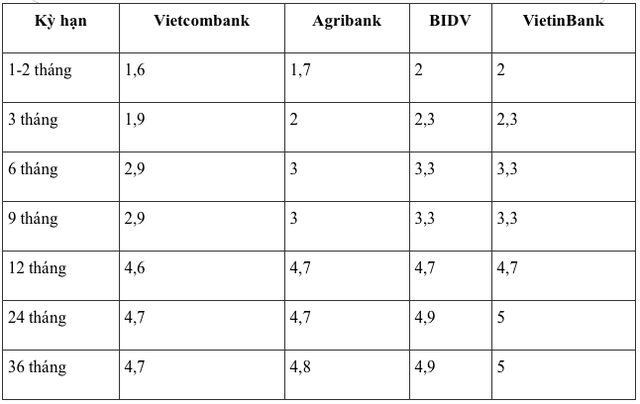

For the 1-2 month term, Vietcombank offers a saving interest rate of 1.6%/year. Agribank offers a slightly higher interest rate of 1.7%/year, while BIDV and VietinBank provide a rate of 2%/year.

Moving on to the 3-month term, BIDV and VietinBank offer a competitive rate of 2.3%/year. Agribank follows closely with 2%/year, and Vietcombank provides a rate of 1.9%/year.

At the 12-month mark, Vietcombank’s interest rate is 4.6%/year. The remaining three banks offer a slightly higher rate of 4.7%/year.

For the 24-month term, Agribank and Vietcombank have the same interest rate of 4.7%/year. BIDV offers a rate of 4.9%/year, and VietinBank leads with 5%/year.

In the case of the 36-month term, Vietcombank has the lowest interest rate of 4.7%/year. Agribank offers a slightly higher rate of 4.8%/year, followed by BIDV at 4.9%/year. VietinBank continues to offer the highest interest rate among the Big 4 banks, with an impressive 5%/year.

Currently, the Big 4 banks still offer relatively low-interest rates for savings accounts compared to the market.

Updated savings interest rates for the Big 4 banks.

A market survey reveals that the highest interest rate for a regular deposit currently stands at 6.1%/year. Cake by VPBank offers this rate for the 24-36 month term. NCB and OceanBank provide the same rate for the 24-month term, and SaigonBank matches it for the 36-month term.

BVBank offers an attractive 6% interest rate for the 24-month term. Cake by VPBank maintains a 6%/year rate for the 12-18 month term. VRB and SaigonBank also offer a 6% rate for the 24-month and 13, 18, and 24-month terms, respectively. ABBank rounds up this category with a 6.0%/year rate for the 12-month term.

For the 9-month term, ABBank takes the lead with a 5.7%/year interest rate. CBBank offers the highest rate of 5.55%/year for the 6-month term. Eximbank stands out with a 4.3%/year rate for the 3-month term, and CBBank offers the highest rate of 3.8%/year for the 1-month term.

Who Benefits from the USD Breaking the 25,000 VND Mark?

The US dollar has been on a downward trajectory over the past few days, falling below the 25,000 VND/USD mark. This positive development is set to boost import activities and have a significant impact on the economy.