On September 16, 2024, the Hanoi Stock Exchange (HNX) will organize an auction for shares of the Joint Stock Company of Economics and Technology (METCO), owned by the Industrial Defense Industry Economic and Technical Corporation (GAET).

The auction volume is 1.34 million shares, equivalent to 100% of GAET’s ownership and corresponding to 34.54% of METCO’s charter capital. With a starting price of VND 15,900 per share, the deal value falls at approximately VND 21.3 billion.

Established in 2010, METCO’s primary mission is to manufacture and trade to develop the national defense industry and other sectors of the country’s economy. Over the past 14 years, METCO has carried out tasks within and outside the military, such as implementing blasting projects in Vietnam and Laos, researching new materials, and producing additives for industrial explosives and other industries. Simultaneously, it effectively executes commercial contracts.

The Institute for Materials Research and Application, under METCO, has conducted research topics at the ministerial level and state-level projects, which have been highly evaluated, achieving excellent results. These projects are practical and applied in production and business activities. METCO affirms its capacity to produce substitutes for similar imported goods to supply the domestic market.

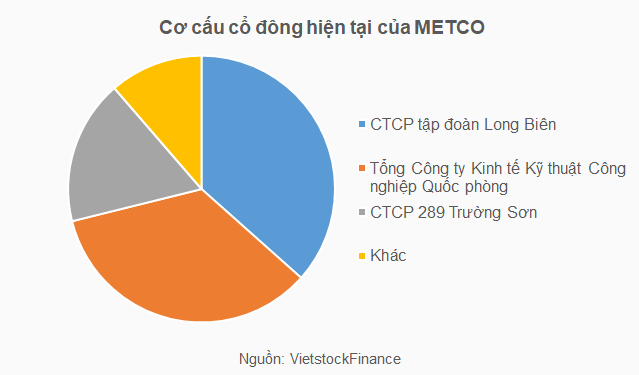

Apart from GAET, Long Bien Joint Stock Company and Joint Stock Company 289 Truong Son are major shareholders of METCO, with ownership ratios of 36.59% and 17.53% of the contributed charter capital, respectively.

METCO’s main business activities that generate revenue include blasting services, technology transfer of chemical mixtures and semi-finished products, and commercial trading.

In terms of financial performance, METCO achieved a revenue of over VND 368.7 billion and an after-tax profit of more than VND 5.1 billion in 2022. In 2023, METCO signed a contract to provide high-tech blasting services to support coal mining operations at the Kaleum mine (Laos) to meet the coal demand in Vietnam and the Lao market and pave the way for developing other businesses there.

METCO is also known for its role as a member of the Vietnam Petroleum Association, coordinating with SkyWind Company (owner of second-generation wind turbine technology) to access energy transformation projects in Vietnam and cooperate with the Vietnam Oil and Gas Group in the project. energy production at offshore rigs in Vietnam. Based on this, in 2024, METCO set a plan to collect VND 100 billion in revenue from sales and services, with an estimated after-tax profit of VND 680 million and a dividend payout ratio of 1.75%.

METCO’s Blasting Service

|

The METCO auction will be the third auction in 2024 organized at HNX, with the previous auctions of shares of Vinacontrol Joint Stock Company and Hai Au Sea Transport Joint Stock Company successfully held.

An individual spends more than VND 170 billion to outbid an organization for 30% of Vinacontrol

8-level Building for Sale at Nguy Nhu Kon Tum Street (Hanoi) Starting from 20.5 billion VND

This is an asset guaranteed by an individual at PVcomBank. The auctioned asset is the right to use 89m2 of land in urban areas, owning a house and other assets attached to the land at the address of block 12, collective residence B15 of the Ministry of Public Security (now number 17, alley 68, Nguy Nhu Kon Tum street), Nhan Chinh ward, Thanh Xuan district, Hanoi.