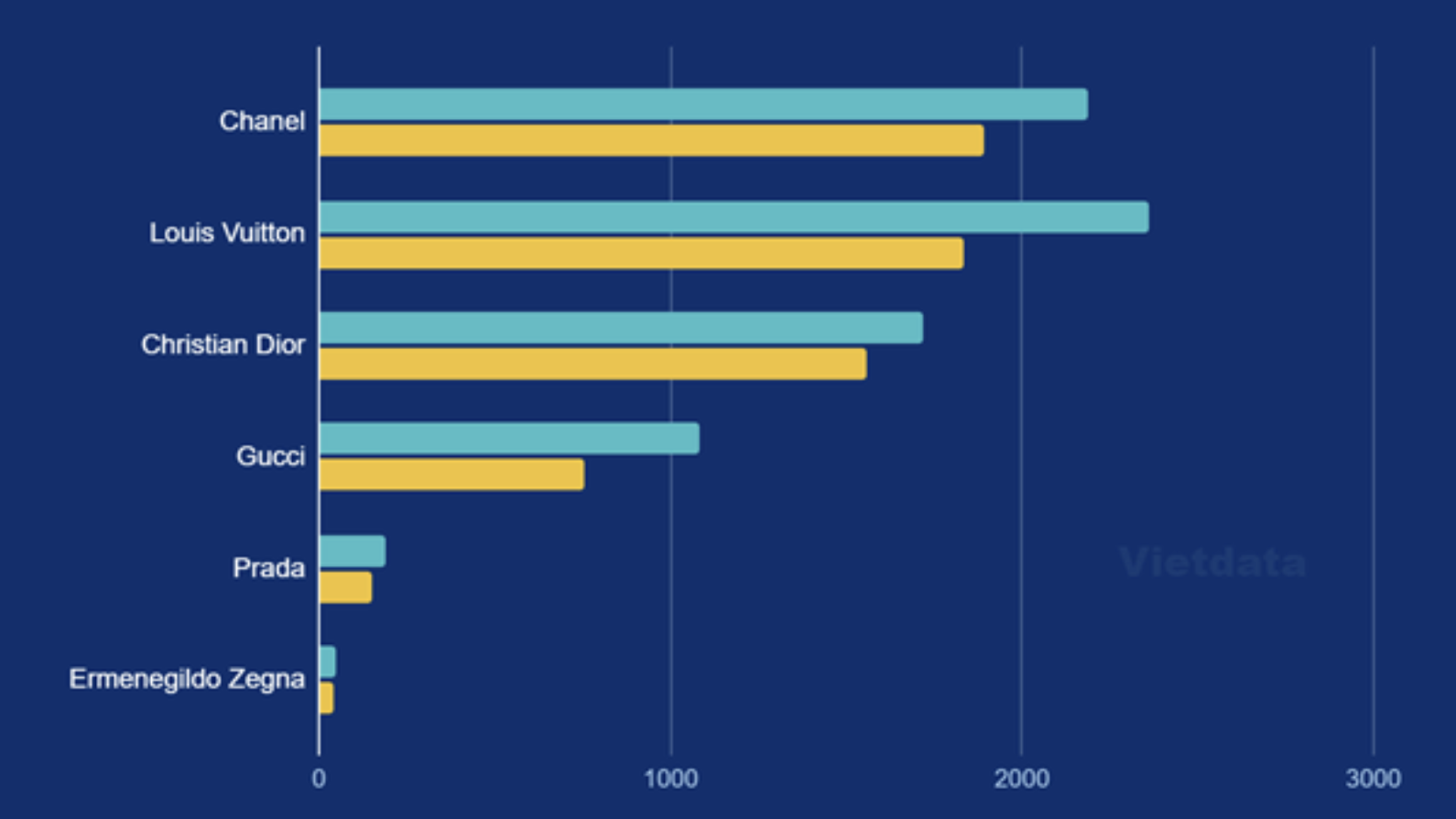

According to Vietdata’s report on the Luxury Goods Market in Vietnam in 2023, after two years of dominating the luxury market (2021-2022), Louis Vuitton Vietnam had to give up its leading position to Chanel Vietnam. In the past year, Louis Vuitton recorded a revenue of approximately VND 1,800 billion, a decrease of 22.5%, causing a 38% drop in profit compared to the same period in 2022.

