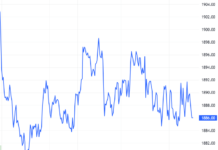

Gold prices remain lackluster as they struggle to breach the crucial $2,500/oz mark, awaiting directional catalysts. Analysts anticipate that the upcoming U.S. jobs report, due Friday this week, could dictate the metal’s trajectory in the near term.

As of Wednesday’s (Sept. 4) close in New York, spot gold edged up by $2.4/oz, or nearly 0.1%, to $2,496.2/oz, per Kitco data.

As of 8 a.m. Vietnamese time on Thursday (Sept. 5), spot gold in the Asian market had gained $1.1/oz from the U.S. close, or 0.04%, to trade at $2,497.3/oz. At Vietcombank’s selling exchange rate, this is equivalent to about VND 75.3 million per tael, up VND 100,000 from yesterday morning.

Gold prices slipped below $2,500/oz on Tuesday as the U.S. dollar rebounded, despite downbeat U.S. economic data raising the odds of an aggressive rate cut by the Federal Reserve in September. Analysts attribute gold’s struggle to break higher to market expectations that the Fed will opt for a 0.25% reduction instead of a larger half-point cut in its first rate decrease.

According to the FedWatch Tool from CME Group, federal funds futures are pricing in a 55% likelihood of a 0.25% rate trim on Sept. 18 and a 45% chance of a more substantial 0.5% reduction.

“The downside pressure on gold at this point is largely related to the expectation that the Fed will only cut rates by 25 basis points at the September meeting,” Peter A. Grant, a strategist at Zaner Metals, told CNBC.

This week’s U.S. economic data, including the weekly initial jobless claims report due Thursday and the non-farm payrolls report expected Friday, will provide insights for investors to gauge the Fed’s rate path. Gold prices are poised to fluctuate as expectations shift.

Rhona O’Connell, an analyst at StoneX, noted that the global stock market sell-off on Tuesday also weighed on gold prices as investors liquidated their gold holdings to cover losses in their equity portfolios.

“I think the trend for gold is still upward, and the recent dips are just adjustments within that upward trend,” Grant commented.

Year-to-date, gold prices have surged over 20% and hit an all-time high of $2,531.6/oz on Aug. 20.

“Gold is facing strong resistance at the $2,510/oz level and then at $2,513/oz. The immediate breakout target for gold remains at $2,543/oz,” Mike Ingram, an analyst at Kinesis Money, stated in a report.

Joni Teves, a strategist at UBS, suggested that even though gold is hovering near record highs, it is supported by net gold purchases from central banks and investors in the physical gold market. Meanwhile, the Fed’s policy could be both supportive and a source of downside pressure for the precious metal.

“We believe the upward trend for gold is justified, and gold will continue to rise over the next two years. Strong central bank purchases and robust demand in the physical gold market provide structural support and lift the range for gold prices. Increasing macroeconomic uncertainty and elevated geopolitical risks will drive capital allocation to gold from currently low levels,” Teves wrote.

“In previous Fed easing cycles, gold prices rose about 9% in the first two to three quarters after the first rate cut,” the report highlighted.

However, the strategist cautioned that if the U.S. economy accelerates, the Fed could shift to a more hawkish monetary policy stance, strengthening the U.S. dollar and exerting downward pressure on gold. She noted that gold prices could decline by 45% in the periods following the Fed’s tightening of monetary policy.