Preventing Bank Manipulation with the 2024 Law on Credit Institutions

The case of Van Thinh Phat is still fresh, and Truong My Lan’s story of appropriating more than VND 677 trillion from SCB, despite not directly managing or operating the bank, but holding the highest decision-making role, is a stark reminder. This highlights how her controlling stake in SCB led to a tragic loss of thousands of billions and severe consequences for the bank, which have yet to be resolved.

This heartbreaking lesson compelled regulatory authorities to reassess the ownership of large shareholders in credit institutions and tighten regulations. As a result, the amended and supplemented Law on Credit Institutions, effective July 1st, stipulates: A shareholder organization must not own more than 10% of a credit institution’s capital. Shareholders and related parties must not own more than 15% of the institution’s charter capital. Major shareholders of a credit institution and their related parties must not own 5% or more of the charter capital of another credit institution.

For shareholders currently holding stakes above the new threshold, from the effective date of the 2024 Law on Credit Institutions, they can continue to hold their shares but must not increase their holdings until they comply with the new ownership regulations. Exceptions are made for dividend payments in the form of shares.

Commenting on this regulation, experts believe that reducing ownership ratios will significantly impact the organizational structure and internal governance of credit institutions. However, the new rule will help address cross-ownership and manipulation among credit institutions while preventing market disruptions.

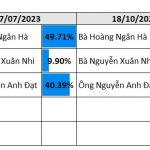

Since the Law on Credit Institutions took effect on July 1, 2024, numerous banks have disclosed lists of shareholders owning 1% or more of their charter capital. As a result, large shareholders owning 10% or more of a bank’s shares have become more transparent and apparent.

Coinciding with the enforcement of the 2024 Law, Eximbank has also witnessed a transformation in its shareholder structure. Alongside small shareholders owning less than 5%, prominent brands like Bamboo Capital Group and Gelex Group have emerged as major shareholders with a controlling stake of 10% or more, joining forces to restore Eximbank’s market position.

Eximbank’s operating model is public, and it can be considered a “typical ownership model” under the 2024 Law on Credit Institutions, featuring multiple shareholders working together to build a healthy banking system.

The Power of Multiple Shareholders and Eximbank’s Repositioning Opportunity

The ownership ratio stipulated in the 2024 Law on Credit Institutions has somewhat influenced the management and governance of credit institutions. Instead of being dominated by large shareholders, the presence of multiple shareholder groups now demands cohesion in the leadership, which is crucial for institutions to navigate through the current challenging financial market conditions and develop strategic business plans.

Through this law, regulators aim to emphasize the public nature of banking activities and prevent large shareholder groups from monopolizing banking operations, especially credit granting authority. This means that the power of large shareholders will be curtailed, allowing credit institutions to gradually enhance their governance foundations and limit manipulation in banking activities.

According to the State Bank of Vietnam, one of the most appealing aspects for business owners seeking to dominate a bank is the manipulation of credit granting authority. They explained, “This is very appealing to business owners because they are often the ones borrowing the most from banks, so they understand the significance of controlling credit granting. When they have influence, they will provide loans to their affiliated businesses, and the bank will bear the consequences when risks arise. Indeed, it is a tempting offer with hidden pitfalls.”

Additionally, the State Bank of Vietnam noted that international practices have set low bank ownership ratios, typically below 5%. In many countries, citizens don’t even know who owns their banks. This is also the case in China, where over 100 private banks have very low ownership ratios and operate as public institutions serving the people and businesses.

“Banking activities will truly be public when people don’t know who owns the banks,” the State Bank of Vietnam representative analyzed.

Eximbank’s changing shareholder structure indicates a return to its journey of reclaiming its market position, backed by significant support from large corporations like Bamboo Capital and Gelex Group.

Eximbank embodies the new model, where prominent business shareholders with extensive financial expertise become the bank’s advantage in regaining its competitive edge.

However, the involvement of multiple prominent brands also presents challenges for Eximbank in terms of strategy adjustment, capital structure, capital increase or mobilization from diverse sources, and the reevaluation of investment plans and new project development to maintain and strengthen its stability.

To achieve this, shareholders must work harmoniously, joining forces to propel Eximbank back into the race while ensuring compliance, establishing robust internal control systems, and managing risks to prevent violations, dominant shareholder groups, and potential risks of manipulation by vested interest groups.

If successful, Eximbank will become a new model, where prominent business shareholders with extensive financial expertise become the bank’s advantage in regaining its competitive edge.

Large shareholders absent, Viet Tin Securities fails to hold extraordinary shareholders’ meeting

The extraordinary Annual General Meeting of Viet Tin Securities Joint Stock Company (VTSS) scheduled on February 5th, 2024, was unsuccessful due to insufficient attendance rate to meet the required quorum.