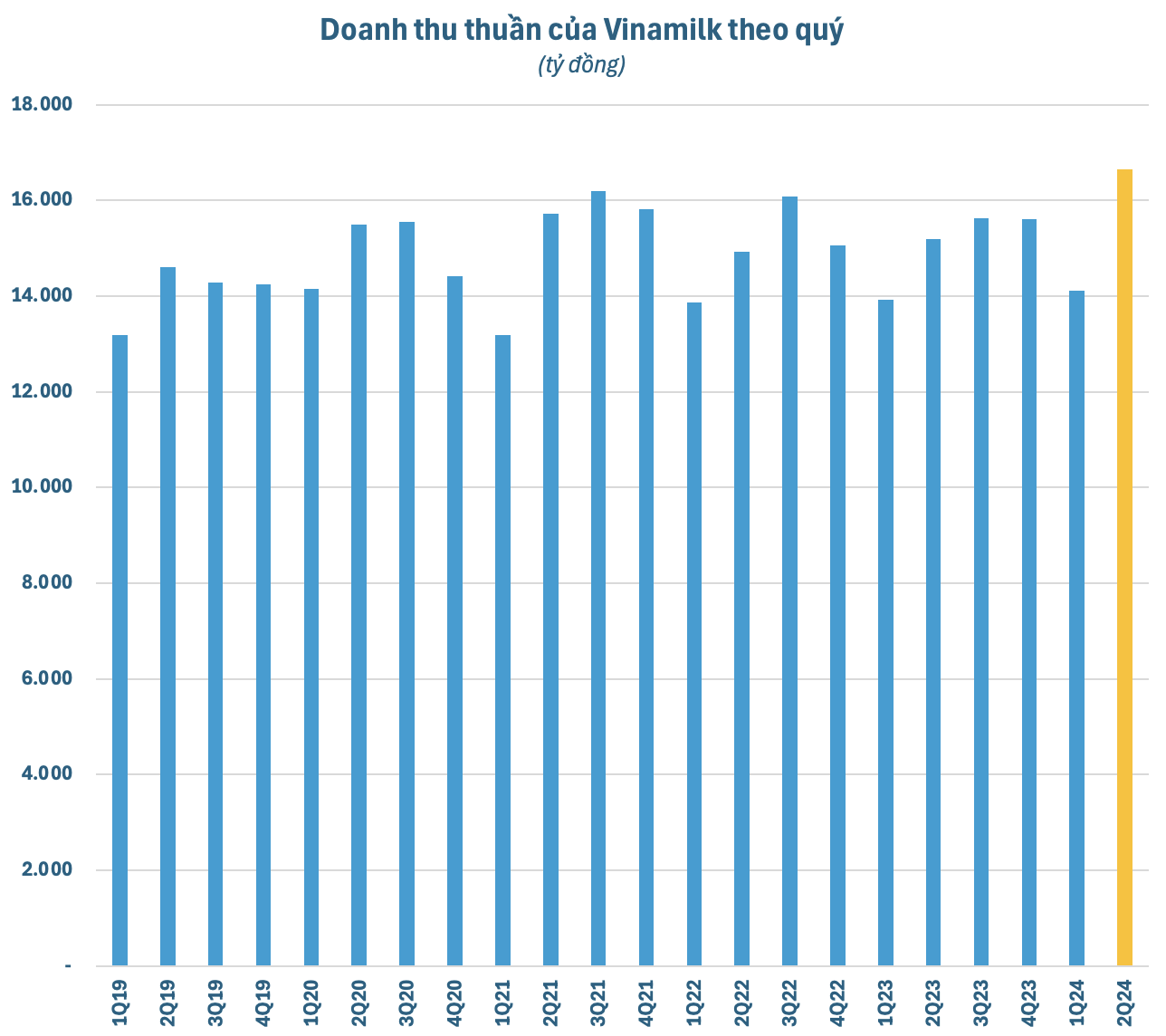

Vinamilk (VNM) has turned the corner after a challenging period, posting breakthrough financial results in the latest quarter. The company’s second-quarter net revenue reached VND 16,656 billion, a nearly 10% increase year-over-year, setting a new record since its inception. This quarter also witnessed the highest growth rate since the beginning of 2022.

Gross profit margin improved by 2 percentage points compared to the same period last year, reaching 42.4% as Vinamilk secured better prices for imported milk powder raw materials. After deducting expenses, the leading dairy company posted a net profit of nearly VND 2,700 billion, a 21% increase year-over-year. This is the highest profit in 11 quarters and the fifth consecutive quarter of year-over-year growth for Vinamilk.

Vinamilk’s business performance is expected to continue thriving in the upcoming periods, mainly driven by its overseas markets. In a recent report, Vietcap upwardly adjusted its forecast for Vinamilk’s 2024 total revenue from overseas business segments by 9% and projected a possible gross profit margin increase of 240–340 basis points.

Revenue from overseas operations is anticipated to rise by 18% year-over-year in 2024. Specifically, exports are expected to increase by 21%, and the combined revenue of Driftwood and Angkormilk (DW & AK) is projected to grow by 14% compared to the previous year. Sales of powdered milk for children are benefiting from competitors’ gradual withdrawal from Iraq due to instability, while demand in this country remains solid.

Additionally, Vietcap believes that Vinamilk’s aggressive marketing efforts over the past year, expected to continue until the end of 2025, will contribute to a 5% CAGR in revenue for the company’s high-margin product categories (such as fresh milk, yogurt, and powdered milk for children) during the 2024–2028 period.

