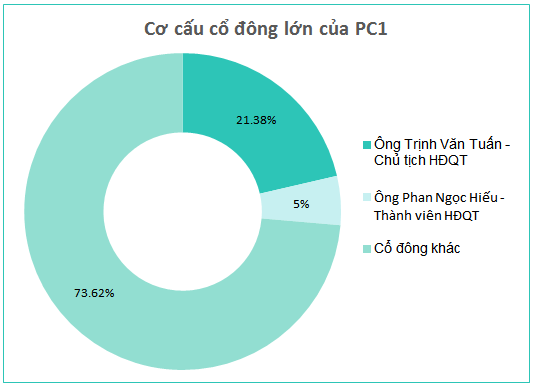

If the divestment is successful, Mr. Hieu will no longer be a shareholder of PC1, just four months after being elected to the Board of Directors.

In late January this year, against the backdrop of the largest shareholder group of PC1, BEHS Joint Stock Company and its subsidiaries, divesting their entire stake of over 73.4 million shares, equivalent to 23.6% of the capital, Mr. Phan Ngoc Hieu purchased an additional 410,000 shares on January 30, 2024, increasing his ownership from 4.87% to 5%, equivalent to nearly 15.6 million shares, officially becoming a major shareholder of PC1. At this time, Mr. Hieu was not an insider of the Company.

At the 2024 Annual General Meeting (held on April 26, 2024), as a major shareholder, Mr. Phan Ngoc Hieu was elected as a member of the Board of Directors for the term 2020-2025, replacing Mr. Mai Luong Viet who had submitted his resignation.

Source: VietstockFinance

|

Currently, PC1 has only two major individual shareholders who are also leaders of the Company. Mr. Trinh Van Tuan, Chairman of the Board of Directors of PC1, holds 21.38% of the capital, and Mr. Phan Ngoc Hieu, Member of the Board of Directors, holds 5%.

| PC1’s share price performance from the beginning of 2024 to August 28 |

Based on PC1’s closing price of VND 28,750 per share on August 28, it is estimated that Mr. Hieu could reap nearly VND 448 billion after ceasing to be a major shareholder of PC1.

| PC1’s financial results for the first half of 2024 |

In 2024, PC1 set a target of VND 10,822 billion in total revenue and VND 525 billion in after-tax profit, up 39% and 73%, respectively, compared to the previous year’s performance.

For the first six months of 2024, the Company achieved nearly VND 5,256 billion in net revenue, up 77% over the same period last year. Additionally, the Company earned more than VND 40 billion in profit from joint ventures and associates (a 17.7-fold increase year-on-year) and reduced losses by over VND 8 billion from other operations. As a result, net profit reached nearly VND 143 billion, 69.1 times higher than the same period last year.

Compared to the full-year targets, PC1 achieved 49% of the revenue target and 39% of the profit plan in the first half.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.

Building Peace earns over one hundred billion in Q4 2023, breaks four consecutive quarters of losses, HBC stock soars in January 30th session.

As of December 31, 2023, Hòa Bình Construction continues to incur a cumulative loss of nearly 2,900 billion Vietnamese dong.