Masan Consumer Holdings (MCH), a subsidiary of Masan Group, has sought shareholder approval for a supplementary dividend for the fiscal year 2023. This proposal was mentioned at the 2024 Annual General Meeting held in April.

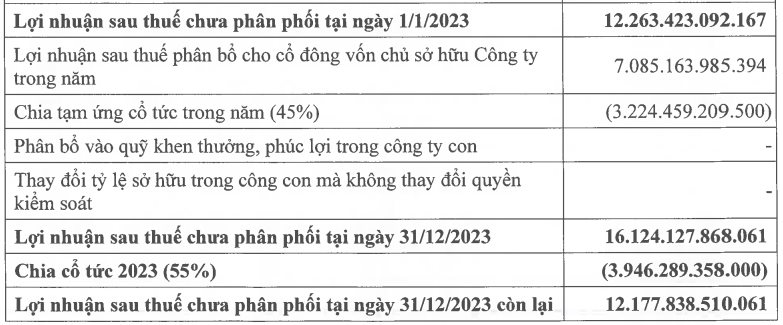

Specifically, a cash dividend of 100% (equivalent to VND 10,000 per share), which was approved at the 2023 AGM, has already been partially paid out, with MCH distributing over VND 7,100 billion during the period of July 2023 to July 2024.

In addition to this dividend, a supplementary cash dividend of VND 16,800 per share (equivalent to a dividend ratio of 168%) has been proposed for the fiscal year 2023. If approved, MCH will distribute over VND 12,000 billion in supplementary dividends.

Essentially, MCH will utilize nearly all of its undistributed profits from fiscal year 2023 (after deducting the aforementioned dividend of VND 10,000 per share) to fund this supplementary dividend.

This supplementary dividend payment may be made in one or multiple installments within six months from the date of the AGM resolution.

Additionally, on August 16, MCH disclosed details of its 2024 Employee Stock Ownership Plan (ESOP), including the list of eligible employees and the number of shares allocated to them.

According to the list, 678 MCH employees were offered the opportunity to purchase up to 7,174,310 MCH shares at a price of VND 10,000 per share, amounting to a total value of VND 71.7 billion.

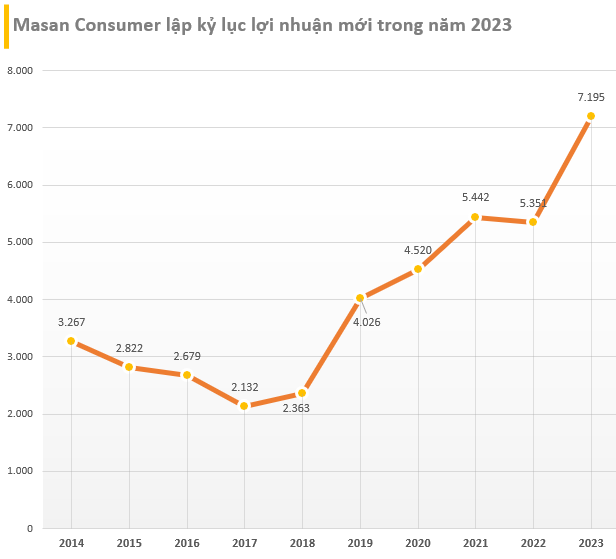

This decision to distribute significant dividends follows a year of robust financial performance for MCH in 2023, with a record profit of VND 7,195 billion, representing a 30% increase compared to 2022. The earnings per share (EPS) for 2023 stood at VND 9,888 per share, a substantial improvement over the 2022 EPS of VND 7,612 per share.

The decision to distribute a substantial portion of profits as dividends is often indicative of a company’s preparation for significant equity sales or other strategic initiatives.

At the 2024 AGM, shareholders also approved the listing of all MCH shares on the Ho Chi Minh Stock Exchange (HoSE). Currently, MCH is traded on the UPCoM. According to a Masan Group document dated May 30, 2024, the transfer to HoSE is expected to take place in the second quarter of 2025.

As per a research report by HSC Securities in April 2024, 93.8% of MCH’s shares are held by Masan Consumer Holdings, a subsidiary of Masan Group.

Consequently, the free float stands at only 6.2%, significantly lower than the VNallshare average of 52.8% and the VN30 average of 43.8%.

To facilitate a successful listing on HoSE, HSC Securities suggested that MCH should increase the proportion of freely tradable shares. This could be achieved by reducing Masan Consumer Holdings’ ownership stake through new share issuances or the sale of existing shares held by the holding company.

“Double-Digit Growth, Double-Digit Dividends: Masan Consumer’s Impressive Performance Streak”

Masan Consumer Holdings (MCH), a leading consumer goods company, has announced plans to propose a generous dividend payout to shareholders. The proposal, which will be presented at the upcoming Annual General Meeting, includes a cash dividend of 168% or VND 16,800 per share for the fiscal year 2023. This significant dividend payout reflects MCH’s strong financial performance and commitment to returning value to its shareholders.

“The Billion-Dollar Diamond: Unlocking the Potential of Vietnam’s Top-Tier Enterprises”

Masan Consumer’s market capitalization has surpassed that of Vingroup and Vinamilk, and it now stands almost 50% higher than that of its parent company, Masan Group.