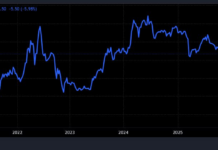

Oil Down 1%

Oil prices fell by 1% on Wednesday after data showed U.S. crude inventories fell less than expected and concerns over Chinese demand, despite limited losses due to supply risks in the Middle East and Libya.

Brent crude futures settled down 90 US cents or 1.13% at $78.65 a barrel. U.S. West Texas Intermediate (WTI) crude fell $1.01 or 1.34% to $74.52.

Data from the U.S. Energy Information Administration showed U.S. crude stocks fell by 846,000 barrels to 425.2 million barrels last week, lower than the Reuters poll of analysts’ expectations for a 2.3 million-barrel drop.

Concerns over Chinese demand also continued to weigh on prices as recent data pointed to a struggling economy and slower oil demand from refineries.

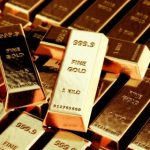

Gold Falls

Gold prices slipped on Wednesday, weighed down by a stronger U.S. dollar as investors focused on U.S. inflation data for clues on the Federal Reserve’s rate cut plans in September.

Spot gold fell 0.8% to $2,505.03 per ounce in late trade, after dropping as much as 1.1% earlier in the session. Gold futures for December delivery settled down 0.6% at $2,537.80.

The dollar rose 0.6%, making gold more expensive for holders of other currencies.

Markets are pricing in a 63.5% chance of a 25-basis-point rate cut in September and a 36.5% chance of a 50-basis-point reduction.

Copper, Aluminum Slide

Copper, aluminum, and other base metals fell on Wednesday as concerns about demand from top consumer China and a rebound in the U.S. dollar triggered a sell-off from funds and producers.

On the London Metal Exchange (LME), three-month copper ended down 2% at $9,256.50 a ton, while aluminum fell 2.4% to $2,489, its biggest decline since June 7.

Production in China’s metal-intensive industries, from automakers to real estate developers and internet companies, has been sluggish.

Iron Ore Slides

Iron ore futures fell on Wednesday from their highest level in nearly three weeks as investors turned cautious ahead of China’s economic data due this week.

The January iron ore contract on the Dalian Commodity Exchange (DCE) in China fell in early trade, then recovered towards the end of the session, ending at 754.5 yuan ($105.81)/ton, after rising more than 3% in the previous session.

September iron ore on the Singapore Exchange fell 0.64% to $100.95 per ton.

Rubber Hits 13-Year Peak

Rubber futures on the Japanese market hit a 13-year high, driven by tight supply prospects in Thailand and stronger demand from China.

The January rubber contract on the Osaka Exchange (OSE) finished 11.8 yen, or 3.28%, higher at 371.8 yen ($2.57)/kg, its seventh straight session of gains.

During the session, prices touched 373.0 yen, the highest since September 1, 2011.

January rubber on the Shanghai Futures Exchange (SHFE) rose 335 yuan, or 2.04%, to close at 16,755 yuan ($2,349.34)/ton.

Coffee Climbs

Robusta coffee for November delivery rose $80, or 1.7%, to $4,926 per ton.

Despite tight global supplies, the market appeared to be technically overbought and could pull back in the short term.

December arabica coffee rose 0.5% to $2,564.5 per lb, just shy of Tuesday’s peak, which was its highest in two and a half years.

Palm Oil Falls

Malaysian palm oil prices fell on Wednesday as concerns about potential higher import taxes in India, the world’s top vegetable oil buyer, outweighed weak supply prospects from top producer Indonesia.

The November palm oil contract on the Bursa Malaysia Derivatives Exchange closed down 3 ringgit, or 0.08%, at 3,920 ringgit ($903.23) per ton, falling for a second straight session.

India is considering raising import taxes on vegetable oils to support domestic farmers who are struggling with low oilseed prices, two government sources said on Wednesday.

Soybeans, Corn Ease

Chicago soybean and corn futures fell on Wednesday as traders assessed whether timely rains and forecasts for mild weather would support U.S. corn and soybean crops in their final growth stages.

Wheat prices edged higher on technical trading and bargain buying.

Soybean futures ended down 9-1/2 cents at $9.77 a bushel, corn fell 2 cents to $3.90-3/4 a bushel, and wheat rose 6 cents to $5.41-1/2 a bushel.

Key Commodity Prices as of August 29:

Top Investment Channels for 2024: Safe and Profitable

2023 is a year full of volatility in the global financial market. Against this backdrop, many investors are interested in gold as a store of assets.

Market Update 02/07: Oil, Gold, Copper Rise while Iron Ore, Rubber Decline

Oil prices increased at the end of the trading session on June 2nd, with gold strengthening as the USD weakened. The currency experienced its first upward trend in 5 sessions, while iron ore and rubber declined.