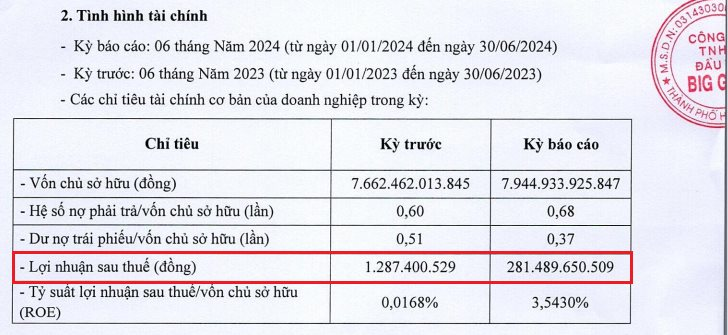

Big Gain Investment JSC has disclosed its semi-annual financial report for 2024 to the Hanoi Stock Exchange (HNX), revealing impressive business results for the first half of the year with a reported after-tax profit of over VND 281 billion, a hundredfold increase compared to the full-year profit of VND 2.3 billion in 2023.

For the fiscal years 2022 and 2023, the company posted after-tax profits of VND 1.4 billion and VND 2.3 billion, respectively.

As of June 30, 2024, Big Gain Investment’s equity stood at VND 7,945 billion, a 3.7% increase year-over-year. The debt-to-equity ratio was 0.68, corresponding to over VND 5,402 billion in liabilities. Of this, the bond debt amounted to more than VND 2,939 billion.

With a total capital of over VND 13,347 billion, the company is now among the largest real estate players in Southern Vietnam’s real estate market.

Big Gain Investment reports a surge in profits for the first half of 2024.

Data from HNX shows that from June to September 2021, Big Gain Investment successfully issued four bond batches: BGICH2124001 (VND 1,000 billion), BGICH2124002 (VND 1,000 billion), BGICH2125003 (VND 1,000 billion), and BGICH2125004 (VND 900 billion). These bonds, totaling VND 3,900 billion, carried an interest rate of 11% per annum and had maturities of 3-4 years.

In June and July 2024, two batches, BGICH2124001 and BGICH2124002, totaling VND 2,000 billion, will mature.

Meanwhile, the remaining two batches, BGICH2125003 and BGICH2125004, valued at VND 1,900 billion, will mature in August and September 2025.

On June 24, Big Gain Investment repurchased a portion of the principal of the matured BGICH2124001 bonds worth nearly VND 922 billion. The company also defaulted on a portion of the principal and interest of this batch, amounting to over VND 87 billion, due to “inadequate repayment sources and ongoing negotiations with investors regarding the repayment schedule for principal and interest.”

On July 30, the company repurchased a portion of the principal of the matured BGICH2124002 bonds worth nearly VND 562 billion. Similarly, it defaulted on a portion of the principal and interest of this batch, valued at nearly VND 500 billion, for the same reasons mentioned above.

According to our sources, Big Gain Investment JSC, formerly known as Big Gain Investment Joint Stock Company, was established on March 21, 2017, with an initial chartered capital of VND 150 billion. In July 2021, the company increased its chartered capital to VND 7,700 billion, which remains unchanged to date.

Currently, the legal representative of Big Gain Investment JSC is General Director Le Van Dung.

“How does Novaland strive to make billions of profits?”

Currently, the NVL stock is experiencing margin cuts, which greatly limits its liquidity attraction. The return of positive profits is a necessary condition for the company’s stock to be granted margin again.