Source: Nam A Bank (Based on information provided by shareholders as of August 21, 2024)

|

The list of shareholders owning 1% or more of Nam A Bank’s charter capital (announced on August 22, 2024) reveals that the bank’s top management does not hold any shares.

In addition, the bank’s six-month management report for 2024 shows that the Chairman of the Board of Directors, Tran Ngo Phuc Vu, does not hold any NAB shares. Vu’s family holds only 29,441 NAB shares, or 0.003% of the bank’s charter capital, which are owned by his brother, Tran Ngo Phuc Khoa.

Two other key leaders, Tran Ngoc Tam and Tran Khai Hoan, hold significant stakes. Tam, the bank’s Vice Chairman, owns nearly 3.4 million shares or 0.32% of the charter capital, while Hoan, a Board member and Acting CEO, holds over 2.95 million shares, equivalent to a 0.279% stake.

Typically, the Chairman of the Board is the company’s largest shareholder. However, in the case of banks, this is not always the case.

While the Chairman often serves as the legal representative, they are not necessarily the largest shareholder. Current laws only stipulate that the Chairman is elected by the Board of Directors, with no requirement for them to hold the most shares in the bank. As a result, the owners of banks in Vietnam can vary, and many “owners” do not appear as the highest-ranking leaders in the bank.

Who are the largest shareholders of Nam A Bank?

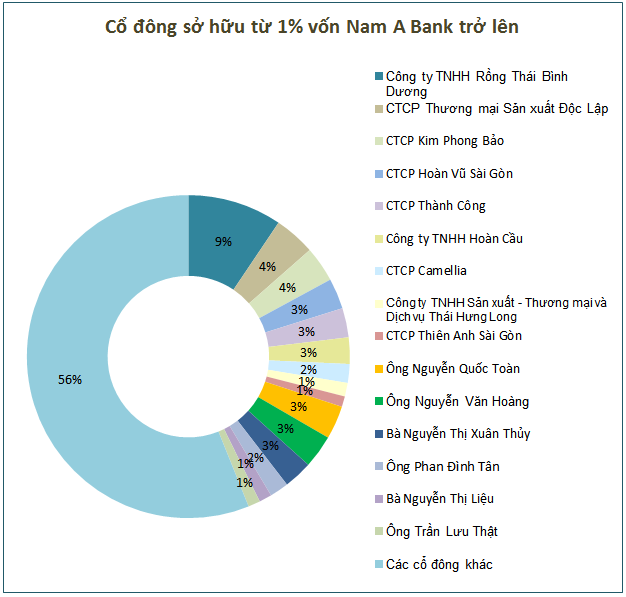

As of August 21, 2024, the largest institutional shareholder of Nam A Bank was Pacific Dragon Company Limited, with a 9.4% stake, equivalent to over 99.8 million shares.

Other major shareholders include Nguyen Quoc Toan, the eldest son of the late businesswoman Tran Thi Huong, with a 3.33% stake (35.3 million shares); Nguyen Van Hoang with a 3.32% stake (over 35.1 million shares); and Nguyen Thi Xuan Thuy, Toan’s sister, with a 2.9% stake (30.4 million shares).

Pacific Dragon Company Limited, Toan, and Hoang are linked. Pacific Dragon was established in October 1999 with an initial charter capital of VND90 billion, with Toan and his sister, Nguyen Thi Xuan Ngoc, contributing nearly 100% of the capital. Specifically, Toan contributed VND89.7 billion (99.7% of the capital), while Ngoc contributed VND250 million.

By the end of 2012, Toan’s wife, runner-up Dương Trương Thiên Lý, owned 99.94% of the company’s shares. In 2013, Đào Thị Diệu acquired all of Thiên Lý’s shares and held them until June 2016.

Thus, when Pacific Dragon was announced to hold a 14.26% stake in Nam A Bank in early 2015, the company was already independent of Toan’s family.

After Diệu divested, the new owners of Pacific Dragon were Trương Vũ Họa Mi (holding 50%, equivalent to VND400 billion) and Hoang, who increased his ownership from 0.06% (VND480 million) to 50% (VND400 billion).

In August 2018, the new owners of Pacific Dragon became Dương Tiến Dũng (holding 80%) and Nguyễn Thị Kim Phượng (holding 20%). In November 2018, Hoang returned as a 50% owner of Pacific Dragon (VND400 billion), and Phượng increased her ownership to 50%.

From April 2019, Phượng and Hoang were no longer shareholders of Pacific Dragon, and they were replaced by Võ Thị Hiệp and Nguyễn Bình Duy, each holding 50% of the capital.

After stepping down as a shareholder, Hoang was appointed as the legal representative and General Director of Pacific Dragon from July 2021 to May 2024. He was then replaced by Hà Học Duy.

Hoang was also a member of the Board of Directors and General Director of Hoan Vu Saigon JSC, the organizer of the Miss Universe Vietnam pageant, which was always sponsored by Nam A Bank.

Doc Lap Trading Production JSC is the second-largest shareholder of NAB, with a 4.096% stake (over 43.3 million shares). In June 2024, Doc Lap issued VND200 billion in bonds, backed by 25 million NAB shares owned by Kim Phong Bao JSC.

Kim Phong Bao JSC is the third-largest shareholder of NAB, with a 3.558% stake (over 36.6 million shares). Hoan Vu Saigon JSC, with a 3.067% stake (nearly 32.5 million shares), is the fourth-largest institutional shareholder.

Hoan Cau JSC is the legacy of the late businesswoman Tran Thi Huong and her husband, Nguyen Chan. Established in 1993, Hoan Cau was initially owned by Huong and Chan. After some changes, the Chairmanship was transferred to several individuals, including Huong, Nguyen Quoc Cuong, and Phan Dinh Tan. The General Director position was also held by Tan, Cuong, and Huong’s daughter, Nguyen Thi Xuan Thuy.

Currently, Hoan Cau is chaired by Tan, who also serves as the General Director. The company has a charter capital of VND1,170 billion, with Tan holding 99% and Nguyen Ton Nu Nhu Hoang holding 1%.

Tan personally holds over 20 million NAB shares, or 1.891% of the charter capital. He also served as Chairman of NAB in 2015, succeeding Toan.

Thus, the total stake held by Toan and related parties (Pacific Dragon, Hoang, Thuy, Hoan Vu Saigon, Hoan Cau, and Tan) is close to 27% of Nam A Bank’s charter capital.

Nguyen Quoc Toan, former Chairman of Nam A Bank

|

Toan was elected Chairman of Nam A Bank in 2014 but unexpectedly left the position a year later, only to return in 2016. In June 2019, he officially announced his resignation from the bank’s Board of Directors to focus on resolving internal family disputes. Thus, after more than five years, Toan has officially left the bank’s leadership.

The company used 25 million NAB shares to issue VND200 billion in bonds

La Mia Bao Loc – A Fresh Start for a Fulfilling Life

La Mia Bảo Lộc is not just a harmonious blend of art and Italian-inspired resort living, but also effortlessly brings every resident to a tranquil and balanced state of body, mind, and soul.

Vietnam Education Publishing House to Receive Over 4 Billion VND from Subsidiary Company

With a 52.54% stake in Education Books and Equipment JSC (HNX: STC), the Vietnam Education Publisher is set to receive over 4 billion VND in dividends in 2023 from this subsidiary.