In a recent announcement, Hoang Anh Gia Lai Joint Stock Company (HAGL – HAG) published its reviewed consolidated financial statements for the first six months of 2024. According to the audit firm Ernst & Young Vietnam, the company’s accumulated loss of VND 957 billion as of June 30, 2024, and its short-term debt exceeding short-term assets by over VND 350 billion are matters of concern.

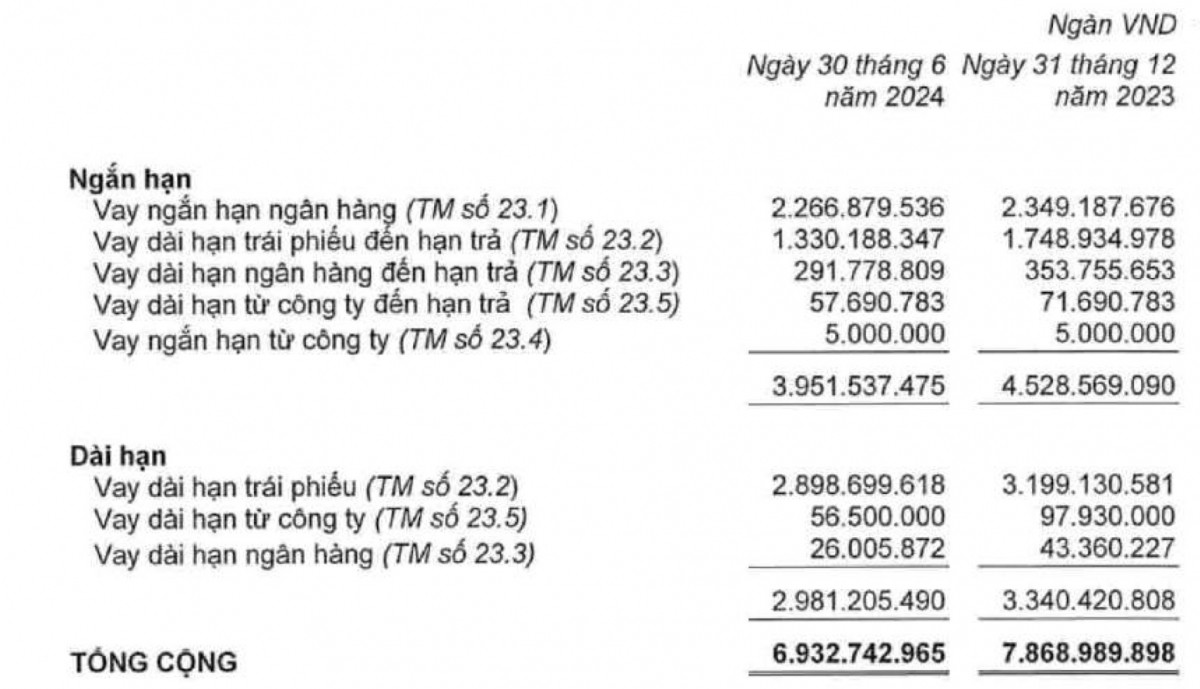

Specifically, as per the financial statements, HAGL’s total liabilities as of June 30, 2024, amounted to VND 12,750 billion, a decrease of VND 1,475 billion from the beginning of the year. Short-term debt stood at over VND 9,058 billion, surpassing its short-term assets of VND 8,707 billion. The debt structure includes short-term financial lease loans of VND 3,951 billion and long-term loans of VND 2,981 billion, totaling nearly VND 7,000 billion.

Additionally, HAGL is in breach of certain commitments regarding bond contracts and has not repaid the principal and interest of bond loans due. As of June 30, the company has not repaid over VND 789 billion in principal, VND 7.7 billion in loan interest, and approximately VND 3,277 billion in bond interest due to non-receipt of debt from HNG.

As a result, the auditors emphasized the “existence of a material uncertainty that may cast significant doubt about the Group’s ability to continue as a going concern.”

HAGL’s Debt Structure

In their explanation of the issues highlighted by the auditors, HAGL stated that they have prepared a 12-month business plan. This plan includes expected cash flows from the partial disposal of financial investments, asset disposals, recovery of loans from partners, bank borrowings, and cash flows from ongoing projects. HAGL expects these measures to enable the company to repay maturing debts and continue its operations for the next 12 months.

“The hog and banana businesses continue to generate significant cash flows in 2024,” the company stated in its report.

According to the report, the company’s net revenue decreased by 12.2% year-on-year to VND 2,762 billion. However, net profit increased by nearly 30% to over VND 500 billion, with the gross profit margin improving from 20% to 35.5%.

Fruit contributed the lion’s share of revenue, amounting to over VND 2,000 billion, or 72.5% of total revenue, an increase of 57% compared to the previous year. Meanwhile, the hog farming segment brought in more than VND 611 billion, a 39% decrease compared to 2023.

Hoang Anh Gia Lai attributed the increase in profit to the rise in fruit revenue. Despite a decline in hog sales, the company remained profitable due to higher hog prices.

For the full year, the company targets revenue of VND 7,750 billion, an increase of 20.3% year-on-year, but expects net profit to decrease by 25.9% to VND 1,320 billion. With a net profit of over VND 500 billion in the first half, the company has achieved 37.9% of its annual profit plan.