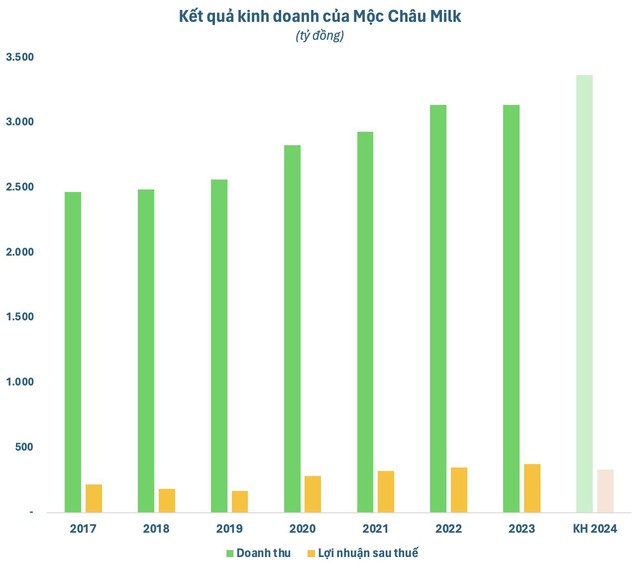

On April 23, Moc Chau Milk Joint Stock Company (Moc Chau Milk – stock code MCM) successfully held the 2024 Annual General Meeting of Shareholders online. At the meeting, Moc Chau Milk shareholders approved the 2024 business plan with the target of record revenue of VND3,367 billion and post-tax profit of nearly VND332 billion, respectively increasing by 7% and decreasing by 11% compared to last year’s implementation.

In 2023, Moc Chau Milk recorded revenue of VND3,137 billion, nearly unchanged but its post-tax profit increased by 8% to VND374 billion, the highest in the history of its operation. Therefore, the profit target is somewhat conservative based on last year’s high comparison base. However, Moc Chau Milk’s potential for positive growth is still highly appreciated by analysts.

VDSC Securities believes that in 2024, revenue growth will be the “backbone” thanks to the support of a wider distribution network. According to Vimanilk, the northern Vietnam market has great potential to expand the distribution network for branded dairy products such as Moc Chau Milk.

In the context of better infrastructure conditions, VDSC expects Moc Chau Milk to continue to open new self-operated milk stores. As of the end of 2023, the business was operating 69 stores, opening 11 more stores than at the end of 2022. In addition, Moc Chau Milk also plans to utilize 200,000 points of sale in the distribution system of Vinamilk’s partners to expand its market penetration in the northern market.

In addition, Moc Chau Milk is also planning a brand repositioning project, following the success of Vinamilk’s brand repositioning strategy. The company expects to deploy this project soon. VDSC believes that the project can attract more customers for the “Moc Chau Milk” brand.

Along with the ability to optimize costs to protect stable profit margins, VDSC forecasts that Moc Chau Milk’s net profit in 2024 will increase at the same rate as its revenue. The brokerage firm projects Moc Chau Milk’s revenue and net profit in 2024 to reach VND3,286 billion and VND397 billion, respectively, up 4.8% and 6.1% compared to 2023.

Continuing to maintain high dividends

With the results achieved in 2023, Moc Chau Milk proposed a 20% cash dividend, which was approved by shareholders. Responding to a shareholder’s question about why not distributing more dividends, Chairwoman Mai Kieu Lien said that Moc Chau Milk still has many projects that need investment, requiring large capital resources. The company proposes to distribute a minimum of 50% of after-tax profit, and the actual figure of 59% has exceeded the target.

Regarding the 2024 profit distribution plan, Moc Chau Milk continues to propose paying 2024 dividends of at least 50% of after-tax profit, assigning the Board of Directors to decide on the interim dividend payment and the payment time for each installment in accordance with the above policy. Maintaining a relatively high dividend yield of about 5% of market price is a plus for Moc Chau Milk in the eyes of investors, especially in the context of the company planning to switch floors.

Previously in October 2023, Moc Chau Milk filed a registration statement to list 110 million MCM shares on the Ho Chi Minh City Stock Exchange (HoSE). The plan to “move” from UPCoM to HoSE was approved by Moc Chau Milk shareholders at the 2023 Annual General Meeting of Shareholders. Chairwoman Mai Kieu Lien said that Moc Chau Milk has submitted all listing documents and is only waiting for HoSE’s decision.

In terms of personnel, Moc Chau Milk’s AGM approved the dismissal of Mr. Nguyen Quang Tri as a member of the Board of Directors and elected one person to replace him. Previously, Mr. Tri submitted a resignation letter to the Company on March 13, 2024, and proposed April 23, 2024 as the termination date. Moc Chau Milk shareholders also approved the dismissal of Mr. Tran Ngoc Duy as a member of the Supervisory Board and elected one person to replace him.