Specifically, SJE plans to offer more than 18.1 million shares to existing shareholders (at a 4:3 ratio), with treasury shares not being allocated subscription rights. If successful, SJE will increase its charter capital from nearly VND 242 billion to nearly VND 423 billion, equivalent to nearly 42.3 million shares.

The expected timeline for this offering is in 2024 or another time frame as decided by the Board of Directors, depending on the company’s business and investment activities. The share offering will be carried out within 90 days and extended (if necessary) from the date of receiving the registration certificate for the offering from the State Securities Commission.

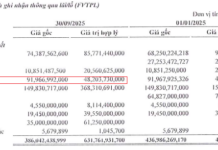

With an offering price of VND 13,000/share, SJE is expected to raise nearly VND 236 billion. Of this, nearly VND 91 billion will be used to repay the loan to BIDV – Hoan Kiem Branch in Q3-4/2024. The remaining amount of over VND 145 billion will be used to invest in purchasing shares of Phuc Long Hydropower Joint Stock Company in Q3/2024 from the existing shareholder, An Xuan Energy Joint Stock Company.

Phuc Long Hydropower Joint Stock Company is the investor of the Phuc Long Hydropower Plant project in Lao Cai province.

|

On December 19, 2017, the People’s Committee of Lao Cai province granted an investment certificate for the construction of the Phuc Long Hydropower Project to Phuc Long Hydropower JSC. The plant is located in Long Phuc and Xuan Thuong communes, Bao Yen district, Lao Cai province. The project was completed and started commercial operation on June 15, 2021. Phuc Long Hydropower Plant is a river-type hydropower model built on the Chay River, consisting of 2 units with a capacity of 22MW and an annual electricity output of 87.81 million kWh. The total investment value until the completion of the project is VND 708 billion.

|

SJE is also known for its investment in several hydropower plant projects, including Thac Trang (6MW capacity), To Buong (10.1MW), Dak Pru (7MW), Dak Doa (14MW), and Song Mien (6MW).

Existing hydropower plants of SJE

|

In the stock market, SJE’s share price has been maintaining a strong upward trend, rising from the VND 20,000/share region to the VND 27,000/share region. Thus, SJE shareholders will be able to exercise their subscription rights at a price equivalent to half of the market price.

| SJE share price has been on an upward trend since May 2023 |

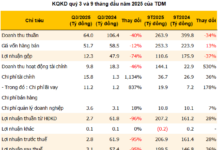

In terms of business performance, in the first half of 2024, SJE recorded a net profit of nearly VND 101 billion, more than four times higher than the same period last year, mainly driven by Q2 results. According to SJE, during this period, the company accelerated the collection of payments for the 500kV Quang Trach – Pho Noi transmission line project. Additionally, other income increased by 95%, while other expenses decreased by 1,412%.

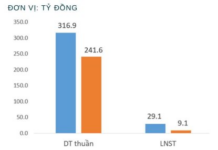

| SJE witnessed a breakthrough business performance in Q2/2024 |

Huy Khai

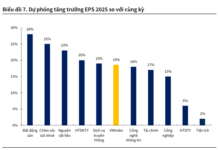

Choose stocks for “Tet” festival celebrations

Investors should consider choosing stocks in the banking industry with good profitability, healthy real estate, and abundant clean land reserves. In addition, the group of stocks in infrastructure investment, iron and steel, and construction materials should also be considered.