Source: VietstockFinance

|

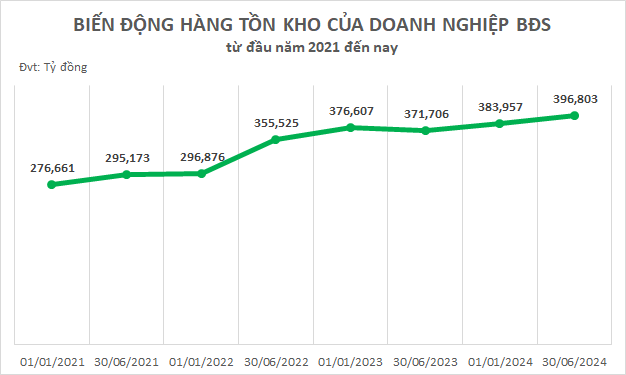

According to the Ministry of Construction, the real estate inventory across all enterprises in the market for Q2 2024 stood at approximately 17,105 units, including apartments, detached houses, and land plots. Specifically, there were 2,999 apartment units, 7,045 detached houses, and 7,061 land plots. The data indicates that the majority of the inventory falls within the detached house and land plot segments.

In Q4 2023, the inventory level was around 16,315 units, comprising 2,826 apartments, 5,173 detached houses, and 8,316 land plots. Again, the majority of the inventory was in the detached house and land plot categories.

Comparing the figures, the Ministry of Construction’s data shows that the number of inventory units in the country increased by nearly 5% over the six-month period.

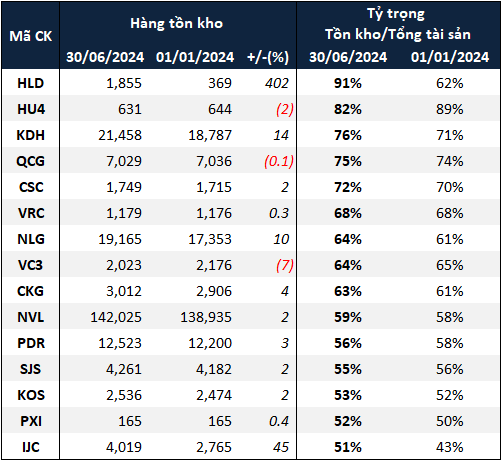

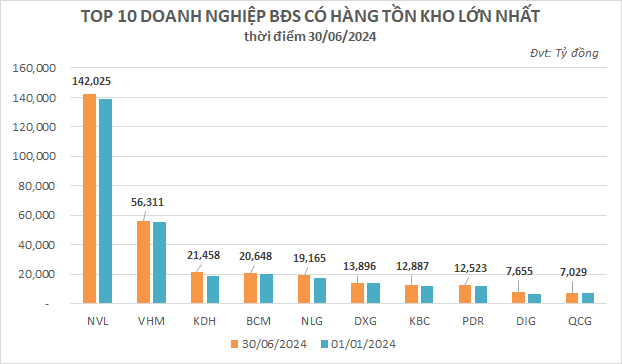

Novaland Leads in Inventory Quantity

The company with the largest inventory value in the industry is Novaland Investment Group Joint Stock Company (HOSE: NVL), with a value of over VND 142 trillion, a more than 2% increase from the beginning of the year. This accounts for nearly 36% of the total inventory of the enterprises in the statistics (listed on HOSE, HNX, and UPCoM). Of this, the value of completed real estate inventory is nearly VND 8.4 trillion, with the majority being under construction at nearly VND 134 billion.

Source: VietstockFinance

|

Novaland’s inventory value is more than 2.5 times that of the second-ranked company, VHM, which stands at VND 56.3 trillion. The majority of this consists of real estate under construction, valued at over VND 48.6 trillion, a more than 5% decrease. This includes land use fees, site clearance costs, and the purchase price of subsidiary companies allocated in projects such as Vinhomes Ocean Park 2 and 3, Vinhomes Grand Park, and Vinhomes Smart City, among others.

In the industrial park segment, the Industrial and Development Investment Corporation (HOSE: BCM) maintains its leading position with an inventory value of over VND 20.6 trillion, a more than 4% increase. The majority of this comprises compensation costs for site clearance, land use rights, infrastructure development, and other expenses, totaling nearly VND 18.3 trillion.

According to VPBank Securities, as of the end of 2023, BCM owned 350 hectares of remaining industrial park land across six existing projects, with most of these industrial parks gradually running out of leaseable area while maintaining over 90% occupancy rates. VPBank Securities assessed that BCM’s land transfer progress is relatively slower than expected, mainly due to issues related to land compensation, despite the high demand for industrial land in Binh Duong province.

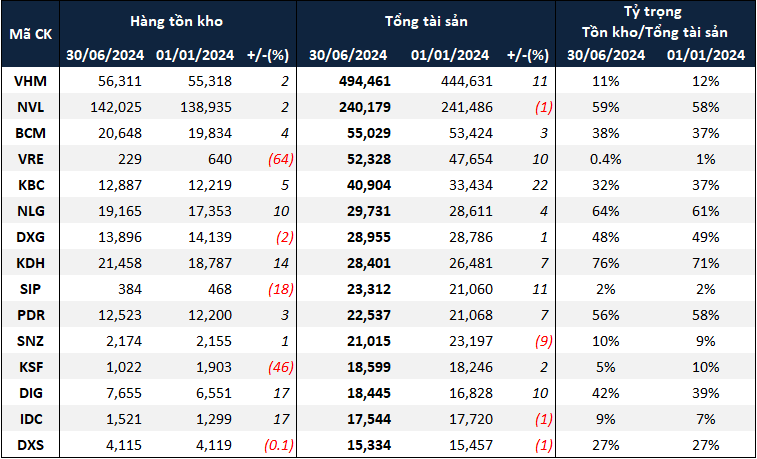

13% of Enterprises Hold More Than Half of Their Assets in Inventory

Out of the 115 enterprises, 15 had inventory values accounting for more than 50% of their total assets. This group includes five prominent companies: NVL, Khang Dien House Trading and Investment Joint Stock Company (HOSE: KDH), Nam Long Investment Corporation (HOSE: NLG), Phat Dat Real Estate Development Joint Stock Company (HOSE: PDR), and Quoc Cuong Gia Lai Joint Stock Company (HOSE: QCG).