According to Vietcap, the gross profit margin for the domestic business segment will gradually improve from 44.3% in 2024 to 44.6% in 2028. This enhancement is mainly attributed to a shift in product mix toward higher-margin categories, supported by Vinamilk’s marketing efforts in these segments.

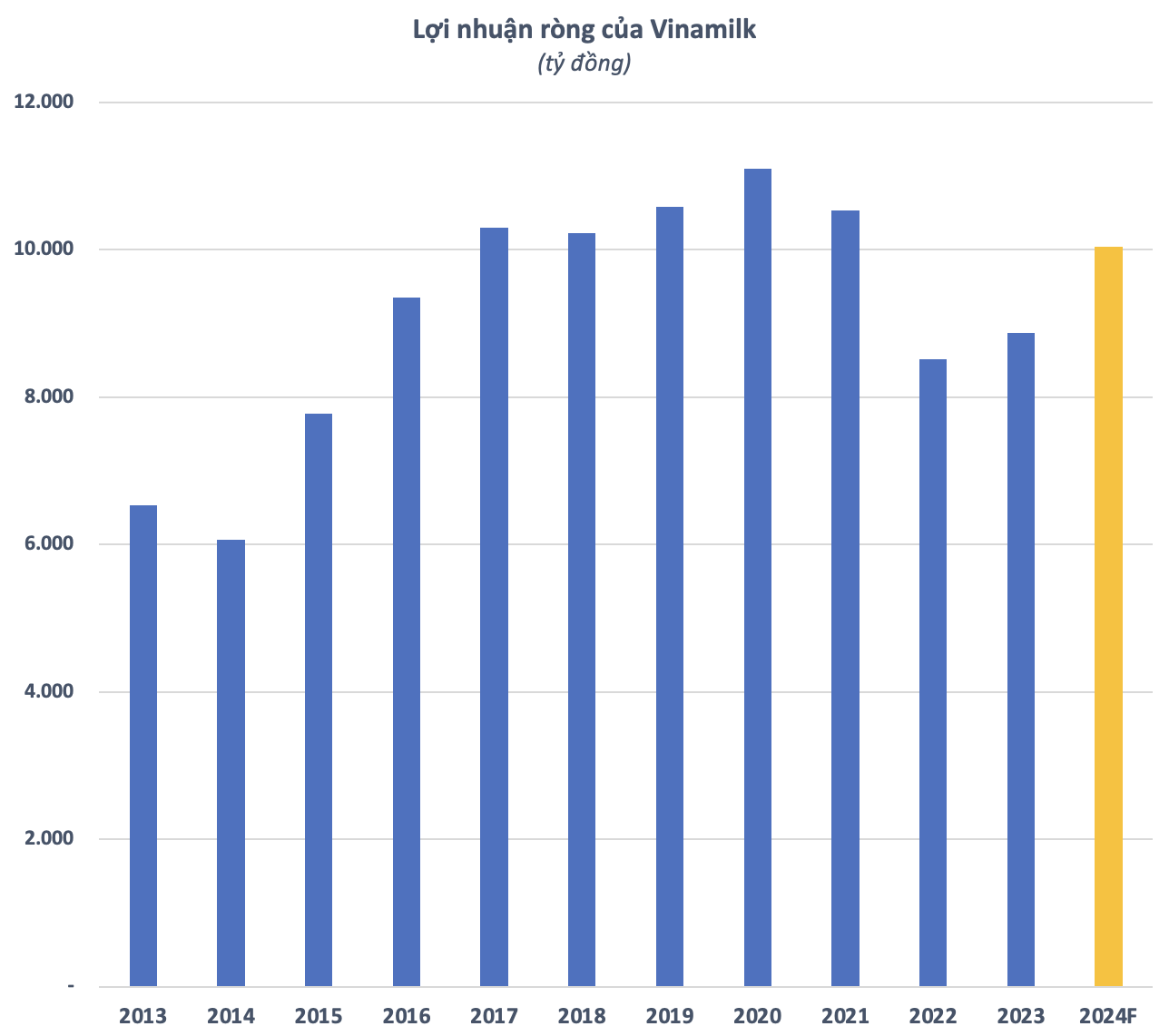

Based on these factors, Vietcap estimates that Vinamilk’s net revenue for 2024 could reach nearly VND 64,500 billion, a 7% increase year-over-year. Net profit is expected to grow by 13% compared to 2023, surpassing VND 10,000 billion. This figure is significantly higher than the company’s plan and would be the highest in three years if the projection proves accurate.

Vietcap projects Vinamilk’s 2024 net profit to surpass VND 10,000 billion

The improved business outlook has attracted foreign capital back to Vinamilk after a period of continuous net selling. Since the beginning of July, foreign investors have net purchased more than 34 million VNM shares, equivalent to a net value of over VND 2,400 billion, the highest on the Vietnamese stock market in the last two months.

The influx of foreign investment has contributed to a strong rebound in the VNM share price from its bottom. The stock has surged by nearly 13% in the last month and is currently trading at VND 73,900 per share. Its market capitalization stands at approximately VND 154,500 billion (~$6.2 billion), making it the largest company in the F&B industry on the Vietnamese stock market.

In a related development, on September 25, Vinamilk will finalize the list of shareholders eligible for the final 2023 dividend of 9.5% and the first 2024 interim dividend of 15%, both in cash. With 2.09 billion outstanding shares, Vinamilk is expected to distribute a total of over VND 5,120 billion for this dividend payout. The payment is scheduled to be made from October 24, 2024.

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.