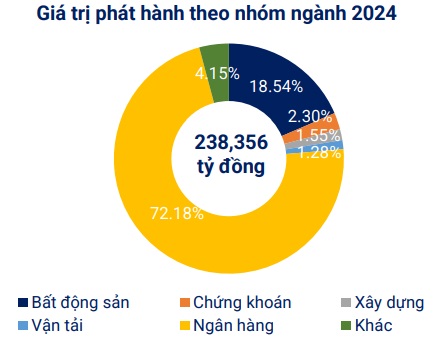

As of the cumulative period from the beginning of the year, there have been 227 private placements worth nearly VND 215.6 trillion and 13 public issuances worth nearly VND 22.8 trillion.

Source: VBMA

|

Source: VBMA

|

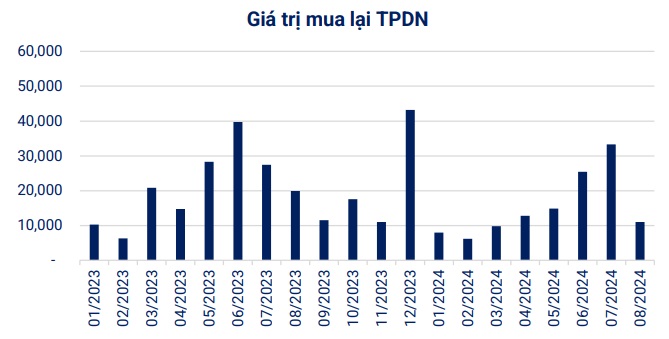

In August, enterprises repurchased bonds worth VND 11,023 billion ahead of schedule, a decrease of 45% compared to the same period in 2023. For the remainder of 2024, it is estimated that there will be about VND 106 trillion of bonds maturing. Most of these are real estate bonds, with nearly VND 43.4 trillion, accounting for 40.9% of the total value.

Source: VBMA

|

Regarding abnormal information disclosure, there were 10 bond codes that were late in paying interest, with a total value of VND 197.5 billion, and 1 bond code that was late in repaying principal of VND 998 billion.

In the secondary market, the total trading value of private corporate bonds in August reached nearly VND 73 trillion, with an average of nearly VND 3.3 trillion/session, down 10.3% compared to the previous month’s average.

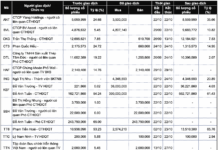

Notably, there are 2 cases of private bond issuances planned for the near future. The first is the Urban Development and Construction Corporation – JSC (HOSE: KBC), whose Board of Directors has approved a plan to issue private placement bonds in Q3/2024 with a maximum total value of VND 1 trillion.

These are non-convertible bonds, without warrants, that are asset-backed, with a par value of VND 1 billion each. The bonds have a 2-year term with a fixed interest rate of 10.5%/year.

This Northern industrial real estate giant intends to use the proceeds from this bond issuance to restructure debts totaling more than VND 1 trillion to its two subsidiaries, Saigon – Bac Giang Industrial Park JSC (KBC owns 88.6%) and Hung Yen Investment and Development Group JSC (KBC owns 93.93%). The scheduled debt repayment period is in Q3-4/2024.

Consequently, KBC currently owes both principal and interest to Saigon – Bac Giang amounting to over VND 392 billion and to Hung Yen Investment and Development Group amounting to nearly VND 609 billion. These debts were incurred through borrowings from its subsidiaries since 2021. The collateral for this bond issue is through the pledge of shares of Saigon – Haiphong Industrial Park JSC, which is owned by KBC (89.26% ownership).

The second case is Asia Commercial Joint Stock Bank (HOSE: ACB). Accordingly, ACB’s Board of Directors approved a plan to issue private placement bonds, divided into 15 phases throughout 2024. These are non-convertible bonds, without warrants or collateral, with a par value of VND 100 million each, equivalent to a maximum mobilization of VND 15 trillion. The bonds have a maximum term of 5 years. The purpose of the issuance is to serve lending and investment needs, as well as to ensure safety indicators as regulated by the SBV.

Chau An

“Struggling Cinema Chain, Galaxy, Plagued by Losses: A Mere $78,000 in Shareholder Equity Remains”

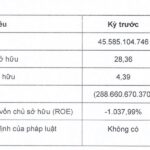

Galaxy EE continues its losing streak, reporting a net loss of over VND 16.6 billion in the first half of 2024. The company’s equity stands at a meager VND 1.8 billion.

Sure, I can assist you with that.

## From the Start of 2024, Becamex (BCM) Successfully Raises 1.8 Trillion VND in Bond Issuance

Becamex (BCM) has successfully issued its fourth bond series, BCMH2427003, raising 500 billion VND with a 3-year maturity. This latest issuance brings the company’s total bond proceeds to an impressive 1.8 trillion VND, showcasing their strong financial standing and the market’s confidence in their offerings.