Vietcap Stock has just announced the documents for the 2024 Annual General Meeting of Shareholders, scheduled to be held on April 2nd, at 88 Dong Khoi Street, Ben Nghe Ward, District 1, Ho Chi Minh City. The ex-rights trading date is March 1st, 2024.

The highlight is the proposals for issuance and offering of shares to increase charter capital, expected to be implemented through 3 options. VCI’s Board of Directors stated that the expansion of the charter capital is necessary to maintain the company’s growth momentum and market share, preparing for the next growth phases of the market.

First, the proposal is to issue 4.4 million shares under the 2024 Employee Stock Ownership Plan (ESOP), equivalent to 1% of the outstanding shares, at a price of VND 12,000 per share. The ESOP shares are restricted from transfer for 1 year from the issuance date.

The expected total proceeds of about VND 53 billion will be used by VCI to supplement working capital and reduce debt. The issuance is expected to take place in 2024, after approval by the State Securities Commission.

Second, the proposal is to issue shares to increase capital from owner’s equity (bonus shares). VCI plans to issue over 132.5 million bonus shares at the ratio of 10:3, meaning 30% (shareholders owning 10 shares will receive 3 new shares). Bonus shares are not restricted from transfer.

The issuance source from owner’s equity is based on the 2023 audited financial statements, including undistributed after-tax profit, surplus from stock capital, and additional capital reserves. The issuance is expected to take place in 2024, after the completion of the ESOP and bonus share issuances.

Third, the proposal is to offer over 143.6 million separate placement shares to domestic and foreign investors with financial capacity, professional securities investors. The individual placement shares are subject to a minimum transfer restriction of 1 year from the completion date of the offering.

The offering price shall not be lower than the book value of the Company at the end of December 31st, 2023, which is VND 16,849 per share (based on the 2023 audited financial statements). With the expected minimum proceeds of VND 2,420 billion, VCI will use over VND 2,100 billion to supplement capital for margin trading and VND 300 billion to supplement capital for proprietary trading activities.

The offering is expected to take place in 2024, after the completion of the ESOP and bonus share issuances.

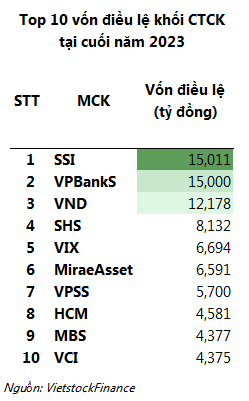

If the above plans are approved, VCI will issue an additional 280.6 million new shares, thereby increasing the company’s charter capital from VND 4,375 billion to VND 7,181 billion, leaping 5 ranks from the 10th position to the 5th position in the ranking of securities companies with the largest charter capital on the current stock exchange, surpassing VIX Securities (charter capital of nearly VND 6.7 trillion).

In the stock market, VCI’s shares are currently trading around VND 48,000 per share (afternoon session on March 12th), increasing by 17% in 1 month and up to 160% after the “decline” period at the end of 2022. However, the stock price is still below the historical peak of VND 58,000 per share set at the end of November 2021.

| VCI Stock Price Performance since the beginning of the year |

Forecasting VN-Index to be around 1,300 points by the end of 2024

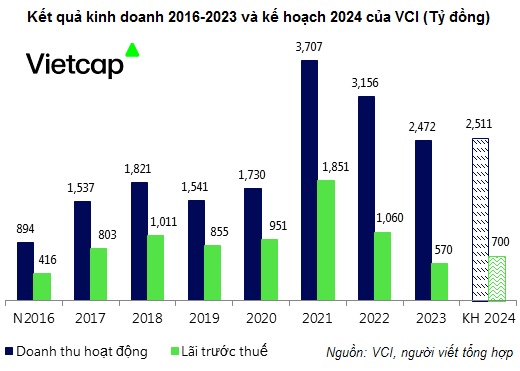

According to the AGM documents, in 2024, Vietcap Stock aims for operating revenue of VND 2,511 billion and pre-tax profit of VND 700 billion, increasing by 2% and 23% respectively compared to the 2023 performance. Authorization dividend for the Board of Directors’ decision is projected at 5-10%.

VCI’s BOD proposed the 2024 plan based on the macroeconomic foundations of the world and Vietnam, which are still subject to many variables and ongoing complexities. The VN-Index is forecasted to fluctuate around 1,300 points by the end of 2024.

Note that VCI’s profit target for 2024 is a double-digit growth but in fact, the increase is from a low base. Looking back at 2023, the company only achieved a pre-tax profit of VND 570 billion, a decrease of 46% compared to the same period and 57% of the annual plan.

According to VCI’s Board of Directors, in 2023, the cost of mobilized capital increased, affecting the NIM of margin trading activities, while the stock market’s performance was not optimistic, resulting in unrealized and unrecorded investment income during the year, impacting profits.

Dismissal and appointment of 1 new BOD member

At the AGM, VCI shareholders will consider the dismissal of Mr. Nguyen Hoang Bao – BOD member of the 2021-2026 term, who submitted a resignation letter on March 6th, 2024. Regarding the relationship, Mr. Bao is the husband of Mrs. Nguyen Thanh Phuong – Chairwoman of VCI’s BOD. Currently, Mr. Bao does not hold any VCI shares; while Mrs. Phuong holds nearly 17.6 million shares, equivalent to 4.01% of the charter capital.

Additionally, the VCI AGM will approve the list of candidates for the 2021-2026 BOD term and appoint 1 new BOD member.

Thế Mạnh