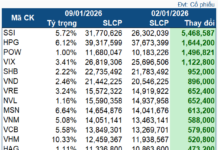

The VN-Index seemed poised for a positive finish to the week, with VIC, CTG, FPT, and TCB rallying towards the end of the session. However, a lack of consensus among the leading stocks once again disappointed investors, and the index closed with only half of the best gains seen during the day. VIC’s performance was the most regrettable, as it had risen as much as 2.26% by 2 pm, but a large sell-off in the ATC session, coupled with weak demand, pushed the stock back to its reference price, erasing all its gains. Other large-cap stocks, such as VNM and GVR, also failed to sustain their momentum, with VNM giving back 1.2% from its peak to close up only 0.54%, and GVR ending up just 0.14% after losing 1.26%.

The VN-Index managed to eke out a gain of 2.4 points or 0.19%, but it was only half of the maximum intraday increase. The VN30-Index, however, fared slightly better, with some strong performers like TCB, which rose 1.52%, FPT up by 0.82%, MWG gaining 1.01%, and HDB increasing by 1.28%. The VN30-Index closed up 0.37% with a positive breadth of 17 gainers and 8 losers.

Despite the efforts of some leading stocks, the intraday movement did not show a significant upward trend. Most stocks fluctuated within a narrow range, and the lack of liquidity made it challenging for individual stocks to sustain any explosive growth. The total matched orders on the HoSE today decreased by 5% from the previous day, reaching a low of VND 12,116 billion in 11 sessions.

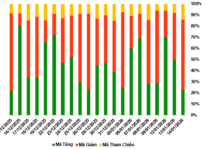

The VN-Index’s intraday breadth did not indicate a clear dominance by either the bulls or the bears. At its peak at 2:27 pm, there were only 199 gainers versus 196 losers. At the index’s low at 10:10 am, there were 151 gainers and 173 losers. By the end of the session, the HoSE had 202 gainers and 180 losers, a similar state of tug-of-war to the previous sideways sessions. Additionally, of the 202 stocks that ended in positive territory, only 65 rose more than 1%, accounting for 20.1% of the total matched orders on the exchange. Meanwhile, out of the 180 declining stocks, only 50 fell by more than 1%, representing 10.7% of the total matched orders. Thus, the vast majority of stocks were confined to narrow ranges, and liquidity, though low today, was concentrated in these stocks.

Among the blue-chip stocks, only three posted gains of more than 1% – TCB, MWG, and HDB. MWG and TCB were among the top 10 most liquid stocks in the market, with matched orders of VND 367.4 billion and VND 307.8 billion, respectively. The other stocks with significant price increases and high liquidity were from the Midcap segment, including DGC, which rose 2.16% with matched orders of VND 466.3 billion; DXG, up 1.29% with VND 177 billion; TCH, gaining 1.09% with VND 121.5 billion; EIB, rising 1.64% with VND 116.4 billion; and FTS, increasing by 1.86% with VND 109.7 billion. Despite several strong performers attracting money, the Midcap index only managed a 0.22% gain against its reference, and the breadth was balanced with 34 gainers and 31 losers. Some small-cap stocks with matched orders of a few billion VND and price increases of more than 3% included SAV, NAF, SJS, SGR, TNH, PVP, and HVN.

On the downside, DIG stood out with a significant sell-off, falling 2.73% on a large volume of VND 744.7 billion, the highest in the market. A few other stocks with matched orders of several billion VND and notable price declines included DBC, down 1.22%; NTL, falling 1.32%; NKG, decreasing by 1.36%; HAG, dropping 1.84%; CII, down 1.28%; TLG, falling 2.41%; and ANV, declining by 1.09%…

Today’s late-day weakness in the VN-Index was unfortunate, but it did not significantly alter the prolonged state of narrow-range consolidation. The index continues to fluctuate around the 1300-point level. The VN30-Index has shown more strength, approaching its June high thanks to the rotational price increases in large-cap stocks. However, the market sentiment will likely experience a “disconnection” due to the upcoming long weekend. Additionally, liquidity remains subdued, with average weekly matched orders on the two exchanges totaling VND 15,035 billion, a 13% decrease from the previous week.

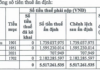

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.