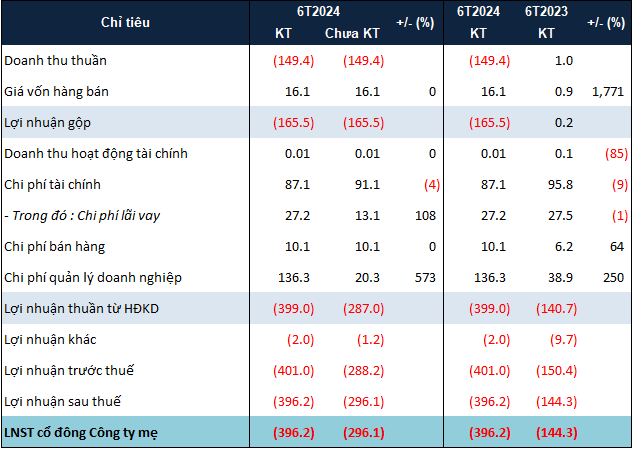

In particular, after the review, LDG recorded a net loss of more than VND 396 billion in the first half of 2024, an additional VND 100 billion compared to the self-prepared financial statements. Previously, in the same period, the Company also recorded a loss of more than VND 144 billion.

On the other hand, the above results caused LDG’s accumulated loss as of 06/30/2024 to increase from more than VND 175 billion to over VND 278 billion. At the beginning of the year, the Company still had accumulated profits of nearly VND 118 billion.

The main reason for LDG’s significant increase in losses after the review was management expenses, which were 6.7 times higher than the self-prepared financial statements, at more than VND 136 billion. Of this, more than VND 116 billion was provision expenses that had just arisen in the reviewed financial statements, while the self-prepared reports did not recognize this amount.

|

2024 Semi-Annual Review Difference of LDG. Unit: Billion VND

Source: VietstockFinance

|

Although there are opinions that fully accept LDG’s reviewed financial statements for the first half of 2024, the auditing firm also highlighted some issues, notably expressing significant doubt about LDG’s ability to continue as a going concern.

Regarding the Tan Thinh residential project with inventory balance as of 06/30/2024 of nearly VND 517 billion, LDG committed to completing the procedures according to the inspection conclusion dated 03/23/2023 of the People’s Committee of Dong Nai province to continue implementing and completing the project.

Also related to the Tan Thinh project, former Chairman of the Board Nguyen Khanh Hung has been prosecuted and detained for investigating the act of deceiving customers at this project. On 04/11/2024, the Dong Nai Provincial Police again prosecuted former Deputy General Director – Nguyen Quoc Vy Liem for the same offense. As of the date of the financial statements, LDG is still awaiting the conclusion of the authorities and has no basis to assess the impact of the case.

After announcing the reviewed financial statements, LDG also explained the audit opinion, especially about the doubt about the Company’s ability to operate continuously.

Accordingly, LDG has been working with banks to restructure its debts. Specifically, on 07/30/2024, the Company was approved by Saigon Thuong Tin Commercial Joint Stock Bank – Branch of District 11 to extend the debt repayment period by an additional 12 months.

At the same time, the Company is working with bondholders to agree to extend the debt obligations of the VND 180 billion bond lot, expected to be fully paid when the Company pays the corresponding interest amount.

Viglacera Reports First-Ever Loss

Viglacera, the construction equipment giant, reported a net loss of 48 billion VND in Q4/2023, due to declining revenues and high maintenance costs. This marks the first time the company has reported a loss since its inception.