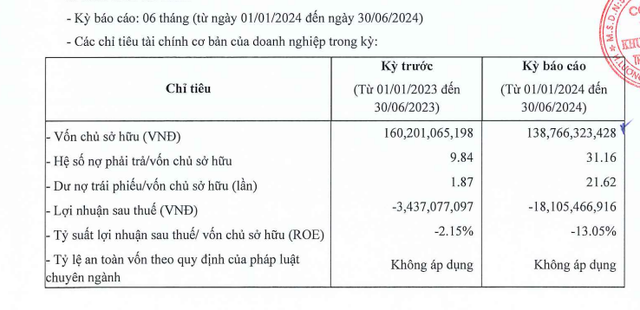

Trung Minh New Urban Area JSC has released its financial report for the first half of 2024, revealing a post-tax loss of over 18 billion VND, a significant increase from the 3 billion VND loss in the same period last year.

As of June 30, the company’s equity stood at nearly 139 billion VND, a 13% decrease from the previous period. The debt-to-equity ratio for this period was 31.16. The company’s payables as of June 30 amounted to approximately 4,324 billion VND, a 2.7-fold increase compared to the previous year. Of this, bond debt accounted for 3,000 billion VND, ten times higher than the previous year.

According to the Hanoi Stock Exchange (HNX), Trung Minh currently has seven bond issues outstanding with a total value of 3,000 billion VND. These bonds have been issued from June 2023 to the present, with an interest rate of 12.5% per annum.

In the first half of 2024 alone, the company issued two new bond issues on April 26 and June 20, with a total value of 1,100 billion VND. Both issues have a five-year maturity and a 12.5% interest rate.

Trung Minh New Urban Area JSC is the developer of the Trung Minh A New Urban Area project (branded as Casa Del Rio), a 1,126-billion VND investment located in Trung Minh Ward, Hoa Binh City. The project covers an area of 83.57 hectares and began its first phase of construction on August 13, 2022.

Established in February 2020, the company is headquartered in Luong Son District, Hoa Binh Province, with a charter capital of 186 billion VND. Its legal representative is Ms. Nguyen Thu Thuy, born in 1986.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.