Vietnam’s stock market recorded a mostly sideways trading week at the end of August. The main index fluctuated within a narrow range, with blue-chip stocks showing some positive momentum but not a strong upward trend. The VN-Index closed the week at 1,283.87 points, a minor decrease of 1.45 points (-0.11%) from the previous week. Trading volume remained moderate, and buying and selling pressures were balanced across sessions, partly due to cautious sentiment ahead of the long holiday break.

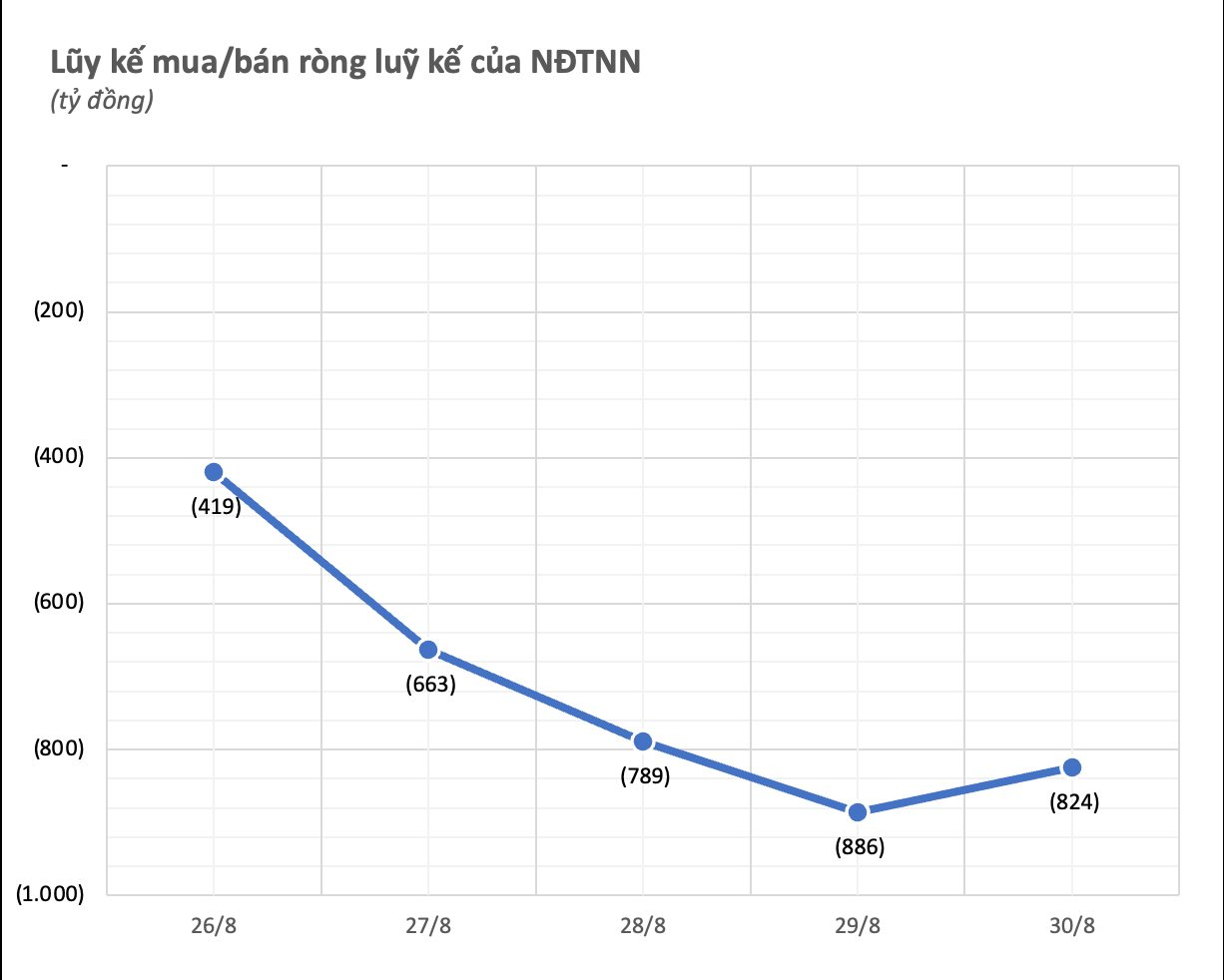

In terms of foreign investment, outflows continued across the market. Cumulatively, foreign investors sold a net amount of VND 824 billion in the five sessions, including VND 612 billion on the matching board and an additional VND 212 billion in negotiated trades.

