Vinacafé Bien Hoa Joint Stock Company (VCF) has a long history in the coffee industry, dating back to 1968 with the establishment of the Coronel Coffee Factory. This was not only the first coffee factory in Vietnam but also the first instant coffee manufacturer in the entire Indochina region.

In 2024, the company underwent a transformation, transitioning from a state-owned enterprise to a joint-stock company. And in 2011, it officially listed on the Ho Chi Minh City Stock Exchange.

Today, Vinacafé Bien Hoa offers a diverse range of products, including roasted and ground coffee, instant coffee, and nutritious cereals under the brand names Vinacafé and Dế Mèn. Their products are not only popular in Vietnam but have also made their way into international markets, reaching consumers in countries such as China, the United States, Canada, Taiwan, Japan, and South Korea.

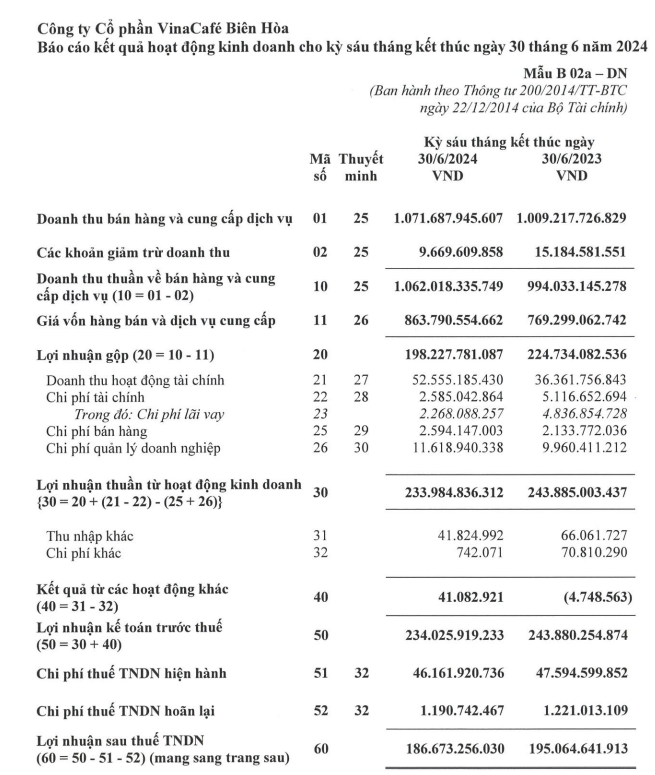

In the first six months of the year, VCF’s revenue reached VND 1,062 billion, a nearly 7% increase compared to the same period last year. However, the growth in cost of goods sold outpaced revenue growth, resulting in a 12% decline in gross profit to VND 198 billion; the gross profit margin also narrowed from 23% to below 19% year-on-year.

The company’s net profit for the period stood at approximately VND 187 billion, a 4% decrease year-on-year. With these results, VCF has achieved nearly 43% of its revenue target and 40% of its low-end profit plan for the full year. In the high-end scenario, the company has accomplished only about 38% (VND 2,800 billion) of its revenue target and 37.3% of its profit plan (VND 500 billion).

VCF attributed the profit decline to rising raw material costs, while sales growth was insufficient to offset this increase, leading to a compression in profit margins.

As of June 30, 2024, VCF’s total assets reached VND 2,828 billion, including short-term receivables of VND 848 billion (mainly comprising short-term deposits for investment activities, accounting for 73.5%) and long-term receivables of VND 806 billion.

The company’s total liabilities stood at nearly VND 529 billion, with short-term debt making up the majority at VND 524.2 billion. Notably, short-term loans accounted for the largest proportion of the debt structure, totaling over VND 233.6 billion.

VCF’s equity was recorded at VND 2,299.5 billion, including undistributed post-tax profits of VND 1,790 billion.

Source: 2023 Annual Report

Vinacafé Bien Hoa has a track record of paying high dividends to its shareholders over the years. Since 2011, the company has consistently paid cash dividends, with the highest ratio reaching 660% in 2017.

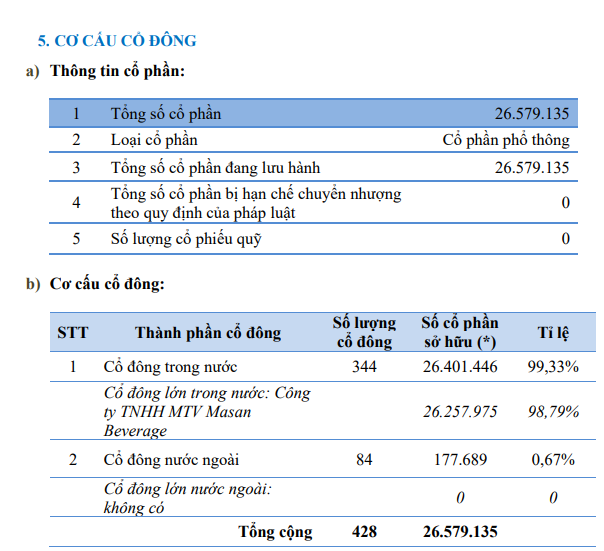

Recently, VCF announced a 250% cash dividend for 2023, equivalent to VND 25,000 per share. With nearly 26.6 million shares in circulation, the company will need to allocate nearly VND 665 billion for dividend payments.

It is worth noting that VCF has a concentrated shareholder structure, with Masan Beverage Company Limited holding 98.79% of the shares. The remaining shares are held by foreign shareholders, totaling 84 in number.

Due to this concentrated ownership structure, VCF shares often experience low liquidity, and the stock price remains relatively unchanged except on dividend-related dates.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.

Building Peace earns over one hundred billion in Q4 2023, breaks four consecutive quarters of losses, HBC stock soars in January 30th session.

As of December 31, 2023, Hòa Bình Construction continues to incur a cumulative loss of nearly 2,900 billion Vietnamese dong.