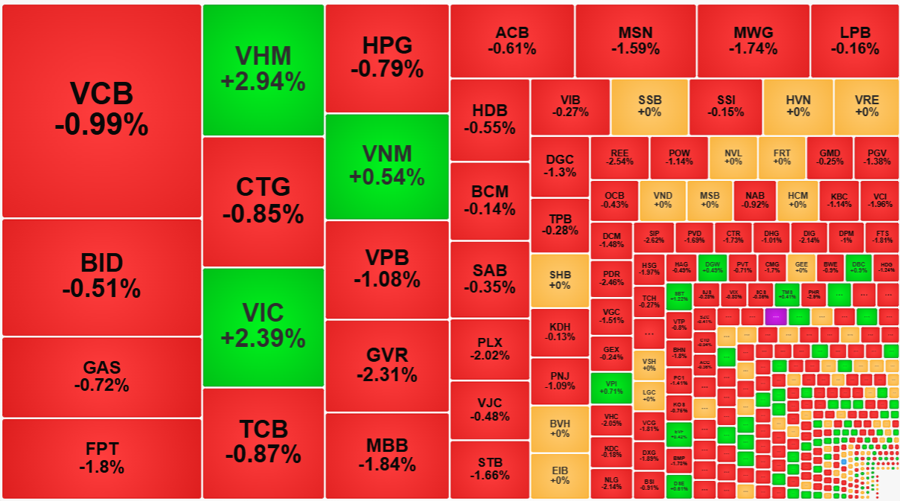

The stock market plunged into a significant sell-off this afternoon, causing a 33% surge in matching liquidity on the two exchanges compared to the morning session. Along with this, the breadth narrowed considerably, with the number of stocks falling more than 1% doubling from the morning. Fortunately, a few pillars remained, helping the VN-Index lose less than 8 points, but the damage to stocks was significant.

Even the five strongest pillar stocks of the morning, VHM, VIC, VRE, VNM, and BID, weakened in the afternoon. Excellent performers like VHM, with strong cash flow support, also fell by about 0.46% from its morning closing price, ending the day up 2.94%. VHM matched an additional 377.3 billion VND in liquidity in the afternoon. VIC also had to accept a price drop of 0.66%, closing up 2.39%. VNM was the only stock in the VN30 basket that remained in the green, but it also gave back about 0.8% to the market, ending slightly up by 0.54% from the reference price. BID faced the most significant pressure, plunging below the reference price by 0.51%, which means it fell by 1.52% in the afternoon alone compared to the morning.

The stock that witnessed the most aggressive selling in the afternoon was FPT, with liquidity reaching 608.1 billion VND, the highest in the afternoon market. FPT had already declined by 1.95% at the morning close, and in the afternoon, it fell further, reaching a maximum decline of -2.48%, but the supportive inflows were also significant. It closed the day down by 1.8%. If we consider only the afternoon session, the stocks with the most substantial fluctuations were MBB, falling by 2.04%, reversing below the reference price by 1.84% at the close; GVR, decreasing by 2.02%, ending the day down by 2.31%; and PLX, dropping by 2.13%, closing 2.02% lower.

The VN30-Index closed 0.66% lower than the reference price, with only three stocks advancing and 23 declining. In the afternoon session alone, only three stocks improved, while 26 others fell. FPT, HDB, and BCM edged slightly higher but remained in negative territory. Thanks to VIC and VHM’s resilience, the VN-Index lost only 7.59 points (-0.59%) by the end of the day, with these two pillars contributing 2.3 points. Nine stocks in the basket fell by more than 1%, but only FPT was among the top 10 in terms of market capitalization.

While the VN-Index was still supported by pillars, the stocks’ performance visibly weakened in the afternoon. Firstly, in terms of breadth, the HoSE had 174 gainers and 188 losers at the morning close, but by the end of the day, there were only 118 gainers and 285 losers. Secondly, the number of stocks falling more than 1% in the morning was 48, but by the close, it had increased to 105. Thirdly, the group facing intense selling pressure (-1% or more) with liquidity above 100 billion VND in the morning included only FPT, MWG, and HDB, but this number rose to 19 stocks in the afternoon.

The increased selling pressure caused a more than 33% jump in matching liquidity on the HoSE in the afternoon compared to the morning session, reaching 8,469 billion VND. This was the highest afternoon trading volume since the beginning of last week. In addition to the blue chips, many mid-cap stocks faced aggressive selling and sharp price declines, such as NKG, which fell by 3.04% with a matching volume of 136.5 billion VND; PDR, decreasing by 2.46% with a volume of 261.8 billion; DIG, dropping by 2.14% with 281 billion; HSG, declining by 1.97% with 281.1 billion; VCI, falling by 1.96% with 339.8 billion; and DXG, decreasing by 1.89% with 372 billion. On the HoSE, out of 35 stocks with liquidity exceeding 100 billion VND, 27 were in the red, and 19 of those fell by more than 1%.

A slight positive note for the afternoon was the emergence of faint bottom-fishing inflows. The market hit its lowest point around 2:20 pm, and most stocks bottomed out at this time. In the final minutes of the continuous matching and ATC phases, some stocks saw price improvements. However, most of the stocks moving against the trend had very low liquidity, with the more prominent exceptions being HNG, EVG, HBC, DCL, NHA, TTA, and SBT.

Foreign investors also cooled their selling in the afternoon, with net selling of around 145.3 billion VND. In the morning session, they had net sold 538.7 billion VND. The stocks that faced the most substantial selling pressure were FPT, with 271.8 billion VND, HPG with 92.4 billion, VPB with 88.7 billion, VCI with 74.2 billion, and HSG with 74 billion. On the buying side, VHM attracted 196.6 billion VND, VNM 94.4 billion, NVL 30.4 billion, and MWG 22.3 billion.