Chanel, founded by Coco Chanel, took the top spot in the luxury industry but couldn’t escape the chorus of declining revenue.

Specifically, the company’s revenue decreased by 13.6% compared to the previous year, reaching VND 1,900 billion. Profit after tax halved. Chanel currently owns six exclusive stores located in prime locations in Hanoi and Ho Chi Minh City.

Revenue of luxury goods distributors in Vietnam in 2023. Source: Vietdata

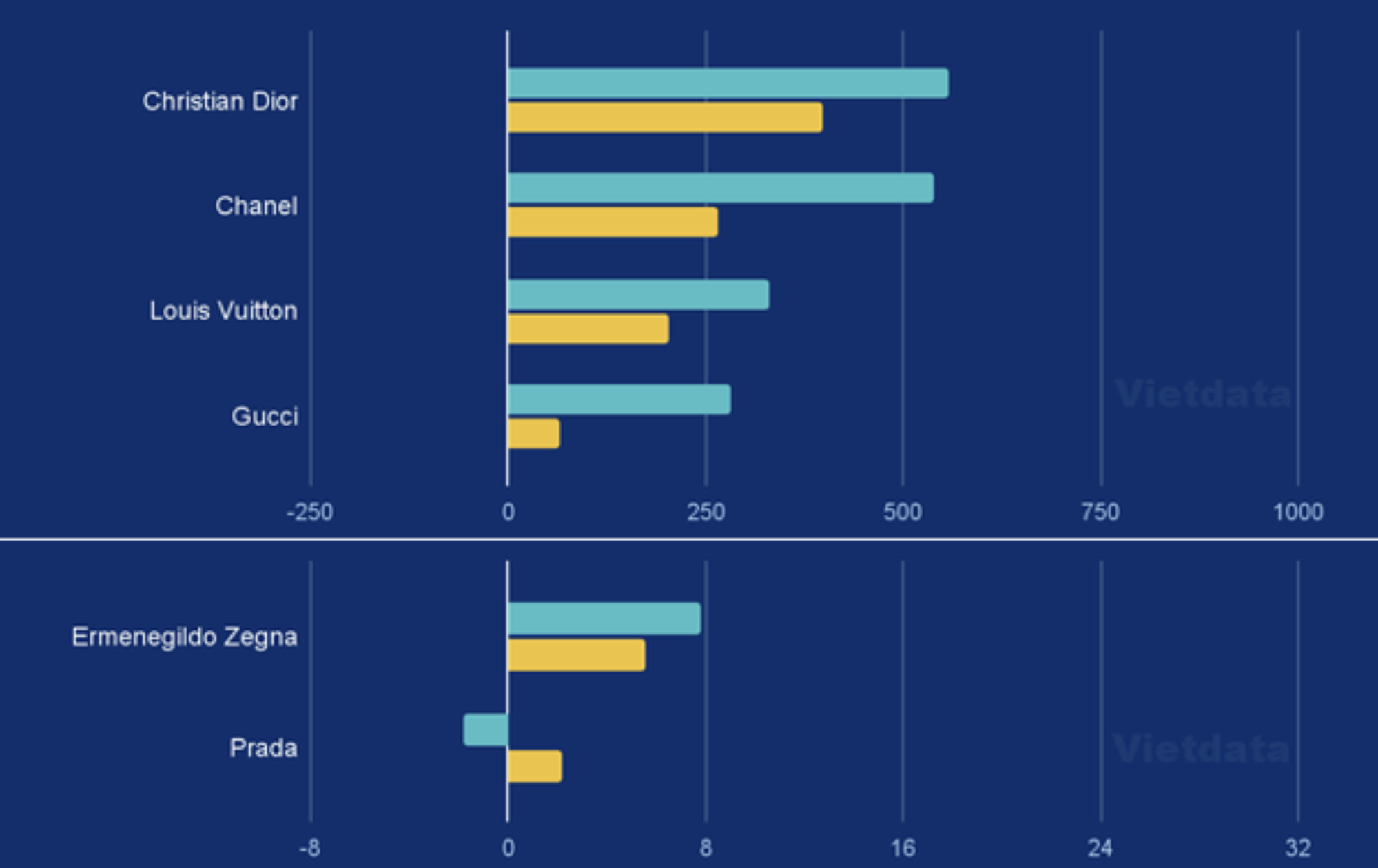

Although it didn’t top the revenue chart, Christian Dior Vietnam led in profit among exclusive distributors for a single luxury brand.