Breaking down by exchange, foreign investors sold a net amount of VND 796 billion on the HoSE, VND 89 billion on the HNX, and bought a net amount of VND 61 billion on the UPCoM.

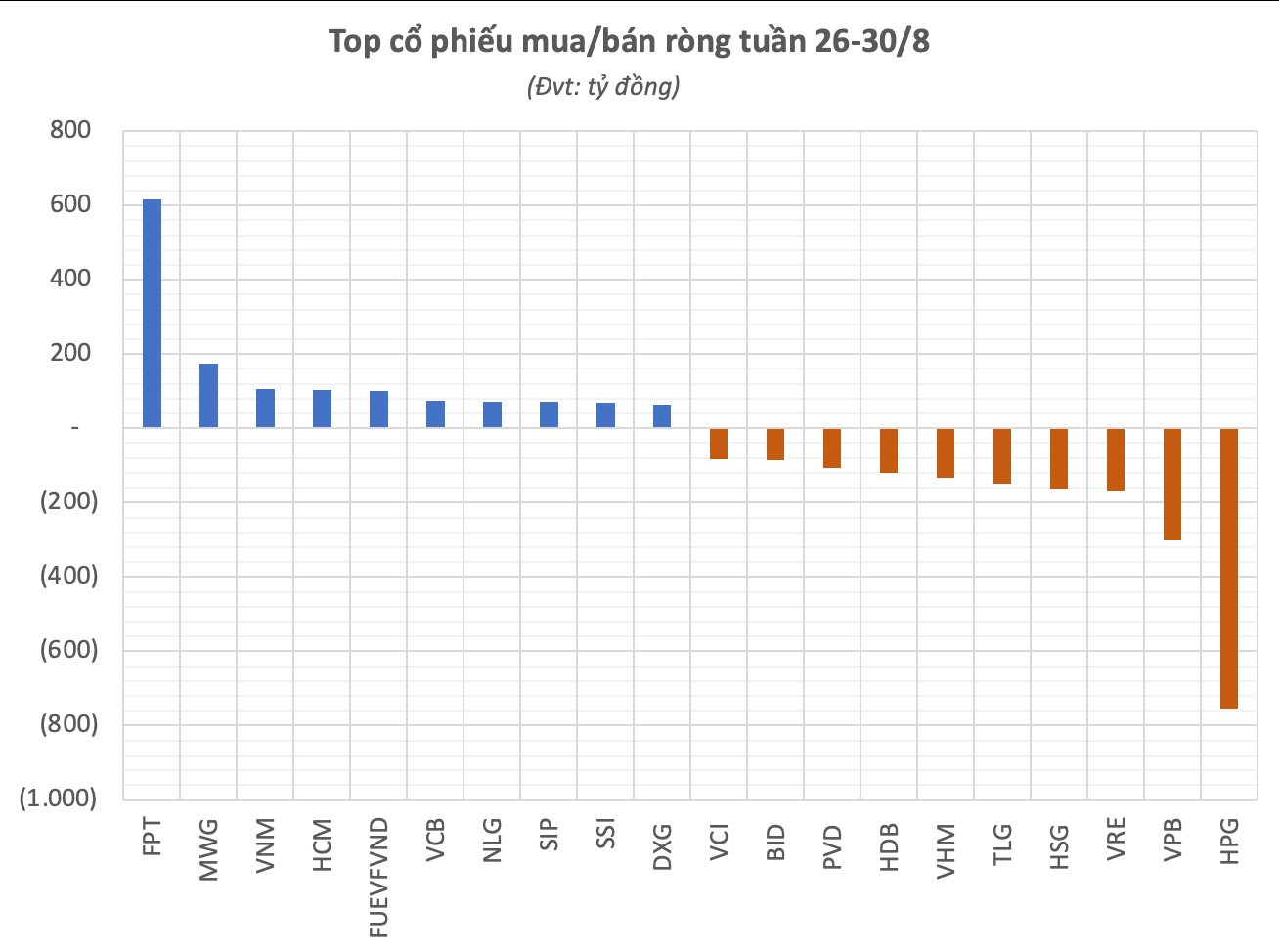

Looking at individual stocks, foreign investors continued to sell off HPG, a steel industry stock, with a net sell value of VND 755 billion. In the previous week, this steel stock also witnessed net foreign selling of over VND 640 billion.

VPB and VRE were the next two biggest net sell stocks, with net selling values of VND 299 billion and VND 168 billion, respectively. The net selling list also included HSG, which saw net outflows of VND 163 billion. TLG, VHM, HDB, PVD, and others were also among the net-sold stocks by foreign investors during the week.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.