The domestic stock market resumed trading with high hopes of breaking through the psychological resistance level of 1,300 points after a dull week of trading leading up to the 2/9 holiday.

Favorable domestic factors, including a cooling exchange rate, bolstered market optimism. However, the after-effects of the US stock market correction and the “domino effect” in Asian markets presented challenges for the VN-Index from the get-go.

During the ATC session (opening price determination), the main index plummeted 14 points, falling below the 1,270-point mark. Overnight, US stocks experienced a sell-off as market participants digested weak manufacturing PMI data, indicating a potential slowdown in the country’s economy. Asian markets, including Japan, South Korea, and China, also witnessed a bloodbath with indices plunging into the red.

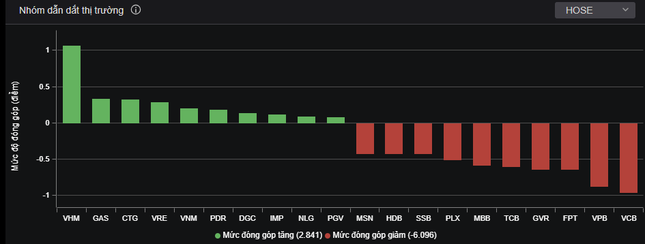

Throughout the session on September 4th, the VN-Index struggled in negative territory. Most sectors underwent adjustments, with large-cap stocks from the VN30 index exerting the most negative influence. The representative VN30-Index declined more sharply than the broader market, with 23 out of 30 stocks losing value.

Large-cap stocks pose challenges for the market.

In the banking sector, VCB and VPB led the decline. The synchronized correction in these “king” stocks significantly weighed on the market. Twenty out of twenty-seven bank stocks witnessed price drops. Trading in influential sectors, such as the “bank-insurance-steel” trio, remained negative.

On the brighter side, real estate stocks displayed resilience, with VHM alone contributing over one point to the index. PDR, DXG, VHM, VRE, DIG, CEO, and GEX all climbed higher. Construction and public investment stocks also shone, with HHV, VCG, FCN, and even PHC hitting the ceiling price.

At the closing bell, the VN-Index fell by 8.07 points (0.63%) to 1,275.8 points. The HNX-Index dropped by 1.42 points (0.6%) to 236.14 points, while the UPCoM-Index shed 0.42 points (0.45%) to end at 93.75 points.

Liquidity increased, with the matched order value on HoSE reaching nearly VND 13,760 billion. Foreign investors net sold nearly VND 790 billion, focusing on DGC, HPG, VPB, and FPT stocks.