The industrial park giant of Binh Duong Province has successfully issued two batches of bonds, BCMH2427003 and BCMH2427004, valued at VND 500 billion and VND 300 billion, respectively, on August 14, 2024.

The secured assets are the rights to use urban land in Thu My Phu, Thu Dau Mot City, Binh Duong Province. The land, measuring 23,995m2, is owned by BCM.

Earlier, in August (on August 8), BCM successfully issued a VND 200 billion bond, BCMH2427002. The secured asset for this bond is also the right to use urban land, specifically a lot in My Phu Ward, Thu Dau Mot City, Binh Duong Province, with an area of 11,552m2, owned by BCM.

All three bond issues have a tenor of three years and will mature in August 2027, with interest rates ranging from 10.2% to 10.5% per annum.

Prior to this, on June 17, Becamex IDC successfully raised VND 800 billion from bond issuance, with a three-year tenor and a maturity date of June 17, 2027. The issuance interest rate was 10.5% per annum.

Thus, since the beginning of the year, BCM has raised a total of VND 1,800 billion through bond issuances, with VND 1,000 billion raised in August alone.

As of the end of June, the industrial park giant of Binh Duong Province had nearly VND 12,245 billion in bond debt. With the additional VND 1,000 billion raised in August, BCM currently has approximately VND 13,245 billion in bond debt.

Apart from bonds, BCM announced that it will offer 300 million shares, with a starting price of no less than VND 50,000 per share, to raise a minimum of VND 15 trillion. The purpose of this capital increase is to invest in key projects as directed by the Government, the Provincial Party Committee, and the People’s Committee of Binh Duong Province. Of the total amount, VND 6,300 billion will be allocated for project investment, VND 3,634 billion for capital contribution to existing members, and VND 5,066 billion for financial restructuring.

BCM’s AGM: Determined to issue 300 million shares through auctions, not less than VND 50,000/share

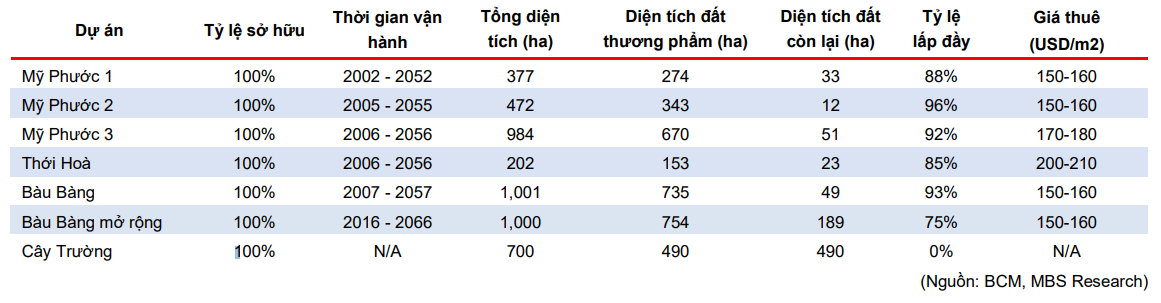

BCM is currently investing in six industrial parks (My Phuoc 1 IP, My Phuoc 2 IP, My Phuoc 3 IP, Thoi Hoa IP, Bau Bang IP, and Expanded Bau Bang IP). The total area of these industrial parks exceeds 4,000 hectares, with over 2,900 hectares of leased land and approximately 350 hectares of land available for lease. As of now, the infrastructure development progress in these industrial parks has reached over 95%, with an occupancy rate of 88%.

|

Thanh Tú

The Heiress and Senior Executive of Phat Dat Want to Sell Millions of PDR Shares

PDR stock is currently down 14% since the beginning of 2024. A concerning decline, but a potential opportunity for savvy investors to enter a promising market. With a strategic approach, this stock could offer a unique entry point and a chance to diversify. A well-timed investment could see a significant rebound, offering a profitable future for those willing to take a calculated risk.