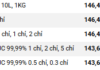

Gold and jewelry companies, Bao Tin Minh Chau JSC, listed the buying and selling prices of gold rings at 77.43 – 78.63 million VND per tael. Saigon Jewelry Company, Doji Group, and Phu Quy Company listed the selling price of gold rings at 78.6 million VND per tael.

Gold bar prices, as maintained by banks and gold trading enterprises, remain at 78 – 81 million VND per tael for buying and selling.

At the same time, world gold prices also stood still at the mark of 2,492 USD/ounce.

Both gold ring and SJC gold bar prices remain unchanged.

Mr. Phan Dung Khanh, a financial market expert, shared that when purchasing gold, buyers immediately face a loss of about 2 million VND per tael due to the buy-sell spread, and this loss could be much higher at certain times.

According to Mr. Khanh, for investors to gain higher profits than bank deposits, world gold prices would need to increase by at least 10% from the current level, but the probability of this happening is also not high as, in a 10-year cycle, precious metals typically only increase in price beyond their peak 1-2 times.

In recent times, gold prices have failed to surpass their previous peak, and the time it is taking to approach the 2,540 USD/ounce threshold indicates that the upward momentum of gold prices is waning. Even purchasing gold at high prices, as they are now, could lead to potential losses for investors due to the impact of the possibility of the US reducing interest rates soon, and the extent of its influence on the precious metals market is also uncertain.

“Money invested in gold is considered dead capital as this asset does not generate returns. Investors can only wait for the price to increase to make a profit, but in terms of short and medium-term investment probabilities, the chances of earning higher profits than bank deposits are not significant. If investors are willing to hold gold for the long term, for 3 years or more, then it could be worth considering.”