Mr. Gia Khang, a resident of District 4 in Ho Chi Minh City, shared with us an incident that occurred about two months ago. A friend who works at a bank needed to meet a target for issuing credit cards and begged Mr. Khang to help by opening one. Out of courtesy, Mr. Khang agreed and applied for a standard credit card for personal and family expenses.

Troubles with Canceling the Credit Card

Last week, a bank employee informed Mr. Khang that he had another credit card linked to the one he was using and was required to pay a fee. Mr. Khang was surprised as he had only applied for one card, but the system showed two active cards that were linked.

In the past, many consumers have encountered problems with “buy now, pay later” credit cards. Photo: LAM GIANG |

“I have lodged a complaint through the hotline, but I have not received any response from the bank yet. This is not the first time something like this has happened. About two years ago, when I took out a mortgage with the bank, one of the conditions was to open a credit card. I also discovered that I had been issued two cards back then. It was a hassle, but I managed to cancel one of them. Now, I am facing a similar situation,” Mr. Khang recalled.

Many others have found themselves in a similar predicament, struggling to cancel their credit cards. Mr. Le Hoang, a resident of Binh Thanh District in Ho Chi Minh City, shared that he recently received a call from a bank consultant based in Hanoi, informing him that if he reactivated his credit card, the annual fee would be waived for the next three years. Interestingly, this was the same credit card that he had canceled just a month ago after a week of hassle.

According to Mr. Hoang, at the beginning of 2024, an acquaintance who worked at V. Bank asked him to open a credit card with a limit of VND 44 million to meet their issuance target. Out of courtesy, Mr. Hoang agreed to open the card even though he had no intention of using it. The process of opening the card was straightforward, requiring only a phone number and a citizen identification card number. Within a week, he received his card.

During the application process, the V. Bank employee mentioned that he needed to deposit VND 10,000 to activate the card, and this amount would be refunded. However, they failed to inform him that interest would be charged on this amount. More than six months later, his card account had deducted the initial VND 10,000 and incurred additional overdue interest and late payment fees, totaling nearly VND 200,000.

“I was surprised to find that even though I hadn’t made any purchases, I was still charged a late payment fee. Moreover, after settling this amount, I went to the bank to initiate the card cancellation process, but the staff asked me to … go home and call the hotline to register for cancellation. After I requested the cancellation, the hotline agent scheduled a confirmation call for 3-5 days later… It’s much easier to open a card than to close it,” said a frustrated Mr. Hoang.

Similarly, Mr. Quoc Ngoc, a resident of Thu Duc City, spent two weeks and made multiple trips to the bank to cancel his credit card. According to the bank’s regulations, credit cardholders who wish to cancel their cards must call the hotline, but the system is often overloaded. When he finally got through, the agent informed him that his account still had a balance of VND 600,000 in promotional money, and the balance had not reached zero, so the card could not be canceled. To cancel, he had to spend all the promotional money!

Banks Should Provide Clear Explanations to Cardholders

Why is it so easy to open a credit card—banks aggressively promote it, and it only takes a few minutes (if you meet the requirements)—but so difficult to cancel?

A few banks only allow card cancellation through their hotline instead of at their branches or via the banking app. An employee of a commercial bank explained that card cancellation through the hotline helps reduce the workload and pressure on staff at branches and transaction offices.

Dr. Chau Dinh Linh, from the University of Banking in Ho Chi Minh City, opined that the situation where consumers rush to open credit cards and then struggle to cancel them due to a lack of usage is a consequence of a phase where banks aggressively expanded card issuance, and employees were pressured to meet business targets. Many individuals simultaneously hold multiple types of credit cards (cashback cards, shopping cards, co-branded cards, etc.) with different limits and purposes.

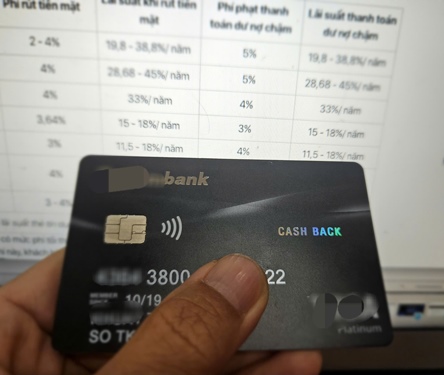

“Credit card businesses often have high profitability due to interest rates (average credit card interest rates range from 30% to 35%), fees, promotions, and cash flow from settlement accounts. This has led banks to compete fiercely in issuing cards, disregarding the actual needs of consumers. Meanwhile, many people open cards out of courtesy to relatives and friends without fully understanding the interest rates, penalty fees, and potential risks involved. In fact, some individuals have incurred bad debts due to uncontrolled spending and inability to repay,” analyzed Dr. Chau Dinh Linh.

Financial expert Phan Dung Khanh shared that he once had seven credit cards, mostly because of favors asked by friends and acquaintances. Working in the financial industry, he noticed that credit card contracts tend to be lengthy and detailed, leading to very few customers reading them thoroughly before signing. Moreover, the contract contents are often complex.

“Once, I read a credit card contract and found some unreasonable clauses, so I requested adjustments. The bank employee said that this was a standard legal framework and could not be modified. To be fair to cardholders, in addition to the contract, banks should provide a summary of specific information about interest rates, penalty fees, and potential risks if payments are not made on time,” suggested Mr. Phan Dung Khanh.

THAI PHUONG – LE TINH