VN-Index briefly surged over 7 points, approaching the 1,290 mark, but subsequently lost steam as buying interest waned, causing the index to trim its gains and close near the reference level. At the close of the session on August 29, the VN-Index edged up 0.03 points to finish at 1,281.47.

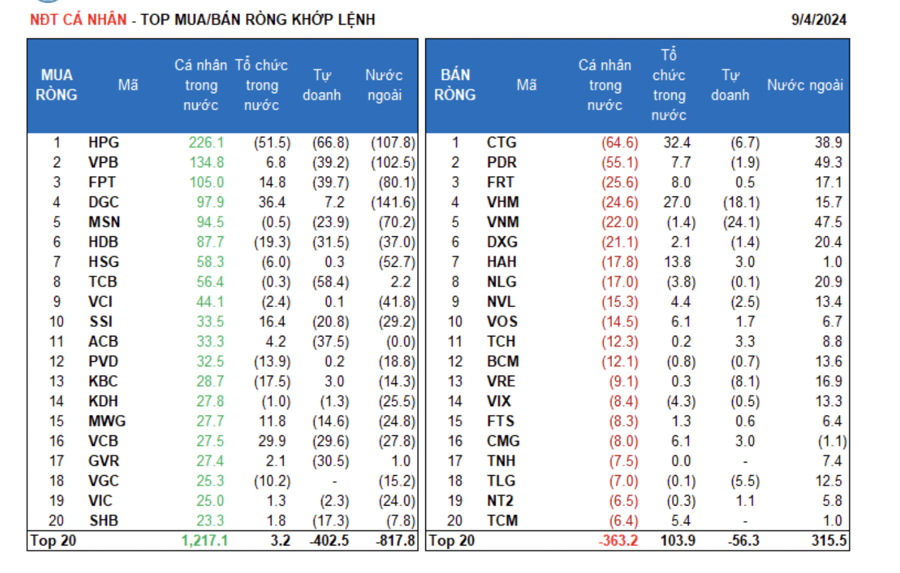

The total matched transaction value on the three exchanges exceeded VND 15,100 billion, a decrease of 16% compared to the previous session. Foreign investors continued to net sell over VND 100 billion, with HPG, VCI, and VRE being the most sold stocks during the session.

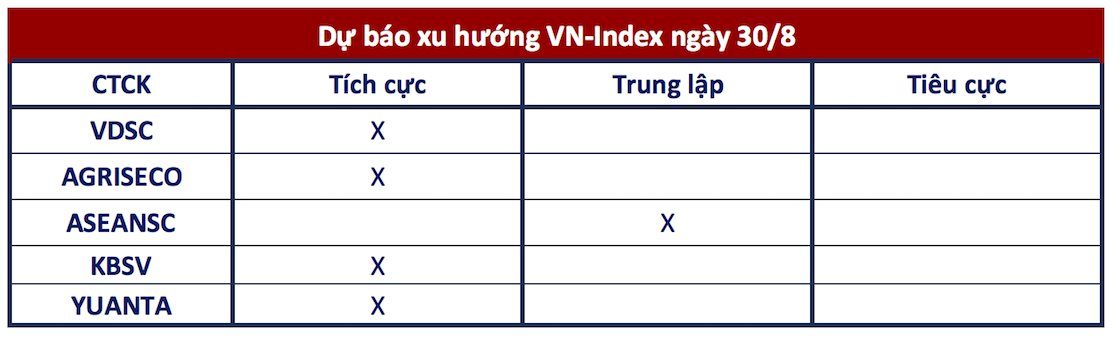

Looking ahead to the session before the 2nd of September holiday, most securities companies anticipate the benchmark index to climb towards the 1,290 level and touch the 1,300 mark.

Opportunity to Extend the Uptrend

VDSC Securities

The cautious sentiment witnessed today could be partly attributed to traders’ reluctance to engage ahead of the holiday. Nonetheless, the market remains balanced around the 1,280 level. It is anticipated that the market will continue to find support and have the opportunity to extend its uptrend in the upcoming sessions.

Therefore, investors can expect a recovery after the recent correction and may consider buying on dips for short-term gains in stocks exhibiting positive dynamics from the support levels.

VN-Index Flirts with the 1,290 Level

Agriseco Securities

For tomorrow’s session, it is predicted that the VN-Index will again flirt with the 1,290 level to test selling pressure. Agriseco recommends that investors maintain their current positions. They also suggest giving priority to buying large-cap stocks, as the VN30 is offering a discounted entry point near the support region during intraday fluctuations.

Consolidation in a Narrow Range

Aseansc Securities

The news about “credit room expansion” painted the Banking sector green, but the effect didn’t spread widely as the pre-holiday cautious mood prevailed. The market is likely to continue consolidating in a narrow range as buying momentum remains subdued and selling pressure persists across various stock groups. The main catalyst to ignite market participation is expected to come from the Financials sector (Securities, Banking, etc.) as selling pressure gradually eases.

Aseansc maintains a positive outlook on the market’s mid- and long-term prospects. Investors are advised to maintain a stable stock proportion in their portfolios, and stocks with strong price performance coupled with positive business updates will likely attract cash flows.

High Probability of Successfully Surpassing the Nearby Resistance Level

KBSV Securities

Despite the presence of latent selling pressure around the nearby resistance level, the short-term uptrend remains intact, indicating a high probability of the VN-Index successfully surpassing the nearby resistance level.

Confronting the 1,290-1,300 Resistance Zone

Yuanta Securities

The market is poised to extend its gains in the next session, with the VN-Index retesting the 1,290-1,300 resistance zone. Meanwhile, money continues to flow mainly into large-cap stocks, and the market remains in a phase of robust positive fluctuations. Thus, the market could swiftly conclude its corrective phase, and Yuanta anticipates the VN-Index to breach the 1,290-1,300 resistance zone soon.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.