|

Nam Rạch Chiếc’s Business Results for the First Half of 2024

Source: HNX

|

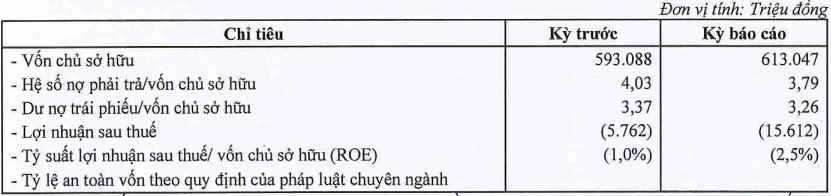

As of June 30, 2024, the company’s total assets stood at over VND 2.9 trillion, a slight decrease of 2% compared to the same period last year. Liabilities also decreased by nearly 3%, to over VND 2.3 trillion. The bond debt remained unchanged at VND 2 trillion. The after-tax profit result for the first half of the year was negative, with a loss of more than VND 15.6 billion.

Nam Rạch Chiếc has two bond batches in circulation: NRCCH2125001, issued in late 2021 with a value of VND 1,300 billion, and NRCCH2226001, issued in early 2022 with a value of VND 700 billion. The bonds have a tenor of 48 months and an interest rate of 11% per annum. The bonds are secured by a high-rise apartment complex combined with commercial and service facilities at two lots, CC3 and CC4, in the Nam Rạch Chiếc Central Area Project (Palm City Project).

In the first half of 2024, the company made interest payments for these two bond batches, amounting to nearly VND 72 billion (on June 10, 2024) and nearly VND 39 billion (on January 26, 2024), respectively.

Nam Rạch Chiếc is the investor of the Palm City project, a new urban area spanning 30.2 hectares along the Ong Tho and Kinh Canals in Thu Duc City (former District 2), Ho Chi Minh City. Palm City is being developed in multiple phases, including a complex of low-rise residential areas and commercial townhouses (Palm Residence); high-rise apartments; office buildings; shopping centers; and other amenities such as schools, hospitals, and commercial centers (Palm Heights).

Nam Rạch Chiếc was established by three parties: Keppel Land (a subsidiary of the Keppel Group), CTCP Bat Dong San Tien Phuoc, and Cong Ty Tran Thai. The Keppel Group owned 42% of the capital through its organization, Flemmington Investments Pte Ltd, while Tien Phuoc held 38% and Tran Thai 20%.

However, in March 2022, Keppel Land announced its withdrawal from the Palm City project by divesting its entire 100% stake in Flemmington Investments Pte Ltd for a value of USD 98.6 million.

Renewable Energy Vietnam: Reducing Losses, Bond Debt Cleared Under SP Group’s Stewardship

The Vietnam Renewable Energy JSC (VRE) has made significant strides in reducing its losses, yet it continues to face a cumulative deficit of over VND 126 billion. A notable achievement for the company was the successful repayment of bond debts in the first half of 2024, shortly after coming under the ownership of SP Group.

The Vanishing Act: Unraveling the Mystery Behind DIC Corp’s Unscathed Profit Amidst Plummeting Revenue

After a thorough review, DIC Corp reported a significant drop in revenue, totaling VND 187 billion, resulting in a revised figure of VND 635 billion. Despite this decline, the company’s net profit remained relatively unchanged at approximately VND 4 billion, largely due to deferred corporate income tax.