Vietnam National Petroleum Group (Petrolimex) has just submitted its audited financial statement for the first six months of 2024 to the State Securities Commission of Vietnam and the Ho Chi Minh City Stock Exchange.

In the first half of this year, the giant petroleum company Petrolimex witnessed a significant surge in its profits.

According to Petrolimex, for the first six months of 2024, the parent company’s after-tax profit reached nearly VND 1,530 billion, a substantial increase compared to the same period last year, which stood at VND 649.3 billion, representing a 135% growth.

The consolidated after-tax profit of Petrolimex for the first half of 2024 reached nearly VND 2,420 billion, while in the same period last year, it was VND 1,558 billion, reflecting a 55% increase.

Explaining the significant profit, Petrolimex attributed it to the stable and efficient gasoline business in the first half of the year, coupled with an increase in sales volume compared to 2023.

The impressive performance was also a result of the stable energy supply and global oil prices, which didn’t experience the same level of volatility as in previous years. Additionally, the gasoline supply from domestic refineries remained steady, and traders executed their import plans effectively while ensuring profitability.

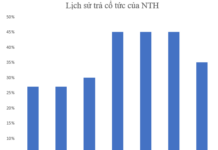

Furthermore, financial investment income increased compared to the previous year, mainly due to higher dividends received from subsidiary and associated companies.

Notably, Petrolimex also reported that the group’s businesses in other fields remained stable and grew compared to the same period last year.

However, the profit from subsidiary companies in the petrochemical and aviation fuel business, which accounts for a significant portion of the group’s profit outside of gasoline, decreased in the first six months compared to the previous year.

Additionally, the divestment from PG Bank in the third quarter of 2023 also led to a decrease in profit from associated companies in the first half of 2024 compared to the same period last year.

Statistics show that Petrolimex currently holds approximately 50% of the market share in Vietnam’s gasoline market. The company operates over 2,700 gasoline stations under the Petrolimex brand and has more than 2,800 stations run by agents, total agents, and franchisees nationwide.