Copper prices on the international market rose to a near six-week high during Tuesday’s trading session (August 27) as investors’ renewed appetite and optimism about the Federal Reserve’s move toward interest rate cuts fueled the surge.

September copper prices on the New York market reached $4,3065 per pound, the highest since July 18, when the metal touched $4,4280. Three-month copper on the London Metal Exchange (LME) rose 1.3% to $9,406 per ton.

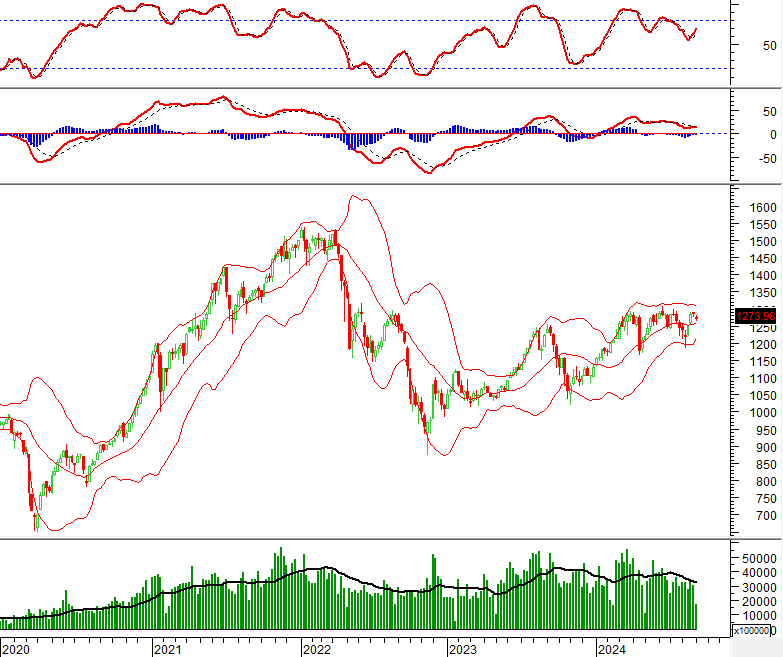

According to CNBC, copper prices have been steadily climbing in recent weeks, narrowing losses after sliding to a four-month low earlier this month.

Saxo Bank’s head of strategy, Ole Hansen, attributed the copper price recovery partly to renewed demand from hedge funds that had previously reduced their exposure to the base metal during its “recent sharp 24% decline.”

“We believe the worst of the copper price correction is behind us, but before a more sustained recovery can unfold, the demand-side fundamentals need to improve, possibly through restocking with cheaper funding once the Fed cuts rates,” Hansen said in a report.

He added, “Until then, traders will continue to look for signs of improving copper demand, especially through declining inventories from elevated levels at the three major futures exchanges worldwide.”

At the Fed’s annual symposium in Jackson Hole last week, Fed Chairman Jerome Powell clearly signaled that the central bank is ready to cut interest rates in September. “It’s time to stop reducing policy,” Powell said, without specifying the timing and magnitude of the rate cut.

Copper is expected to benefit from lower US interest rates as easier monetary policy could ease financial strains for manufacturers and construction businesses.

Experts consider copper consumption a crucial indicator of economic health. The red metal is indispensable in various sectors, including the energy transition ecosystem, electric vehicles, power grids, and wind turbines.

Wall Street banks are optimistic about copper price prospects this year due to improved supply risks and demand for conductive metals. In an April report, Citigroup predicted that the copper market is on the brink of entering a bull market, the second time this century, about 20 years after the first such cycle.

“From a technical perspective, copper’s upward momentum has stalled after hitting resistance at the early August high of $4.22 per pound in New York and $9,320 per ton in London,” Hansen said, adding that a breakthrough above these resistance levels would push prices to $4.31 and $9,500, respectively.

Chinese market demand will play a crucial role in copper’s potential recovery. However, the outlook for the world’s second-largest economy remains bleak due to the prolonged real estate crisis.

In June, copper inventories in China hit a four-year high. According to Bloomberg data, copper inventories at the Shanghai Futures Exchange rose to around 330,000 tons in June, the highest since 2020. The previous time copper stocks on this exchange reached such levels was in 2015.

Market Update on February 2nd: Oil, Copper, Iron & Steel, Rubber, and Sugar Prices Decline, Gold Surges to Almost 1-Month High.

At the end of the trading session on February 1st, the prices of oil, copper, iron and steel, rubber, and sugar all dropped, while natural gas hit a nine-month low and gold reached its highest point in nearly a month.