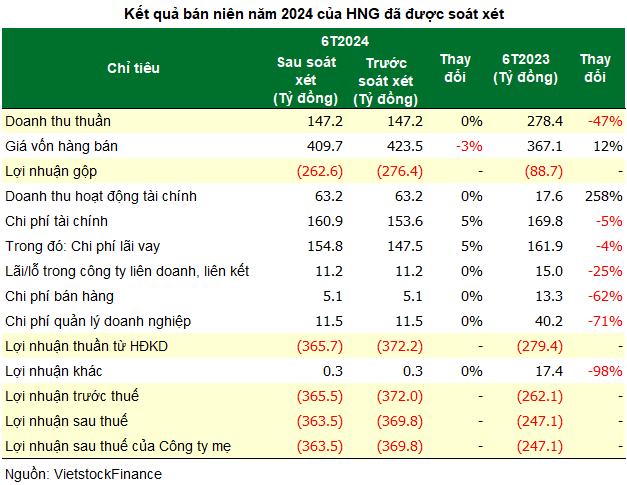

HAGL Agrico’s reviewed consolidated financial statements for the first half of 2024 showed a net loss of 363.5 billion VND, a significant increase from the net loss of over 247 billion VND in the same period last year. Compared to the self-prepared financial statements, the net loss for the half-year decreased by 6 billion VND, mainly due to the company’s adjustment of the cost of goods sold.

Post-review, the semi-annual revenue remained unchanged from the self-reported figure of 147 billion VND, but it evaporated by 47% compared to the first half of 2023. Of this, fruit trees contributed 87 billion VND in revenue, with a yield of 7,193 tons, down 54% year-on-year; rubber tree revenue reached only 58 billion VND, with a yield of 1,721 tons, due to a shortage of rubber tappers.

In 2024, the company set a target of 694 billion VND in net revenue, an increase of nearly 15% from 2023, and expected a net loss of 120 billion VND. After six months, HAGL Agrico achieved more than 21% of its revenue target but incurred a deep loss compared to the plan.

Despite fully accepting HAGL Agrico’s reviewed interim financial statements for 2024, the auditor emphasized the company’s ability to continue as a going concern. This is because the company incurred a net loss of 363 billion VND, accumulated losses of 8,466 billion VND, short-term debt exceeded short-term assets by 10,345 billion VND, and violated some loan covenants.

HAGL Agrico is continuing to implement projects to ensure operating cash flow, restructure some debts, and work with related parties to resolve debts and regain land use rights certificates for projects in Laos and Cambodia. This will enable them to initiate legal investment procedures and mobilize capital to generate investment cash flow.

Based on these initiatives, the company has prepared and presented its financial statements for the first six months of 2024, assuming it will continue as a going concern for the next 12 months.

In a notable development, the Ho Chi Minh City Stock Exchange (HOSE) announced that September 6th is the mandatory delisting date for HNG shares due to the company’s consecutive losses in the last three years (2021-2023). On the stock market, HNG shares fell to their lowest level of the year at 3,650 VND/share on August 5th, before recovering to the 4,400 VND/share range, an increase of over 20% in almost a month.

| HNG Share Price Movement since the beginning of 2024 |

At the 2024 Annual General Meeting of Shareholders held in early May, Chairman of the Board of Directors, Tran Ba Duong, assured shareholders that even if the company’s shares were delisted from HOSE and moved to the UPCoM, they would continue to disclose information transparently to their 33,000 shareholders, just as they did on HOSE. He also stated that the company would work to relist on HOSE as soon as they met the requirements.

“Shareholders may be concerned about the delisting, but I believe that transparency and the formation of real value are more important. Even if we move to UPCoM, if we perform well, our share price can still go up,” affirmed Mr. Tran Ba Duong.

The World

Viglacera Reports First-Ever Loss

Viglacera, the construction equipment giant, reported a net loss of 48 billion VND in Q4/2023, due to declining revenues and high maintenance costs. This marks the first time the company has reported a loss since its inception.