|

International Influence

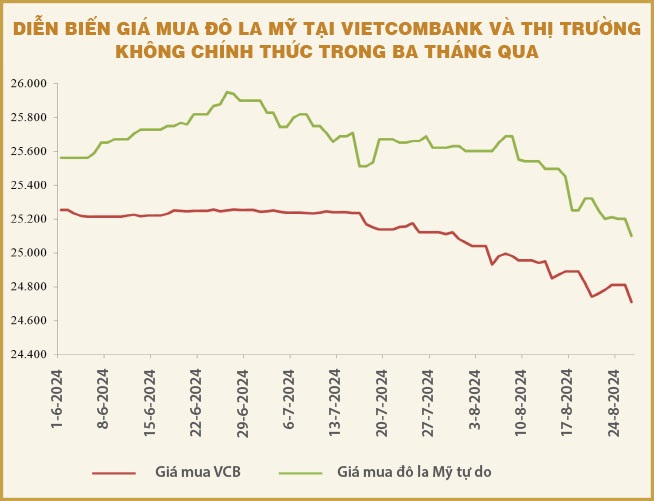

This week (August 26, 2024), commercial banks simultaneously reduced the buying and selling prices of US dollars by 100-130 VND. For example, Vietcombank decreased both buying and selling prices by 100 VND each, to 24,710-25,050 VND/USD – the lowest level in nearly four months. VietinBank even reduced it by 130 VND. Techcombank decreased the buying price by 128 VND and the selling price by 129 VND, while other banks mostly reduced by 110-120 VND.

Since the beginning of August 2024, the USD/VND exchange rate at banks has continuously decreased. Compared to the beginning of August, the USD price at many banks has decreased by nearly 400 VND, equivalent to a decrease of nearly 1.5%. This is also the second consecutive month of significant decreases in transaction prices at banks, after a notable increase in the first half of the year, especially in Q2-2024.

The price of USD in the unofficial market also followed the same downward trend, having decreased by 430 VND compared to the end of July. In the past two months, the USD price in the unofficial market has decreased by 700 VND, equivalent to a decrease of nearly 3%; thereby narrowing the increase from the beginning of the year to around 500 VND, equivalent to an increase of nearly 2%. Currently, the buying price in the unofficial market is only higher than the buying price at banks by less than 400 VND, while the selling price is higher by 150 VND, marking the lowest difference since November 2023.

The continuous downward trend of the USD in the international market is considered one of the main factors affecting the decrease of the USD in the domestic market. Since the beginning of July 2024, the USD Index has decreased by 5%, to around 100.7 points as of the beginning of this week – the lowest level in a year. The decline of the USD may continue as the possibility of a decrease in the basic interest rate by the US Federal Reserve (Fed) is becoming increasingly likely.

According to the CME Fedwatch tool as of August 26, the probability of the Fed reducing the interest rate by 0.25 percentage points in the September meeting is at 63.5%. Notably, the probability of a 0.5 percentage point reduction has increased to 36.5% from 11.3% a month ago, indicating a higher expectation of a more aggressive cut that could appear in the first reduction. The risk of economic recession, along with inflation approaching the target, may support a more decisive action by the Fed when reversing policies.

In the last three meetings of this year, investors bet that the Fed will reduce interest rates by a total of more than 0.75 percentage points. And with the trend of USD interest rates continuing to fall in the next phase, a notable development recently is the return of carry-trade activities, but this time with the USD instead of the Japanese yen. According to a recent Citigroup report, hedge funds are borrowing USD as the funding currency and investing in emerging markets with higher interest rates, thereby putting downward pressure on the USD.

Domestic Situation

First, the foreign currency supply in Vietnam continues to improve and become more abundant, mainly due to the surplus of trade in goods and foreign direct investment (FDI) disbursement. This has contributed to the downward trend of the USD/VND exchange rate. Just these two activities brought in more than $27 billion in the first seven months of this year, excluding remittances and tourism, which are also recovering strongly. It is expected that Vietnam will continue to record a large trade surplus this year as export orders have been recovering positively in recent months, while FDI continues to flow into Vietnam to take advantage of the incentives from free trade agreements (FTAs).

|

If in the first months of the year, the borrowing interest rate for USD among banks was 3-4%/year higher than that of VND, even reaching 5%/year at times, thereby stimulating many banks to shift to USD for lending – taking advantage of both interest rate differentials and exchange rate expectations, now this interest rate differential is less than 0.9%/year from the overnight term to two weeks. |

The second supporting factor is that the domestic gold market has been stabilized recently. The mechanism of selling gold through state-owned commercial banks, along with strict inspection and supervision, has put pressure on speculation, helping to narrow the gap between domestic and international gold prices, thereby reducing speculative pressure on the foreign exchange market. From a peak difference of 20 million VND/tael, the domestic SJC gold price is now only about 5 million VND/tael higher than the international price, even though the world gold price has recently surged past the $2,500/ounce mark.

The third factor is that the interest rate differential between VND and USD in the interbank market (the “2” market) in Vietnam has narrowed significantly compared to the previous period, thereby reducing speculative pressure on exchange rates and interest rate arbitrage by banks. Specifically, if in the first months of the year, the borrowing interest rate for USD among banks was 3-4%/year higher than that of VND, even reaching 5%/year at times, thereby stimulating many banks to shift to USD for lending – taking advantage of both interest rate differentials and exchange rate expectations, now this interest rate differential is less than 0.9%/year from the overnight term to two weeks.

With the deposit interest rate of VND being continuously adjusted upward by banks since Q2, it is understandable that the VND interest rate in the “2” market has also increased and remained at a high level. In addition, the interest rates of the open market operation (OMO) and the issuance of bills by the State Bank of Vietnam (SBV) are also pegged at high levels, making it difficult for the “2” market interest rates to decrease. Recently, although the regulator has reduced the OMO and bill interest rates, they are still maintained above the 4% threshold.

Moreover, the VND liquidity of many banks is no longer abundant for speculative activities in exchange rates. With credit growth from the beginning of the year to now of the system in general and banks in particular being much higher than deposit growth, the amount of excess capital for foreign currency speculation in the “2” market has decreased significantly. Recent speculative activities are facing exchange rate risks as the VND is appreciating again, along with higher borrowing costs.

Triệu Minh

4 Factors Putting Pressure on USD/VND Exchange Rate in Q1/2024

With the currency exchange rate fluctuating in the first few weeks of 2024, Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets and Securities Services at HSBC Vietnam, highlights four factors putting pressure on the USD/VND exchange rate in Q1/2024…