The Can Tho Tax Department has announced that they are in the process of recovering over VND 25 billion in outstanding land rent from Joint Stock Company 720, following the decision of the High Court in Ho Chi Minh City.

This ruling is related to an administrative case involving “complaints against administrative decisions regarding state management in the fields of land and tax administration, specifically in the collection of land rent, late payment penalties, and enforcement of administrative decisions on taxation.” The case was initiated by Joint Stock Company 720 against the Can Tho Tax Department.

The High Court in Ho Chi Minh City decided to accept the appeal of the Can Tho Tax Department and reject the lawsuit filed by Joint Stock Company 720.

Headquarters of the Can Tho Tax Department (Image source: Finance Magazine)

In June 2024, the High Court in Ho Chi Minh City reopened the appeal trial for this case. During the trial, the representative of the Ho Chi Minh City People’s Procuracy proposed that the Council should base their decision on Clause 2, Article 241 of the Law on Administrative Litigation and amend the first-instance judgment. Subsequently, the Council decided to accept the appeal of the Can Tho Tax Department and reject the lawsuit filed by Joint Stock Company 720.

“Following the court’s decision, the Can Tho Tax Department is proceeding with the necessary steps to recover more than VND 25 billion in tax arrears from Joint Stock Company 720 and return it to the state budget,” said the Can Tho Tax Department.

According to the case details, in September 2005, Joint Stock Company 720 signed a land lease contract for over 65,500 square meters of land in Binh Thuy District with the Can Tho People’s Committee (represented by the Department of Natural Resources and Environment). The lease term was 10 years. In fulfillment of the contract, Joint Stock Company 720 made an advance payment of over VND 5.6 billion through the Can Tho Tax Department and believed that they had overpaid by more than VND 2.5 billion.

In March 2016, the Can Tho Tax Department notified Joint Stock Company 720 that they had to pay the principal amount and a penalty of over VND 18 billion. After the company failed to comply within a month, the Can Tho Tax Department issued a decision to enforce the collection by deducting the amount from their bank account.

Subsequently, Joint Stock Company 720 filed a lawsuit with the Ninh Kieu District People’s Court, requesting the termination of the land lease contract with the Can Tho People’s Committee and the refund of the alleged overpayment of more than VND 2.5 billion. However, during the first-instance trial, Joint Stock Company 720 withdrew their request for a refund.

In late April 2016, Joint Stock Company 720 submitted another lawsuit to the Can Tho City Court, requesting the cancellation of two notices issued by the Can Tho Tax Department regarding land rent arrears and account enforcement. The company argued that they did not owe the state budget and that there was a dispute over the land lease contract, which was being handled by the court in a civil case.

In July 2017, the Can Tho Tax Department once again notified Joint Stock Company 720 about the outstanding amount and late payment penalties, which had increased to over VND 23.3 billion. The tax authority then applied enforcement measures by freezing the company’s invoices. In August of the same year, Joint Stock Company 720 filed another lawsuit, requesting the cancellation of the notice of arrears and the enforcement measure of invoice freezing by the tax authority.

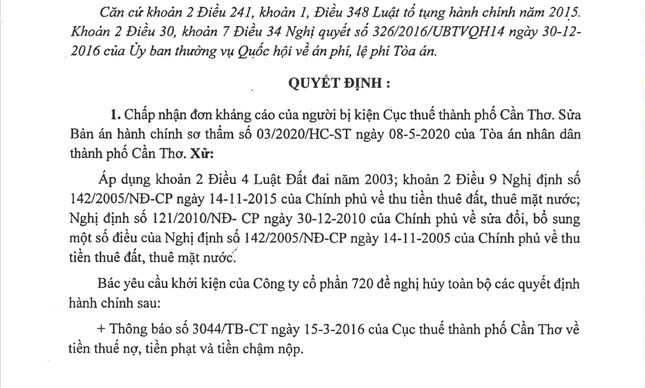

Decision of the High Court in Ho Chi Minh City on June 13, 2024

The Can Tho Tax Department explained that the land lease contract with the state, signed by Joint Stock Company 720 before 2006, involved annual land rent payments. The contract did not include a clause on adjusting the rental rate. Therefore, according to Decree 142/2005/ND-CP on land rent collection and related regulations, the land rent of Joint Stock Company 720 was subject to adjustment from 2006 onwards.

Based on this, the tax authority recalculated the land rent and notified Joint Stock Company 720 accordingly. However, the company disagreed with the recalculation and filed a lawsuit against the administrative decisions of the Can Tho Tax Department.

At the first-instance trial (Can Tho City Court) and the appeal trial (High Court in Ho Chi Minh City), the court ruled in favor of Joint Stock Company 720, agreeing to cancel the land lease contract and revoke the notices and enforcement decisions related to land rent collection by the tax authority.

Disagreeing with these rulings, the Can Tho Tax Department submitted a request to the Supreme People’s Court for a review under the supervisory procedure. In December 2023, the Council of Judges of the Supreme People’s Court decided to annul the appeal judgment and ordered the High Court in Ho Chi Minh City to retry the case.

Dong A Group sues Thanh Hoa City’s People’s Committee for land dispute

The Thanh Hoa Provincial Court recently announced the handling of a case involving an administrative dispute between the plaintiff, Dong A Group Limited Liability Company (Dong A Group), represented by Mr. Cao Tien Doan, CEO, located at 1A Nguyen Hieu, Le Loi Boulevard, Dong Huong Ward, Thanh Hoa City, and the defendant, Thanh Hoa City People’s Committee, with the related rights and obligations held by Thanh Hoa Provincial People’s Committee.

Justice Department Sues Two Cryptocurrency Companies for Billions in Fraud

According to the New York State Attorney General, Gemini Trust Company concealed risk when investing with Genesis, and Genesis lied to the public about its losses, causing investors to lose over $1 billion.