Oriental Commercial Joint Stock Bank (OCB) has just announced a revision to the fee schedule for its credit card products, effective from September 10, 2024.

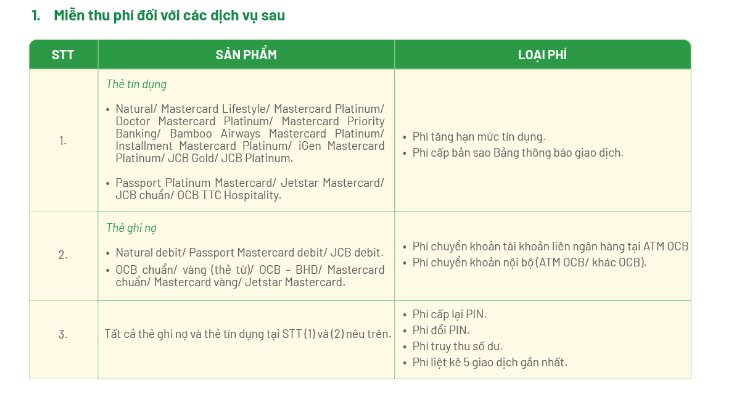

Accordingly, OCB will waive the Credit Limit Increase Fee and the Statement of Notification Copy Fee for most of its credit card lines, including Natural/Mastercard Lifestyle/Mastercard Platinum/Doctor Mastercard Platinum/Mastercard Priority Banking, and more.

In addition, cardholders will be exempt from interbank transfer fees when using OCB ATMs and internal transfer fees at OCB or other ATMs (applicable to 3 debit card lines and 6 credit card lines). Previously, the bank charged VND 11,000 per interbank transfer and VND 2,200 per internal transfer at non-OCB ATMs.

Moreover, all the aforementioned debit and credit cards will be exempt from PIN reissuance fees, PIN change fees, balance retrieval fees, and fees for listing the last 5 transactions from September 10, 2024.

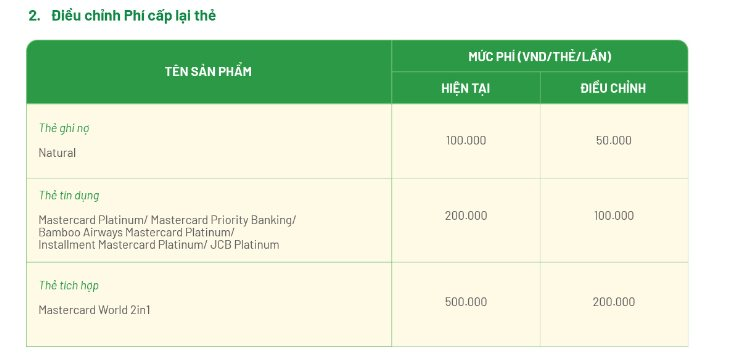

OCB has also made adjustments to the fee schedule regarding card reissuance services. Specifically, for the Natural debit card line, the card reissuance fee has been reduced from VND 100,000 to VND 50,000; for some credit card lines, the fee has been decreased from VND 200,000 to VND 100,000. Cardholders of the integrated Mastercard World 2in1 card now only need to pay VND 200,000 for card reissuance instead of VND 500,000 previously.

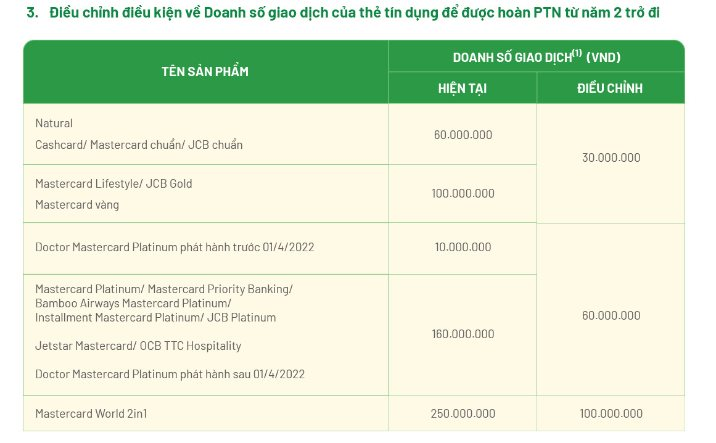

OCB has also relaxed the conditions for annual fee waivers from the second year onwards for some credit card lines. For example, cardholders of Natural Cashcard or Mastercard Lifestyle only need to spend a minimum of VND 30 million per 12-month statement period instead of VND 60 million and VND 100 million previously to be eligible for the annual fee waiver.

Only the Doctor Mastercard Platinum card line, issued before April 1, 2022, has had its required transaction amount increased from VND 10 million to VND 60 million.

For customers who wish to cancel their cards, OCB will not charge a fee if the cardholder has paid the annual fee. For cards that are exempt from/refunded the annual fee, the fee will be equal to the annual fee.

Breakfast in Hanoi, Lunch in Ho Chi Minh City: A $70 Billion Dream for a 350km/h Railway

“The time is ripe for high-speed rail investment, given Vietnam’s current standing and potential,” asserted Nguyen Danh Huy, Deputy Minister of Transport.

Rearing in Revenue: The Ministry’s Mandate?

The Vietnamese government has made significant strides in reforming state capital investment management. One notable change is the decision to no longer manage second-tier enterprises and reduce the number of enterprises requiring the Prime Minister’s approval for leadership appointments. These moves signify a shift towards greater autonomy for businesses and a streamlined decision-making process. However, a point of contention remains: how should state-owned enterprises distribute profits when the state does not hold a substantial amount of capital in these businesses? This question sparks an important debate, highlighting the need to balance state involvement and enterprise independence.