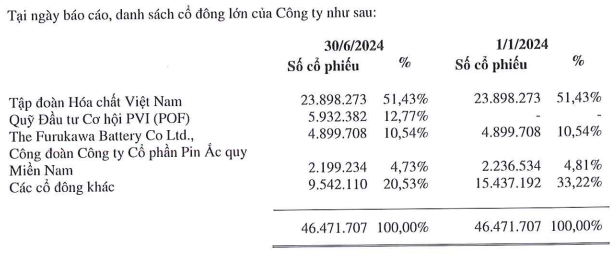

In terms of dividends, the payout ratio stands at 10%, which equates to VND 1,000 per share. With nearly 46.5 million shares in circulation, PAC will need to distribute nearly VND 46.5 billion for this dividend payout.

According to updated data as of June 30, 2024, the Vietnam National Chemical Group (Vinachem) is the parent company of PAC, holding 51.43% of the shares. They are estimated to receive nearly VND 24 billion from this dividend payout. The PVI Opportunity Investment Fund (POF), with a 12.77% stake, could earn nearly VND 6 billion. Another major shareholder, The Furukawa Battery Co. Ltd., with a 10.54% stake, is expected to receive nearly VND 5 billion.

From June 30 to the present, no additional transactions of PAC shares that would affect the structure of major shareholders have been disclosed.

Source: Reviewed Semi-annual Financial Statements for the first half of 2024 of PAC

|

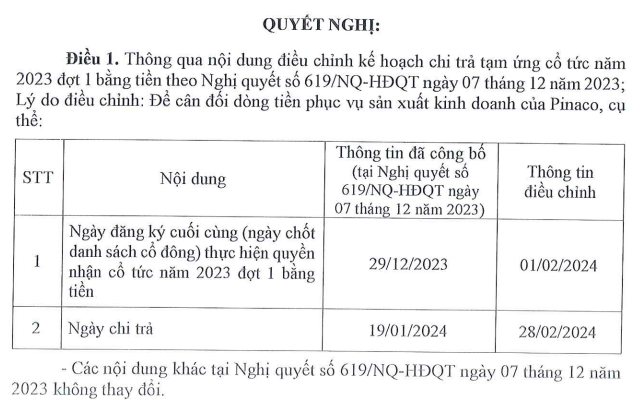

Prior to this, the 2023 Annual General Meeting of PAC approved a dividend plan for 2023 with a target ratio of 15%. PAC has already paid an interim dividend of 5%, equivalent to over VND 23 billion, in February 2024. If the remaining dividend is distributed as planned, PAC will achieve its 2023 dividend target.

In fact, PAC had planned to pay the first dividend installment in January 2024 but had to postpone it for over a month to balance cash flow for production and business activities.

Source: PAC

|

In the first half of 2024, PAC generated more than VND 1,646 billion in net revenue, almost unchanged from the same period last year. After deductions, PAC posted a net profit of over VND 62 billion, an increase of 5%.

PAC‘s resolution on business results for the first half of 2024 and plans for the third quarter of 2024 revealed that the total investment in construction during the first six months exceeded VND 9.6 billion, corresponding to over 58% of the yearly plan. Most of this amount was allocated to equipment, totaling nearly VND 9.4 billion.

For the third-quarter business plan, PAC expects to generate VND 950 billion in revenue, a 41% increase compared to the same period last year, and a 54% surge in pre-tax profit, reaching VND 40 billion. Looking at the nine-month plan, revenue is projected at VND 2,900 billion, with a pre-tax profit of VND 123 billion.

At the 2024 Annual General Meeting, the Company set a target of VND 3,800 billion in revenue and VND 160 billion in pre-tax profit for 2024, representing a 19% and 4% increase, respectively, compared to the previous year.

Speaking at the Annual General Meeting in late April 2024, PAC‘s leadership shared that they are considering plans to execute a lithium-ion battery project. However, the Company needs to carefully study and prepare for production, including assembly for product lines (electric bicycles, electric motorcycles, forklifts, golf carts, etc.).

Currently, PAC is capable of producing lead-acid batteries for electric bicycles and motorcycles, which have already been introduced to the market. The Company also noted that each electric car is equipped with a lead-acid battery, and they are currently supplying 100% of VinFast’s lead-acid battery needs.

PAC is planning to invest in a new factory with a budget of VND 1,000 billion (capital structure of 30% self-funded and 70% borrowed) in the An Phuoc Industrial Park. The Company stated that the self-funded portion will come from the investment development fund at the end of 2023, amounting to VND 355 billion.

In the stock market, PAC‘s share price has been trading around the VND 43,000 per share mark, consolidating after a sharp increase followed by a dramatic decline in the May-July 2024 period.

| PAC’s share price consolidates after a period of strong volatility |

Major Banks Donate Tens of Billions to Support Fellow Citizens in Storm and Flood-Affected Areas

With the above donations, banks, both private and national, aim to contribute additional resources to provide further support to the flood-affected communities.

“Pocketing” 8.6 Billion VND in 2023, Sacombank’s Chairman of the Board Leads Vietnam’s Banking Sector in Earnings

The recently published survey by FiinGroup reveals that the Chairman of Sacombank’s Board of Directors boasts an impressive income of 8.6 billion VND in 2023, surpassing the average income of 4.1 billion VND for chairpersons in the banking industry. This news comes as Sacombank also faces the fact that it has not paid dividends to shareholders for nine years.

“Tasco Auto Invests in Strategic Subsidiary Takeovers and Increased Holdings in High-Performing Subsidiaries”

Tasco Auto, a leading automotive distributor in Vietnam, has unveiled its strategic investment plan. The company aims to transform select associated businesses into subsidiaries and increase its stake in high-performing ones. This move underscores Tasco Auto’s commitment to fortify its core business and investment prowess, solidifying its position as a powerhouse in the Vietnamese automotive landscape.