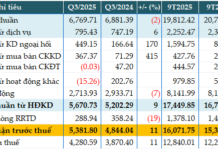

Quoc Cuong Gia Lai Joint Stock Company (QCGL), with the stock code QCG, has released its audited semi-annual financial report for 2024. According to the report, the company’s revenue plummeted in the first six months. In Q2 2024, their recorded revenue was over VND 26 billion, a 41% decrease compared to the same period last year. Quoc Cuong Gia Lai reported a net loss of more than VND 17 billion. This is the highest quarterly loss in over a decade for the “mountain city tycoon.”

In the first half of the year, Quoc Cuong Gia Lai’s cumulative revenue decreased by 69% to VND 65 billion. The main contributors were the hydropower sector, with over VND 37 billion, and the rubber sector, with nearly VND 19 billion. In contrast, the real estate sector only contributed VND 8.6 billion in revenue.

After deducting the cost of goods sold, the company’s gross profit was VND 70 million, while it was nearly VND 22 billion in the previous year. After accounting for expenses, Quoc Cuong Gia Lai reported a net loss of nearly VND 17 billion, with a net loss of over VND 15 billion.

With a target of VND 1,300 billion in revenue and a pre-tax profit of VND 100 billion for 2024, the company has only achieved 5% of its revenue target and has not recorded any profit in the first six months.

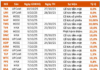

As of June 30, the company had over VND 27.5 billion in cash and bank deposits. Their inventory was valued at more than VND 7,028 billion, accounting for 75% of the company’s total assets.

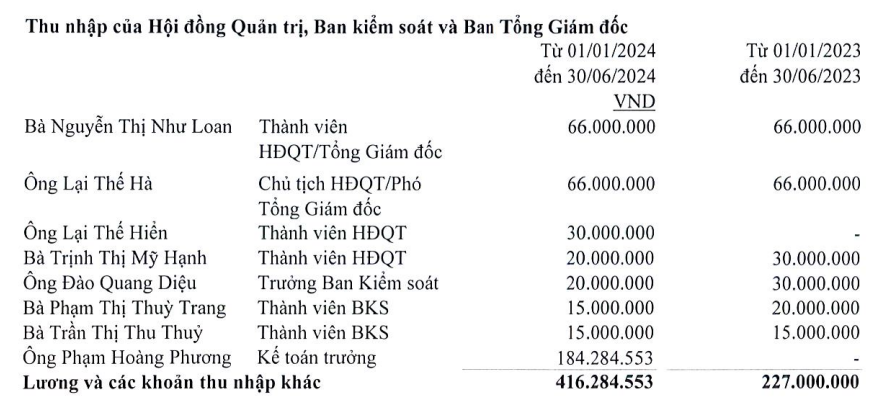

Another notable point in this report is the income of QCG’s management team. Despite the significant drop in revenue, the income of the eight members of the Board of Directors, Supervisory Board, and Board of Management nearly doubled.

In the first half of the year, Ms. Nguyen Thi Nhu Loan served as General Director and Member of the Board of Directors. The Board of Directors dismissed Ms. Loan in July after she was arrested and detained for “Violation of regulations on the management and use of State assets, causing waste and losses.”

In the first six months of the year, Ms. Loan and Mr. Lai The Ha, Chairman of the Board of Directors and Vice General Director, received an income of VND 66 million, equivalent to VND 11 million per month.

The remaining members of the Board of Directors, Board of Management, and Supervisory Board received incomes ranging from VND 15 million to VND 30 million for the six-month period, equivalent to VND 2.5 million to VND 5 million per month.

The highest-paid individual was Mr. Pham Hoang Phuong, the company’s chief accountant. Mr. Phuong received an income of over VND 184 million in the first half of the year. This significant income increase was the main reason for the overall rise in the management team’s total income during this period.

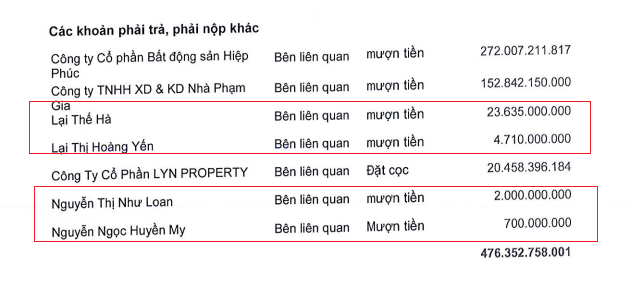

Not only did the senior management have low incomes, but they were also significant creditors of Quoc Cuong Gia Lai. As of June 30, the company recorded personal loans of approximately VND 32 billion.

This included a VND 2 billion loan from Ms. Nguyen Thi Nhu Loan, a VND 700 million loan from her daughter, Nguyen Ngoc Huyen My, a nearly VND 24 billion loan from Mr. Lai The Ha, and a VND 5 billion loan from his daughter, Lai Thi Hoang Yen.

Regarding personnel matters, Mr. Nguyen Quoc Cuong (Cuong Dolla), Ms. Loan’s son, is now the General Director of Quoc Cuong Gia Lai. At the recent 2024 Annual General Meeting of Shareholders, Mr. Cuong assured that “business operations will return to normal.” He asked shareholders to stand by the company during this challenging period and beyond.

The Hoarding Property Moguls: A Deep Dive into the Risky World of Real Estate Speculation

As of Q2 2024, Novaland, Khang Dien, Nam Long, and Quoc Cuong Gia Lai are among the real estate companies with tens of thousands of billions of Vietnamese dong in inventory, accounting for more than half of their total assets.

“Taking Over Management of Quoc Cuong Gia Lai from His Mother, CEO Nguyen Quoc Cuong Asserts ‘No Impact on Personal Businesses’”

“Mr. Nguyen Quoc Cuong, also known as Cuong “Dollar”, has been appointed as the new CEO and legal representative of Quoc Cuong Gia Lai, taking over from his mother, Mrs. Nguyen Thi Nhu Loan. With a strong business acumen and a deep understanding of the industry, Mr. Cuong is well-positioned to lead the company towards new heights of success.”

The Ho Chi Minh Stock Exchange (HoSE) Seeks Clarification from Quoc Cuong Gia Lai

Closing the trading session on July 25, QCG shares of Quoc Cuong Gia Lai Joint Stock Company plummeted to their daily limit, reaching a new low of VND6,800 per share.