In a stagnant real estate market, Big Gain Investment JSC in District 7, Ho Chi Minh City, surprisingly recorded booming business results, reporting a semi-annual profit of over VND 281 billion, more than 100 times higher than the full-year 2023 figure.

Similarly, a real estate company headquartered in Hanoi has also recorded a surge in post-tax profit in the first half of the year, amounting to over VND 518 billion.

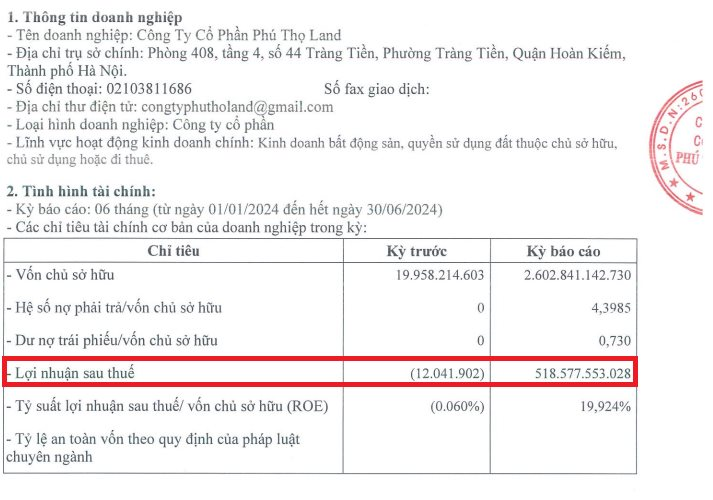

Specifically, Phu Tho Land Joint Stock Company (Phu Tho Land) has released its semi-annual financial report for 2024, revealing a remarkable turnaround with a post-tax profit of over VND 518 billion. This is a significant improvement compared to the loss of VND 12 million in the same period last year.

Previously, in the financial years 2022 and 2023, Phu Tho Land continuously reported losses of VND 6 billion and VND 140.7 billion, respectively.

As of June 30, 2024, Phu Tho Land’s equity stood at VND 2,602 billion, a staggering increase of over 130 times compared to the previous year (nearly VND 20 billion). The debt-to-equity ratio was 4.3985, corresponding to payables of over VND 11,448 billion. Of this, bond debt amounted to VND 1,900 billion.

Phu Tho Land’s financial figures show a dramatic increase compared to the previous year.

Notably, despite the surge in post-tax profit to over VND 518 billion in the first half of this year, the company’s payables ballooned from zero to over VND 11,448 billion in just one year.

In the first six months of 2024 alone, Phu Tho Land’s payables increased by more than VND 6,000 billion.

Phu Tho Land currently has only one lot of PTJCB2324001 bonds outstanding, with a value of VND 1,900 billion, a term of 12 months, and a fixed interest rate of 10.5% per annum. The bonds were issued and fully settled on August 25, 2023, making the maturity date August 25, 2024.

According to data from the Hanoi Stock Exchange (HNX), the PTJCB2324001 bond lot has been fully repaid by Phu Tho Land as per the due date.

Phu Tho Land Joint Stock Company was established on November 1, 2019, and is headquartered at F2-123 Dong Ma, Thanh Mieu, Viet Tri, Phu Tho. According to the latest business registration information, the company’s legal representative is Mr. Nguyen Danh Toan (DOB: 1970), with a charter capital of VND 1,750 billion and a total workforce of 5 employees.

On August 8, 2023, Phu Tho Land amended its business registration information, increasing its charter capital by 87.5 times from VND 20 billion to VND 1,750 billion. The company also changed its legal representative from Mr. Hoang Ngoc Minh (DOB: 1991) to Mr. Nguyen Danh Toan.

Hanoi to have nearly 100m wide road soon

Hanoi is about to have a nearly 100m wide, 1.3km-long road connecting from Xuân Diệu street to the Tây Hồ villa area.

Hanoi’s Update on the Delayed 1.000 billion VND Hospital Project

To address the challenges faced by investors, the Hanoi People’s Committee has instructed the Long Bien People’s Committee and the Department of Natural Resources and Environment to resolve any obstacles that arise during the implementation of the Thang Long 1,000-Year Oncology and Plastic Surgery Hospital project.