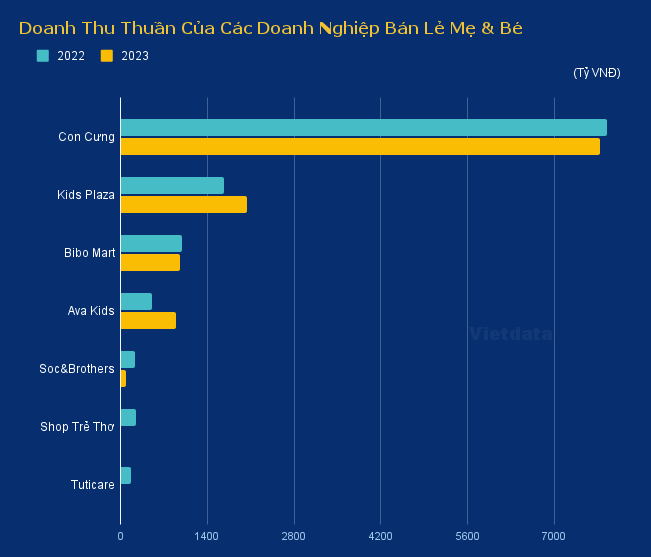

According to Vietdata, most mom-and-baby retail businesses witnessed a decline in their net revenue in 2023. The rare exceptions were Kids Plaza and AvaKids, who managed to achieve growth.

AvaKids, a retail chain specializing in mother and baby products, boasts the highest average revenue per store in Vietnam, with an impressive figure of 1.7 billion VND per store. Notably, their online channel contributes a significant 30% to this total.

These figures are also reflected in the 2023 report released by The Gioi Di Dong.

Bibo Mart, with its network of 117 traditional stores, experienced a slight dip in revenue in 2023, amounting to approximately 900 billion VND. However, the company turned a profit again after a challenging year, thanks to a successful digital transformation.

On the other hand, Kids Plaza, operating 159 stores, witnessed a remarkable 21.8% growth in revenue, surpassing 2,000 billion VND, with a net profit of nearly 100 billion VND. This marks the third consecutive year of robust growth for the company.

Con Cung currently dominates the market, far surpassing its competitors in terms of both store count and revenue.

Con Cung’s rapid expansion was fueled by significant investments from various funds. They grew from 120 stores in 2017 to an impressive 500 stores in 2019, peaking at 800 stores in early 2022.

However, the company has since downsized, operating around 700 stores throughout 2023, and currently, they have 694 stores. Additionally, their plans for Super Centers seem to have taken a backseat in the last two years.

Con Cung now focuses on maintaining its 694 stores while strengthening its online sales channel. Their revenue for 2023 stood at 7,700 billion VND, a slight decrease from the previous year, accompanied by a significant drop in net profit for the second consecutive year.

Soc&Brothers, a subsidiary of the SNB Company, experienced a challenging year, with a revenue decline of about 60.8% compared to the previous year. However, they showed signs of improvement by reducing their net loss.

The post-pandemic economic recovery boosted household spending, particularly on products and services related to children. According to Nielsen’s report, the market for mother and baby products and services in Vietnam reached an estimated 7 billion USD in 2023, reflecting an impressive growth rate of 30-40%.

Despite this growth, modern retail chains hold only about 20% of the market share, indicating significant room for expansion. Children’s clothing, in particular, presents an attractive yet untapped opportunity.

However, the intense competition has posed significant challenges for traditional retailers. They grapple with rising rental costs, past decisions to expand inefficiently, and the ever-increasing demands for product diversification and enhanced customer experiences.

Moreover, the rapid growth of e-commerce has profoundly impacted consumer shopping behavior, further complicating the landscape for traditional retailers.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.