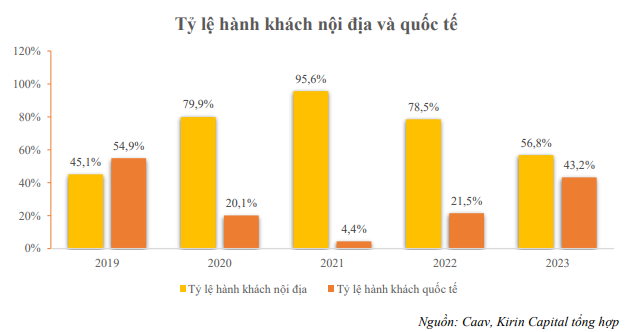

According to the Vietnam Aviation Authority, the total number of passengers in the first six months of 2024 reached 38 million, a 6.7% increase compared to the same period last year. Notably, international visitors surpassed 21 million, a remarkable 44% jump from 2022 and a 3% increase compared to the pre-pandemic period in 2019.

“As of the summer 2024 flight schedule, 63 foreign airlines and 4 Vietnamese carriers have fully restored their international flight networks to pre-COVID-19 levels and continue to expand into new markets in Central Asia, India, and Australia. Vietnamese airlines capture 44% of the international passenger market share with an average seat utilization rate of over 77%,” said the leader of the Vietnam Aviation Authority.

Notably, the key air transport market in China is gradually recovering, serving 2.5 million passengers in the first six months, more than triple the figure for the same period in 2023, but only 62% of the number in 2019. The passenger market from the country with a population of billions has also returned to second place among the top 10 largest international markets in Q2/2024. The South Korean market remains the most important, serving 5.3 million passengers in the past six months.

In contrast to the boom in international visitors, the domestic market is showing signs of cooling down. In the first six months of 2024, the number of domestic passengers reached 17 million, a 19% decrease compared to the same period last year.

Major airlines gain market share

The recovery of international passengers – who bring higher profit margins – is injecting new life into the aviation industry.

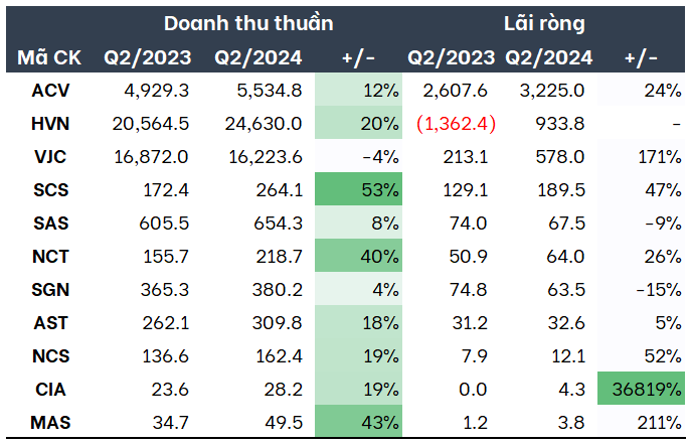

Vietnam Airlines (HVN) turned around from a loss of VND 1,362 billion in Q2/2023 to a profit of VND 934 billion in Q2/2024. However, this revival is not only due to improved business operations but also due to debt forgiveness of nearly VND 1,700 billion, raising questions about long-term sustainability.

Meanwhile, low-cost carrier Vietjet Air (VJC) continues to demonstrate its flexibility. Despite a slight 4% decrease in revenue, reaching VND 16,224 billion, the airline recorded an impressive 171% profit growth, earning VND 578 billion. Bamboo Airways and Vietravel Airlines have not yet released specific business performance figures.

