.

Thus, from May to June 2026, Nguyen Binh Investment will have to settle all three bond lots mentioned above, with a total value of nearly VND 1,900 billion.

It is known that Nguyen Binh Investment was established on June 24, 2019, with the main business field being real estate business. The company’s headquarter is located at Sunshine Center, 16 Pham Hung, My Dinh 2, Nam Tu Liem, Hanoi.

As of June 2019, Nguyen Binh Investment had a charter capital of VND 300 billion, in which the two shareholders, Mr. Nguyen Van Cuong and Mr. Do Xuan Ky, contributed VND 150 billion each.

By the end of April 2024, the company’s charter capital remained unchanged from the time of establishment (VND 300 billion). The legal representative of the company is Director Nguyen Van Cuong.

Viglacera Reports First-Ever Loss

Viglacera, the construction equipment giant, reported a net loss of 48 billion VND in Q4/2023, due to declining revenues and high maintenance costs. This marks the first time the company has reported a loss since its inception.