|

15 enterprises with inventory values accounting for more than 50% of their total assets

Source: VietstockFinance

|

KDH stands out with a 14% increase in inventory value over the six-month period, reaching nearly VND 21.5 trillion. According to the company, the construction value of the ongoing project in Binh Trung Dong Ward, with a scale of 5.8 hectares (Binh Trung Dong 1), increased by over VND 1 trillion compared to the beginning of the year, reaching nearly VND 4.2 trillion. The value of the Binh Hung 11A residential area also increased by over VND 900 billion, exceeding VND 1.5 trillion.

NLG’s inventory value rose by 10%, reaching nearly VND 19.2 trillion, mainly attributed to the value of the ongoing projects: Izumi (nearly VND 8.7 trillion), Waterpoint Phase 1 (over VND 3.8 trillion), Phase 2 (over VND 2 trillion), and Akari (over VND 2.4 trillion).

Vinhomes (HOSE: VHM) and BCM have inventory-to-total asset ratios of 11% and 38%, respectively.

|

Inventory value situation of the 15 real estate enterprises with the largest total assets on the stock exchange (in VND trillion)

Source: VietstockFinance

|

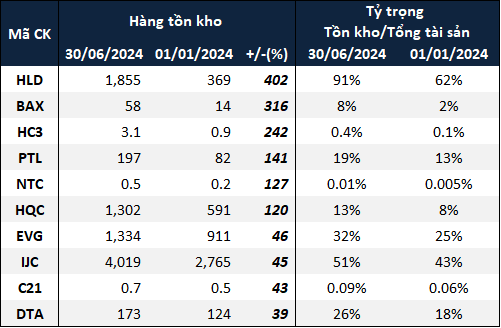

Significant Inventory Reduction by Major Enterprises

In terms of increase, HUDLAND Joint Stock Company (HNX: HLD) tops the list, with its inventory at the end of June five times higher than at the beginning of the year, reaching nearly VND 1.9 trillion.

The main difference comes from the production and business costs of the ongoing project in Thai Hoc and Nhuận Đông, Binh Minh communes, Binh Giang district, Hai Duong province (referred to as the Binh Giang – Hai Duong project), which increased from nearly VND 313 billion to over VND 1,796 billion. An additional VND 1,400 billion was paid by HLD to the Hai Duong Tax Department for land use and other obligations in the first six months of 2024.

|

10 enterprises with the highest increase in inventory value in the first six months of 2024 (in VND billion)

Source: VietstockFinance

|

Following HLD is Thong Nhat Joint Stock Company (HNX: BAX), with an inventory value over four times higher than at the beginning of the year, reaching VND 58 billion as of Q2 2024. The company stated that as of June 30, 2024, all inventory comprised finished real estate products: one commercial service store, 11 commercial houses, 36 social houses, and a kindergarten with a total area of 12,665m2, belonging to the Bàu Xéo Industrial Park central service area development project.

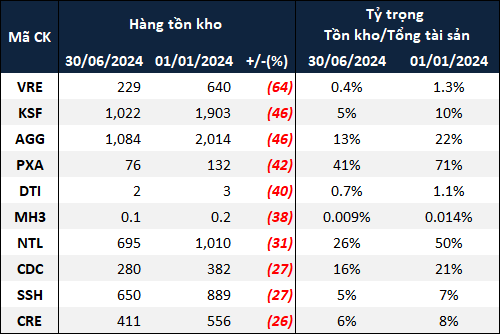

On the other hand, Vincom Retail Joint Stock Company (HOSE: VRE) leads the group with the most significant inventory reduction, witnessing a 64% decrease to VND 229 billion. This mainly consists of construction costs and the development of commercial townhouses for sale.

In addition to inventory, VRE’s cash holdings and basic construction costs also decreased by 78% and 24%, respectively, to over VND 1,100 billion and over VND 782 billion. The reduction in construction costs is mainly due to the exclusion of nearly VND 284 billion from Vincom Plaza Dien Bien Phu after the project was put into operation.

|

10 enterprises with the highest decrease in inventory value in the first six months of 2024 (in VND billion)

Source: VietstockFinance

|

Another large enterprise that recorded a decrease in inventory is An Gia Investment and Development Joint Stock Company (HOSE: AGG), with a 46% reduction, resulting in an inventory value of nearly VND 1.1 trillion. Within this, the value of the Westgate project (Binh Chanh) decreased from nearly VND 1.4 trillion to VND 517 billion.

Spanning 3.1 hectares, Westgate comprises over 2,000 apartments and shophouses that were handed over to customers in 2023. As per the project’s website in early June 2024, Westgate contributed 90% to AGG’s revenue plan in 2023, equivalent to VND 3,531 billion.

Novaland reports over VND 1,600 billion in profit for Q4/2023, bond debt reduced by VND 6,000 billion in one year.

In 2023, Novaland achieved a profit of over 800 billion VND, in contrast to the first half of the year when the company incurred a loss of over 1,000 billion VND.