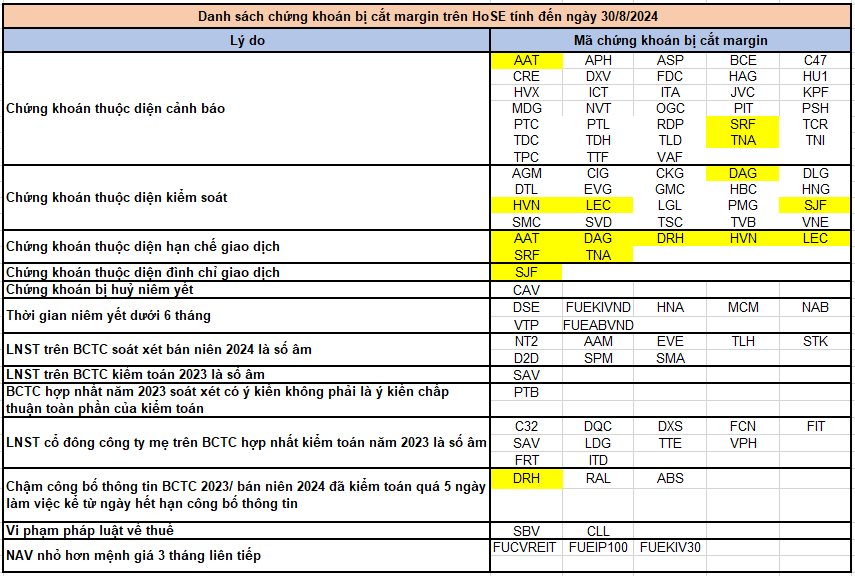

The Ho Chi Minh City Stock Exchange (HoSE) has updated the list of securities ineligible for margin trading. Among the additions is TLH , the stock code for Tien Len Steel Group Joint Stock Company, due to a negative net profit after tax for the parent company’s reviewed semi-annual financial statement in 2024.

According to TLH’s reviewed semi-annual financial statement for 2024, the company recorded a slight 9% increase in net revenue, totaling VND 2,895 billion for the first six months. However, after accounting for expenses, TLH posted a loss of over VND 152 billion in post-tax profit.

Furthermore, HoSE also added EVE, the stock code for Everpia Joint Stock Company, and STK, the code for The Ky Joint Stock Company, to the list of securities ineligible for margin trading for the same reason: a negative net profit after tax for the parent company’s reviewed semi-annual financial statement in 2024.

As of August 30, 2024, the total number of securities ineligible for margin trading on HoSE stands at 89. The reasons for being cut off from margin trading include stocks under warning/control/trading restriction; negative net profit, audited financial statements with opinions from the auditing firm; less than 6 months of listing time, etc. Popular stocks like FRT, ITA, HBC, HAG, SMC, HVN, and TVB remain on the list.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.