Q2/2024 Financial Results of Aviation Enterprises

Unit: Billion VND

Source: VietstockFinance

|

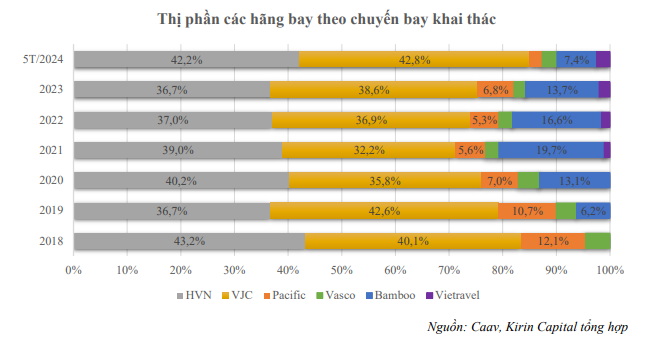

The aviation market share landscape has also undergone changes. According to a report by Kirin Capital, the market share of the two industry leaders, Vietnam Airlines and Vietjet, reached 42.2% and 42.8%, respectively, a significant increase compared to 2023 when they held 36.7% and 38.6%. respectively.

The increase in market share for the two giants is largely due to the “slice of the pie” left by Bamboo Airways after its aggressive restructuring in 2024, focusing only on developing a few profitable domestic routes. As of now, Bamboo Airways’ market share stands at 7.4%. As for Pacific, a subsidiary of Vietnam Airlines, after three months of suspension for restructuring, resumed its first flight in late June 2024, operating domestic routes.

Airline services are on the rise

In the field of aviation services, ACV, the “airport mogul,” continues to assert its leading position with record business results. Revenue increased by 12% to VND 5,535 billion, while net profit surged by 24% to VND 3,228 billion. Notably, ACV is also improving the contribution of its non-aviation services segment. At the 2024 annual meeting, CEO Vu The Phiet stated that ACV had shifted its non-aviation business model to a revenue-sharing partnership with service providers at the airport.

Currently, ACV is focusing on two key projects: Long Thanh International Airport and Terminal T3 at Tan Son Nhat International Airport.

Saigon Cargo Service Joint Stock Company (SCS) has emerged as a shining star in the field of air cargo transportation. Its revenue reached VND 264 billion, and net profit was VND 190 billion, increasing by 53% and 47%, respectively, compared to the same period last year. This achievement is due to the recovery in cargo demand and attracting new customers from Qatar.

However, not all businesses have enjoyed the “sweet fruit.” Saigon Ground Service Joint Stock Company (SGN) experienced a 15% drop in profit to VND 64 billion in Q2/2024, despite a 4% increase in revenue to VND 380 billion. The main reason for this decrease is a 40% surge in management expenses, mainly due to bad debt allowance from Bamboo Airways.

Nevertheless, the outlook for SGN remains positive, especially as the company is preparing for the “battle” at Long Thanh Airport, a project that Chairman Dang Tuan Tu considers “deciding the future of SGN.”

Tan Son Nhat Aviation Service Joint Stock Company (SASCO, UPCoM: SAS), led by Johnathan Hanh Nguyen, also had mixed results. While revenue increased by 8% to VND 654 billion, net profit decreased by nearly 9% to VND 68 billion. This was mainly due to increased selling and management expenses and weak financial performance.

Overall, the picture of the Vietnamese aviation industry in Q2/2024 has revealed a brighter prospect, but it also poses challenges. The resurgence of “heavyweights” like Vietnam Airlines and ACV is driving the entire industry, while auxiliary service businesses like SCS are seizing the opportunity to break through. However, the uneven recovery and challenges related to costs and competition remain issues that require attention in the future.

Soaring Airfare Prices

The Vietnamese Aviation Authority has reported a surge in airfares during the National Day holiday period. According to their observations, ticket prices rose by approximately 20% compared to the week before, and a significant 40% increase from the average during low-demand periods.

The Master Plan for Pleiku Airport to Welcome 5 Million Passengers

Pleiku Airport is set to undergo a significant transformation in the coming years, according to the master plan for the period 2021-2030. With a vision to become a bustling aviation hub, the airport aims to welcome 4 million passengers annually by 2030. And that’s just the beginning – further expansion is on the horizon, with a target to accommodate 5 million passengers per year by 2050. This ambitious roadmap underscores the airport’s commitment to keeping pace with the region’s growing aviation demands and solidifying its position as a key transportation gateway.

Upcoming Price Surge for Airline Tickets

Starting from March 1st, the new regulation from the Ministry of Transport states that the ceiling price will be adjusted upwards by approximately 5% compared to the previous rate. It is worth noting that this is the first adjustment in nearly 10 years.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)