Last year, the company’s revenue reached VND 1,500 billion, a mere 9.5% drop from 2022. Thanks to effective cost control and business optimization, Christian Dior Vietnam recorded the highest profit after tax in the exclusive brand distribution segment, according to Vietdata.

Christian Dior Vietnam currently has a network of eight stores in Hanoi, Hoi An, and Ho Chi Minh City, including both Christian Dior Couture Boutiques and Parfums Christian Dior Boutiques.

Compared to the three giants mentioned above, Gucci Vietnam has a smaller revenue scale, estimated at VND 1,000 billion in 2022, a 30% drop last year to around VND 750 billion. This company also experienced the most significant profit decline in the luxury market, a 77% drop compared to 2022. Gucci currently has three stores in Hanoi and Ho Chi Minh City, one of which is a collaboration with Adidas.

Prada Vietnam and Ermenegildo Zegna Vietnam are smaller in scale and quite far from the leading enterprises, with annual revenues of less than VND 200 billion.

Although Prada VN’s revenue in 2023 also showed a general downward trend, Vietdata highly appreciated its effective cost control strategy and appropriate business strategy adjustments, turning losses in 2022 into profits.

Meanwhile, Ermenegildo Zegna Vietnam started making profits in 2022 after several years of presence in this market. Currently, both Prada VN and Ermenegildo Zegna VN have only one store each in Hanoi.

Despite a decrease in purchasing power, experts believe that the challenges for luxury brands are short-term. According to a recent assessment by Savills, the luxury market has passed its trough and is showing positive signs of recovery due to the return of international tourism and the trend of decreasing inflation. However, the situation varies in different countries and regions.

In Europe, high-end retailers still face challenges with high rental costs, and sales per store continue to decline. Wealthy customers willing to spend large sums on luxury goods have decreased due to the global economic downturn, especially the struggling real estate market.

In contrast, Vietnam remains an attractive market for this industry as the number of middle-class and super-rich individuals is growing rapidly.

According to World Data Lab’s estimates, among the nine Asian countries predicted to have the most significant number of people joining the middle class in 2024, Vietnam ranks fifth, with four million. India leads the list (33 million), followed by China (31 million), Indonesia, and Bangladesh (five million each).

The organization defines middle-class individuals as those who spend at least $12 per day in purchasing power parity terms in 2017. Accordingly, the middle class in Vietnam currently accounts for about 17% of the population, and the Ministry of Labor, Invalids, and Social Affairs expects this proportion to increase to 26% by 2026.

Knight Frank also reports that by the end of 2022, the number of people with a net worth of over $30 million had reached 1,059. It is forecasted that this number will reach 1,300 by 2027, a 122% increase in a decade. The number of people with assets over $1 million is also expected to rise by 173% between 2017 and 2027.

This partly explains the wave of foreign retail brands entering Vietnam. This wave began in 2023, with brands like Mont Blanc and Balmain Paris opening their first stores in Tràng Tiền Plaza, and Devialet setting up shop on Tràng Tiền Street.

Additionally, several other prominent brands, including Victoria’s Secret, Foot Locker, Maison Margiela Paris, Coach, Marimekko, Karl Lagerfeld, and Come Home, made their debut at Lotte Mall West Lake Hanoi. This year, the luxury “trio” of Cartier, Rene Caovilla, and The Hour Glass Opera simultaneously expanded their presence, further fueling this wave.

“The High Cost of Impulse Shopping: A Tale of Credit Card Conundrums”

Li Wenchao stumbled upon a lucky find—a lost credit card. However, instead of returning it, greed got the better of him, and he embarked on a shopping spree at the upscale Christian Dior store in District 1, Ho Chi Minh City.