Illustration

Oil Down $1

Oil prices fell on Friday as investors weighed the prospect of OPEC+ boosting supply from October against fading hopes for deep interest rate cuts by the US Federal Reserve next month after data showed resilient consumer spending.

October Brent crude futures settled down $1.14, or 1.43%, at $78.80 a barrel. US West Texas Intermediate (WTI) crude fell $2.36, or 3.11%, to $73.55.

For the week, Brent fell 0.3% and WTI dropped 1.7%. For the month of August, Brent rose 2.4% and WTI fell 3.6%.

US consumer spending increased solidly in July, suggesting the economy started the third quarter on a stronger footing, which could give the Fed room to stick to a smaller rate cut when it meets in September.

Data from the Commerce Department showed the US personal consumption expenditures (PCE) price index rose 0.2% last month, in line with economists’ expectations.

Gas Up

Asian spot liquefied natural gas (LNG) prices rose this week as outages at LNG facilities in Australia and Malaysia raised supply concerns, although buying interest from China remained limited due to higher prices.

Spot LNG for October delivery to Northeast Asia averaged $14 per million British thermal units (mmBtu), up $0.20 from the previous week.

Supply concerns have supported prices in Asia and Europe. An unplanned outage at the Ichthys facility in Australia will affect production through October, and production constraints at Malaysia’s Bintulu plant are expected to disrupt the loading schedule in the coming weeks.

Gold Down

Gold fell 1% on Friday as the US dollar and Treasury yields rose after US inflation data met expectations. Spot gold dropped 0.9% to $2,497.53 per ounce, while gold futures for December delivery settled down 1.3% at $2,527.60. However, for the month of August, gold prices rose 2%.

Iron Ore Down

Iron ore prices fell on Friday, pressured by persistently weak near-term demand and rising inventories in top steel producer China, although prices posted a second consecutive weekly gain.

The most-traded January iron ore contract on China’s Dalian Commodity Exchange ended daytime trading down 0.53% at 754 yuan ($106.33) per tonne.

Singapore Exchange iron ore futures for October fell 1.03% to $101.15 a tonne.

Average daily steel output by China’s major steel mills surveyed by consultancy Mysteel fell for a sixth straight week, dropping 1.6% to around 2.21 million tonnes as of Aug. 30, the lowest since mid-March, Mysteel data showed.

Copper Steady

Copper prices steadied on Friday as optimism over potential Chinese government stimulus to support the economy and bets that prices had bottomed out early in the month offset pressure from a stronger dollar.

Three-month copper on the London Metal Exchange ended the session flat at $9,245 a tonne, after earlier touching $9,382, its highest since Aug. 1.

Prices rose early in the session after a report that China was considering allowing mortgage borrowers to defer interest payments of up to $5.4 trillion to reduce borrowing costs.

Robusta Coffee at 16-Year Peak

Robusta coffee futures surged to a 16-year peak, with November robusta rising 47 cents, or 1%, to $4,948 a tonne at Friday’s close, after hitting a peak of $5,180, the highest in at least 16 years. Prices rose 5% for the week.

The robusta market continues to be supported by tight supplies and concerns that a severe heatwave earlier in the year could reduce the size of the next harvest in Vietnam, the world’s top robusta producer.

December arabica coffee fell 1.4% to $2,4405 per lb.

Rubber Up

Rubber futures rose for a ninth straight session, logging their biggest monthly gain in nearly four years, driven by persistent supply disruptions amid wet weather in top producer Thailand.

The most active rubber contract on the Osaka Exchange (OSE) ended the session up 1.7 yen, or 0.45%, at 375.6 yen ($2.59) per kg.

Earlier in the session, the contract touched 380.3 yen, its highest since Aug. 8, 2011.

Wheat, Corn, Soybeans All Up

Chicago wheat futures rose on Friday on bargain buying amid concerns over shrinking production in Europe.

Soybean futures also climbed to a three-week high, while corn edged higher on increased demand.

At the close of trading on the Chicago Board of Operations (CBOT), wheat futures were up 2-1/2 cents at $5.51-1/4 a bushel, corn was up 4-1/2 cents at $4.00-1/2 a bushel, and soybeans were up 5-1/2 cents at $9.98 a bushel, the highest since Aug. 9.

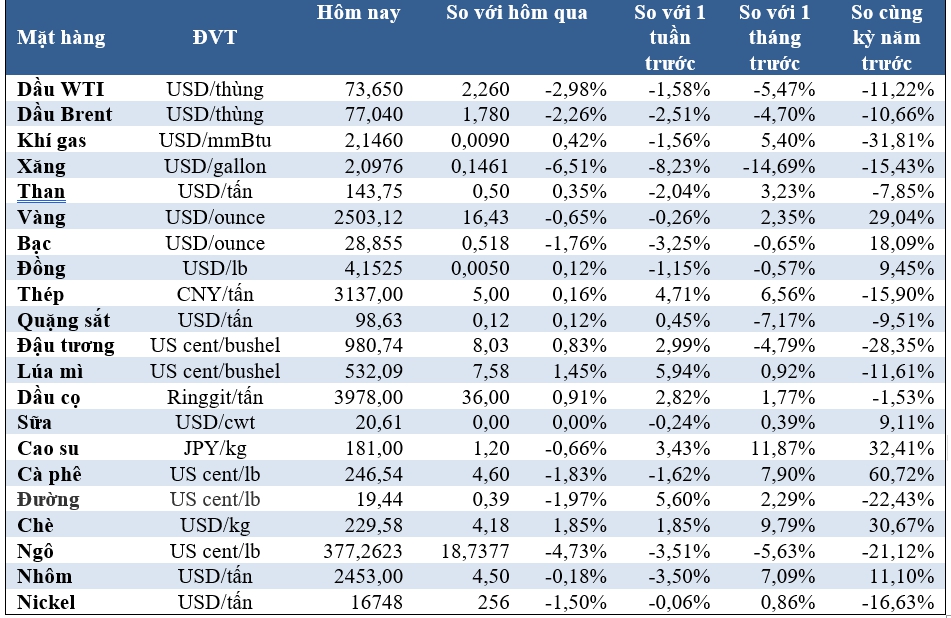

Key Commodity Prices as of August 31

Top Investment Channels for 2024: Safe and Profitable

2023 is a year full of volatility in the global financial market. Against this backdrop, many investors are interested in gold as a store of assets.

Market Update 02/07: Oil, Gold, Copper Rise while Iron Ore, Rubber Decline

Oil prices increased at the end of the trading session on June 2nd, with gold strengthening as the USD weakened. The currency experienced its first upward trend in 5 sessions, while iron ore and rubber declined.