Source: HNX

|

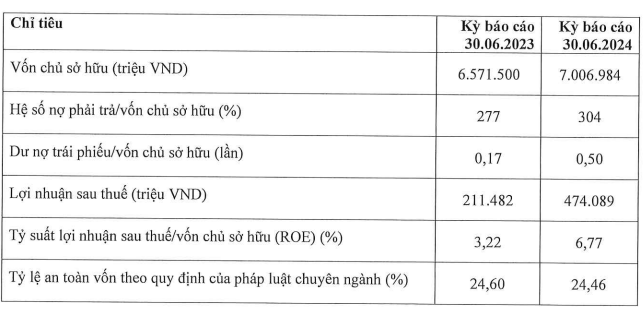

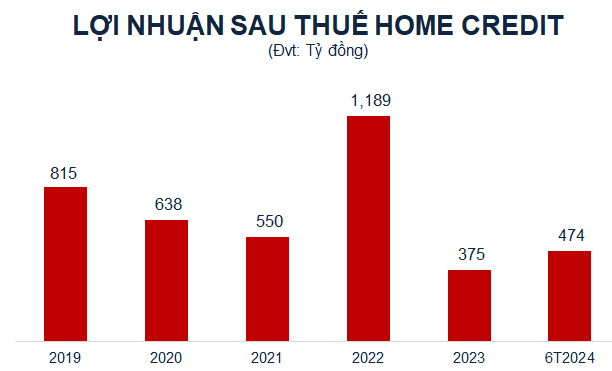

Home Credit’s half-year financial report submitted to the Hanoi Stock Exchange (HNX) reveals promising results, with a post-tax profit of over VND 474 billion, doubling that of the same period last year.

As of June 30, 2024, owner’s equity stood at nearly VND 7,007 billion. The return on equity (ROE) was 6.77%, a significant improvement from the previous year’s figure of 3.22%.

The debt-to-equity ratio was 304%, corresponding to VND 21,301 billion in debt. The bond debt-to-equity ratio reached 0.5, amounting to VND 3,500 billion.

The capital adequacy ratio as per regulations was 24.46%.

Source: VietstockFinance

|

In other news, Home Credit currently has six bond batches in circulation: HCVCL2224001 (VND 600 billion), HCVCL2426002 (VND 500 billion), HCVCL2426003 (VND 500 billion), HCVCL2426004 (VND 300 billion), HCVCL2427001 (VND 1,000 billion), and HCVCL2427005 (VND 600 billion).

The HCVCL2224001 bond batch, worth VND 600 billion, will mature on August 31, 2024. The remaining bond batches, totaling VND 2,900 billion, were issued by Home Credit in May and June 2024 and will mature in mid-2026 and 2027.

In February 2024, Home Credit Group announced the transfer of 100% of its capital contribution in Home Credit Vietnam Finance Company to The Siam Commercial Bank Public Company (SCB), a member of SCBX Public Company (SCBX). The transfer agreement is valued at approximately EUR 800 million (equivalent to 865 million USD).

The transfer process is expected to be completed in the first half of 2025, pending approval from the competent authorities in Vietnam and Thailand.

Viglacera Reports First-Ever Loss

Viglacera, the construction equipment giant, reported a net loss of 48 billion VND in Q4/2023, due to declining revenues and high maintenance costs. This marks the first time the company has reported a loss since its inception.